Gold (XAUUSD) weekly forecast: demand for safe-haven assets will support gold

Gold (XAUUSD) remains in the 3,350-3,380 per ounce range and stays under the influence of a mixed news backdrop. The metal receives support from soft US inflation data and the high probability of a Federal Reserve rate cut in September. All this stimulates interest in safe-haven assets.

At the same time, geopolitical uncertainty persists in the market, with attention also focused on Donald Trump’s statements regarding personnel changes in the Fed’s leadership. A possible replacement of the chair and changes in the Board of Governors could shift the trajectory of monetary policy.

Let us analyse the possible scenarios for gold movement amid the current macroeconomic and geopolitical factors.

XAUUSD forecast for this week: quick overview

- Weekly dynamics:

Gold (XAUUSD) ended the week near 3,357 per ounce, remaining in a sideways range that has been in place since mid-May. After attempts to rise earlier in the month, quotes faced resistance in the 3,380-3,416 area and returned to the middle of the range.

The week’s drivers are weakness of the US dollar amid moderate US inflation data, expectations of a Fed rate cut in September, and rising geopolitical tensions. The weekly low was 3,350, with the high at 3,380.

- Key support:

The 3,350-3,345 area remains an important level for buyers. A breakout below it would open the way to 3,283 and then to 3,245. Pressure may intensify if US Treasury yields rise and the Fed issues more hawkish comments.

- Key resistance:

The nearest resistance lies at 3,380-3,416, with further levels at 3,439 and the all-time high at 3,501. A breakout above 3,439 amid weak US macro data or rising political risks could be a signal for accelerated growth

- Fundamental drivers:

Gold receives support from an almost 100% likelihood of a Federal Reserve rate cut in September and expectations of another move in December. Investors also react to growing geopolitical uncertainty. The dollar’s weakness and soft inflation data boost demand for safe-haven assets.

- Overall sentiment:

Overall sentiment is moderately positive. While prices hold above 3,350, there remains potential for growth within the range. Consolidation above 3,439 will open the target area near 3,500.

- XAUUSD forecast for the week:

The baseline scenario suggests trading in the 3,350-3,439 range with an attempt to break upwards. If prices break and hold above the 3,439 level, this would pave the way for a target of 3,500. Support levels are 3,350, 3,283, and 3,245. Key triggers include US retail sales and consumer sentiment data, along with any signals from the Fed.

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) hovered around 3,360 per ounce last week. The rise was gradual and slow, with the US July inflation data supporting prices. Consumer prices rose by 2.7% year-on-year, below the forecast of 2.8%. This eased fears about price acceleration due to tariffs. The core index rose to 3.1%, in line with market expectations.

Against this backdrop, expectations strengthened that the Federal Reserve would resume rate cuts in September. The likelihood of a 25-basis-point cut is close to 100%, with some participants betting on a more aggressive 50-basis-point move. US Treasury Secretary Scott Bessent urged a half-percentage cut to start and continuing easing thereafter.

Geopolitical risks also supported gold demand, with the US-Russia talks in focus.

Combined with dovish monetary policy expectations and ongoing geopolitical tensions, gold (XAUUSD) retained its appeal as a safe-haven asset. Investors are closely watching upcoming US retail sales and jobless claims data.

