Gold (XAUUSD) weekly forecast: transition to consolidation

Gold (XAUUSD) remains under pressure. The decline is driven by a sharp drop in expectations for a December Fed rate cut to 30%, internal division within the FOMC, and the delay in official statistics due to the shutdown.

This review highlights the key factors that could influence gold’s dynamics during 24–28 November 2025. The focus will be on the release of delayed US labour market data, the Fed’s response to the risks of an economic slowdown, and the technical market structure after XAUUSD entered the 4,050–4,150 range.

XAUUSD forecast for this week: quick overview

- Weekly dynamics: gold (XAUUSD) ended the week below 4,070 USD per ounce. After a short-lived recovery, selling pressure resumed as the FOMC meeting minutes confirmed internal division. The delay in macroeconomic data due to the shutdown added further uncertainty

- Support and resistance: key zones are concentrated in the 4,050–4,150 range, where the market is consolidating. The main support levels are located at 4,050 and 3,883, with resistance lying at 4,230–4,250 and the all-time high of 4,378. A move above 4,250 would open the way to 4,370–4,380, while a return below 4,050 would raise the risk of a drop to 3,883

- Fundamentals: the FOMC minutes revealed a split among policymakers. The likelihood of a December rate cut dropped to 30%, down from 50% earlier. Employment and inflation data are distorted due to the shutdown. Gold is receiving mixed signals: on the one hand, soft data typically strengthens demand; on the other hand, improving risk appetite reduces safe-haven interest

- Outlook: the baseline scenario is continued consolidation within the 4,050–4,150 range, with a potential short-term pullback due to weak oscillator momentum. For an upward move to resume, gold must consolidate above 4,250. The lack of catalysts and dollar strength could bring prices back to 4,050 and 3,883. The medium-term trend remains upward

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) ended the week with a decline below 4,070 USD per ounce. After two days of gains, downward pressure resumed as investors reassessed expectations for a December Fed policy easing.

The FOMC minutes revealed a deep division among committee members. Some favour supporting the labour market, while others see inflation risks as too high to allow for a quick rate cut. As a result, the probability of a December rate cut fell to 30%, down from 50% a day earlier.

An additional uncertainty factor is the delayed macroeconomic data due to the shutdown. The market was waiting for the September employment report. The October figures will not be released, and some data will be included in the November release.

Improved sentiment in equity markets also reduced safe-haven demand, intensifying the correction in gold. Overall, the week ended under pressure. The XAUUSD outlook now largely depends on the upcoming US labour market data and the Fed’s response to it.

XAUUSD technical analysis

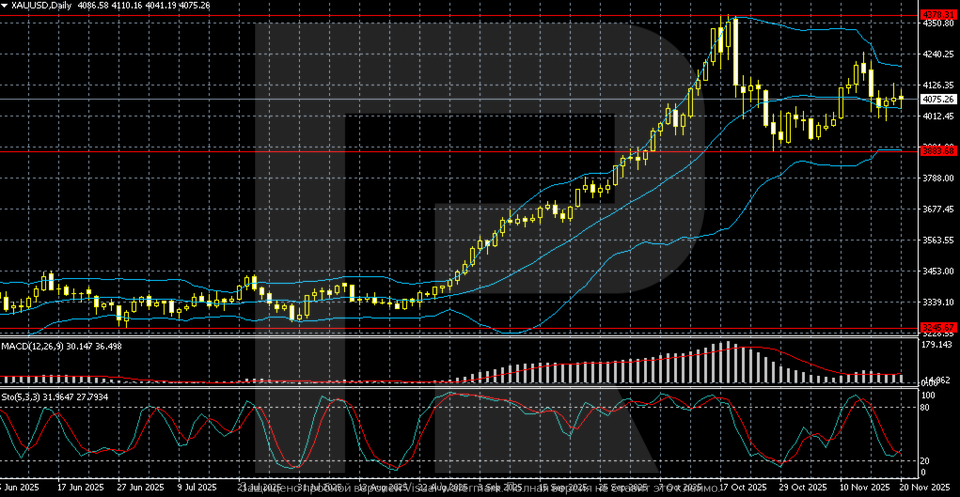

On the daily chart, XAUUSD shows a broad uptrend, which peaked near 4,378, an all-time resistance level from which prices sharply retreated. After a strong rally in September and October, gold entered a corrective phase, with candlesticks stabilising above the key support level at 3,883, forming a consolidation range roughly between 4,050–4,150.

Prices are trading in the upper section of the Bollinger Bands channel, but the middle band around 3,950–4,000 acts as nearby support. MACD is gradually declining, indicating waning bullish momentum, although it remains above the zero line. The Stochastic Oscillator is moving lower from overbought territory, suggesting the possibility of a short-term pullback or sideways movement.

Overall, gold is holding above the key 3,883 level, maintaining a stable uptrend. However, the nearest resistance at 4,378 is still capping further upside. The 4,050–4,150 zone forms the current consolidation range.

XAUUSD trading scenarios

The fundamental backdrop for gold remains moderately positive despite the recent decline. Pressure on XAUUSD increased due to revised expectations for the Fed’s December decision and internal FOMC division. The probability of a rate cut fell to 30%, but ongoing uncertainty over US data – delays due to the shutdown, missing October labour report, and weak private employment estimates – still supports safe-haven demand. Gold stabilised in the 4,050–4,150 range.

- Buy scenario

Long positions are appropriate if prices remain above 4,050.

A breakout above resistance at 4,230–4,250 would open the way to retest the all-time high of 4,378, and a move above this level would expand targets toward the 4,400+ area. Bullish drivers include weak US macroeconomic data, dovish Fed commentary, and persistent uncertainty from delayed data.

- Sell scenario

Short positions become relevant if prices break below 4,050. This would shift targets towards the 3,880–3,900 zone – the next strong demand area. Additional pressure may come from dollar strength, rising bond yields, and renewed risk appetite following the full resumption of statistical publications.

Conclusion:

Gold remains within the 4,050–4,150 range and continues to stabilise. The baseline scenario suggests consolidation above 4,050 with potential for a move back to 4,230–4,250. A breakout below 4,050 would signal a deeper correction. The medium-term trend remains upward.

Summary

Gold (XAUUSD) ended the week with losses and settled below 4,070 USD per ounce after a two-day rebound. Selling pressure intensified following a drop in the probability of a December Fed rate cut to 30% and the release of FOMC minutes. Additional uncertainty came from delays in key macroeconomic data due to the shutdown: the September employment report is late, and October figures will not be released. Improved market sentiment has reduced demand for safe-haven assets.

Technically, gold remains in a consolidation phase after its recovery. The 4,050–4,150 range continues to define the short-term structure, with key support levels at 4,050 and 3,883. Resistance lies at 4,230–4,250 and the all-time high of 4,378. A breakout above 4,250 would be the first signal of a retest of the highs, while a dip below 4,050 increases the risk of a return to 3,900 without breaking the medium-term bullish trend.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.