Gold (XAUUSD) weekly forecast: profit-taking may give way to growth

Gold (XAUUSD) entered a phase of moderate correction. Profit-taking after a prolonged rally and partial strengthening of the dollar triggered this move, temporarily reducing interest in gold as a safe-haven asset.

This overview examines the key factors that may influence gold performance during 3–7 November 2025.

XAUUSD forecast for this week: quick overview

- Weekly dynamics: gold (XAUUSD) continues to correct after its sharp rise in September. After peaking at 4,378 USD per ounce, quotes declined to the 3,930–3,950 area, where the market temporarily stabilised

- Support and resistance: the nearest support level is at 3,840, followed by 3,72The resistance area lies at 4,000–4,050; consolidation above this zone would open the path towards 4,2A breakout below 3,840 would deepen the correction to 3,600–3,450

- Fundamentals: the Fed’s 0.25-percentage-point rate cut and Jerome Powell's cautious comments limited gold’s growth. Hopes for progress in US-China trade talks reduced demand for safe-haven assets. Nevertheless, gold maintains monthly gains and remains a key hedging instrument

- Outlook: the baseline scenario for the week suggests consolidation in the 3,900–4,050 range with gradual recovery possible. A breakout above 4,050 would confirm the return of bullish momentum, while a drop below 3,840 increases pressure and may lead to a decline towards 3,72The overall trend is moderately upward

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) stabilised around 3,930 USD per ounce, holding near a three-week low. Pressure on the metal intensified as the market revised expectations for further Fed rate cuts.

Previously, the US central bank, as expected, lowered rates by 0.25 percentage points. However, Federal Reserve Chairman Jerome Powell cooled expectations for another cut in December, citing internal disagreements and limited economic data due to the government shutdown. The likelihood of another cut is now estimated at less than 70%, down from nearly 100%.

Another factor reducing interest in gold is optimism around US-China trade negotiations. The upcoming meeting between Donald Trump and Xi Jinping in South Korea could result in a deal. This reduces demand for safe-haven assets.

Despite this, gold remains in positive territory for the month and has surged by around 50% year-to-date. This rally reflects sustained investor interest in long-term defensive instruments.