XAUUSD technical analysis

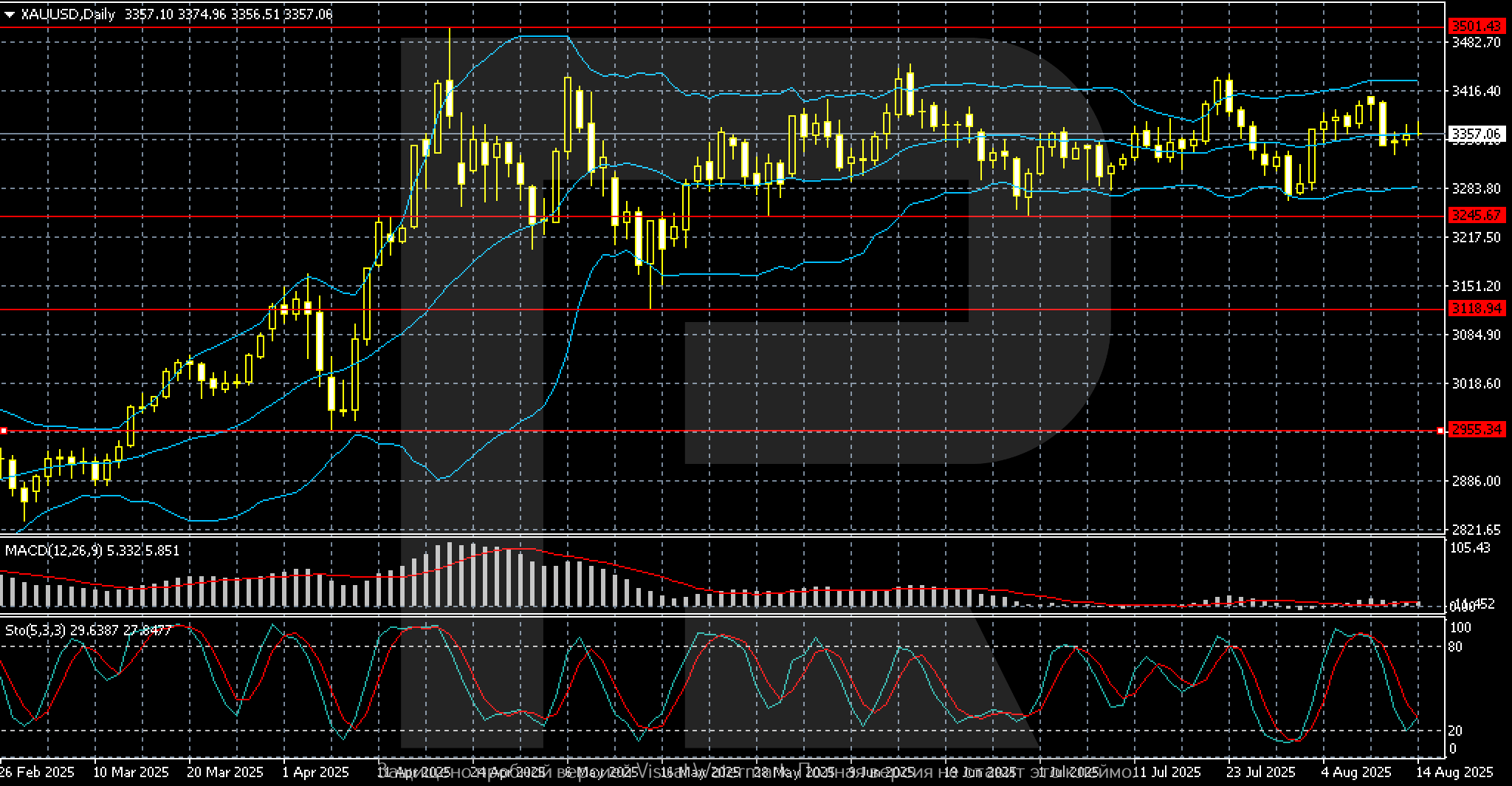

On the daily chart, gold (XAUUSD) prices hovered around 3,357 per ounce and remained within the range. This range has remained unchanged since mid-May 2025, with the upper boundary in the 3,416-3,439 area and the lower around 3,283-3,300.

The first half of the year saw a steady uptrend that began in late February from levels below 3,000 and culminated in a sharp rally in April, when prices reached an all-time high near 3,501. After that, gold shifted into sideways movement.

Indicators show no clear momentum. MACD is close to the zero line, and the histogram is minimal, indicating declining volatility. The Stochastic Oscillator has dropped into oversold territory, signalling a possible short-term rebound if the current support level holds.

Key support levels are at 3,245, 3,118, and 2,955, with resistance at 3,416-3,439 and the all-time high at 3,501.

XAUUSD trading scenarios

The fundamental background remains mixed.

On one hand, gold is supported by soft US inflation data, an almost 100% probability of a Fed rate cut in September, and heightened geopolitical risks. On the other hand, rising stock indices and optimism in capital markets are limiting demand for safe-haven assets. Additional uncertainty comes from possible US trade measures and currency market fluctuations. Against this backdrop, gold starts the week near 3,357, in the mid-range.

- Buy scenario

Long positions remain preferable if support at 3,350-3,345 holds. This area coincides with the lower boundary of the consolidation formed in May. A repeated rebound from the level with the formation of a reversal candlestick pattern could open the path to 3,439 and further to 3,500.

An additional catalyst would be weak US data on consumer sentiment or retail sales, which would heighten expectations of aggressive rate cuts.

- Sell/short scenario

Short positions become relevant if prices break below 3,350. Consolidation below this level would open the way to 3,283 and 3,245. This scenario will gain strength with rising US Treasury yields, a stabilising US dollar, and hawkish comments from Fed officials. Selling is also possible amid improved global risk appetite and declining volatility.

Overall conclusion

Gold remains in a phase of sideways consolidation between 3,350 and 3,439. Until it breaks out of this range, the market will continue to balance between expectations of Fed policy easing and fluctuations in risk appetite. The baseline scenario suggests moderate growth, aiming for a breakout above 3,439 and a move towards 3,500, provided the news backdrop proves favourable.

Summary

Gold (XAUUSD) closed the second week of August near 3,357 per ounce, holding within the mid-range of recent months. The metal received support from soft US inflation data, an almost 100% probability of a Fed rate cut in September, and heightened geopolitical risks.

However, upside remains limited as stock indices are hitting new highs, and optimism in capital markets is reducing demand for safe-haven assets. Additional uncertainty comes from possible US trade actions and currency fluctuations, which impact the dollar and, in turn, gold dynamics.

Technically, the key support level lies at 3,350, with resistance at 3,439. An upward breakout would open the way to 3,500, while consolidation below 3,350 would increase the risk of a decline to 3,283 and 3,245. For now, the range remains intact. The market focuses on short-term strategies as it reacts to macroeconomic statistics and political news.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.