XAUUSD technical analysis

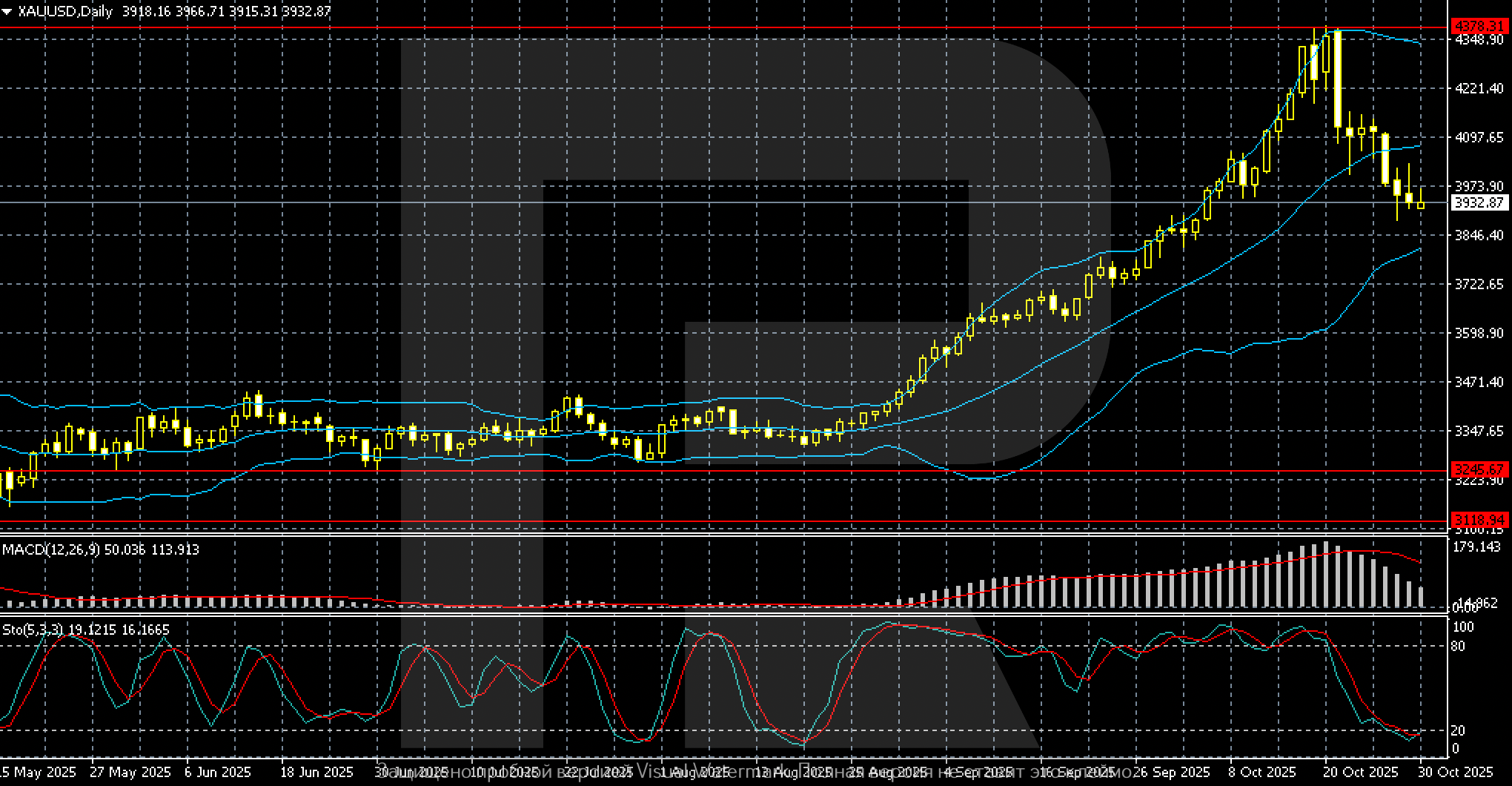

On the daily chart for gold (XAUUSD), after prolonged sideways movement in the 3,400–3,600 range, quotes began a rapid ascent in late August. In September, prices reached a peak of around 4,378 USD per ounce before entering a correction.

By the end of October, gold declined to the 3,930–3,950 area, hovering near the middle Bollinger Band. Indicators show weakening momentum, with MACD moving towards the zero line, and the Stochastic Oscillator remaining in oversold territory. This may indicate a short-term rebound.

The overall trend remains bullish as long as prices stay above 3,840. A breakout below this support level would open the path for a deeper correction towards the 3,600–3,450 area. To resume steady growth, gold needs to consolidate above 4,000–4,050, which would confirm a return of upward momentum.

XAUUSD trading scenarios

The fundamental backdrop for gold remains moderately positive. The market is adjusting to the Fed's decision. Despite temporary USD strengthening, gold maintains its position due to demand for safe-haven assets and expectations of progress in US-China trade talks. The ongoing US government shutdown adds to market uncertainty, providing additional support.

- Buy scenario

Long positions remain a priority if prices hold above 3,900–3,930. A breakout above 4,050 would open the path towards 4,200–4,250, with consolidation above that level increasing the chance of moving to 4,370–4,400. Additional drivers may include dovish Fed signals and weak US macroeconomic data.

- Sell scenario

Short positions become relevant if quotes drop below 3,840, with targets shifting to 3,720–3,600, which represent nearby demand zones. Pressure on gold would intensify with a stronger dollar, rising US bond yields, and declining interest in safe-haven assets.

Conclusion: gold remains in the 3,900–4,050 range. The baseline scenario for the coming days is consolidation above 3,930 with potential recovery towards 4,200. A breakout below the 3,840 support level would confirm the development of a correction, but the medium-term trend remains bullish.

Summary

Gold (XAUUSD) is consolidating after reaching its all-time high, correcting on profit-taking. The market receives support from expectations of continued Fed easing, a weaker dollar, and steady demand for safe-haven assets, particularly from Asian investors and central banks.

The 4,030 support level and resistance near 4,350 remain key levels. A breakout above 4,350 would open the way to 4,450–4,500, while consolidation below 4,030 increases the risk of a drop to 3,960–3,940.

In the coming days, gold’s dynamics will depend on Fed commentary and geopolitical developments, which will determine the direction of the next move.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.