Gold (XAUUSD) weekly forecast: the Fed and trade deals may give gold a chance

Gold (XAUUSD) maintains a neutral sentiment and consolidates within the 3,350-3,435 range. The main support for prices comes from expectations of a more dovish Federal Reserve policy and growing demand for safe-haven assets amid ongoing trade negotiations and global economic uncertainty. At the same time, gold faces pressure from the USD and high US bond yields.

Interest in the precious metal remains subdued, but in the context of new tariff threats and potential disagreements between the Fed and the White House, demand could strengthen. Technically, holding above 3,350 preserves the potential for growth towards 3,440-3,450, with a possible upward breakout if the positive backdrop is confirmed.

In the coming days, focus will be on the Federal Reserve meeting and the details of trade agreements with China and the EU, as they will likely set the direction for XAUUSD this week.

XAUUSD forecast for this week: quick overview

- Weekly dynamics:

Gold (XAUUSD) ends the week in a sideways range between 3,350 and 3,435 USD per ounce. Pressure on the metal came from rising interest in risk assets due to optimism about US trade agreements with Japan and the EU. However, escalating tariff rhetoric towards India and South Korea and uncertainty in negotiations with China keep gold from a deeper correction. The weekly low is 3,351, while the high is 3,439.

- Key support:

3,350 is the nearest level closely watched by the market. A breakout below this level would open the way to 3,300 and then to the more significant support at 3,245. If pressure and yields rise further, a decline to 3,118 is possible.

- Key resistance:

The key resistance area lies between 3,435-3,440. A breakout in this area on the daily timeframe will confirm the market’s readiness to resume the uptrend with targets at 3,500-3,520.

- Fundamental factors:

Gold remains influenced by news on US trade talks and expectations regarding the Federal Reserve rate. The upcoming negotiations with China this week could affect demand for safe-haven assets. Another important factor is the prospect of policy easing: markets are pricing in a pause in July and a possible rate cut in October. This supports gold amid a moderately strengthening dollar.

- General sentiment:

Moderately bullish. The technical picture remains neutral to positive, as prices stay above 3,350. Indicators point to consolidation with upward potential. A breakout above 3,440 would signal growth towards the spring highs.

- XAUUSD weekly forecast:

The baseline scenario suggests consolidation with a bullish bias, with targets at 3,440 and, if broken, at 3,500-3,520. The support level lies at 3,350, with further levels at 3,300 and 3,245 in case of a breakout. Federal Reserve decisions and trade news will act as key catalysts for movement.

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) trades below 3,390 per troy ounce and remains under local and rather emotional pressure. Optimism around potential US trade deals with key partners has reduced the metal’s appeal as a safe-haven asset.

The European Union is nearing a deal with Washington that would introduce a broad 15% tariff on EU goods, avoiding the harsher 30% rate scheduled to take effect on 1 August. The new structure may also include automobiles, mirroring the format already agreed upon in the deal between the US and Japan.

However, caution remains as negotiations with South Korea and India are still ongoing, and the threat of tariffs ranging from 15% to 50% remains valid.

Investors are also awaiting progress in dialogue with China: US Treasury Secretary Scott Bessent is scheduled to meet with Chinese representatives in the final week of July.

On the monetary policy front, focus is on this week’s Fed meeting. The market expects the rate to remain unchanged. However, a potential easing in October is already being priced in.

XAUUSD technical analysis

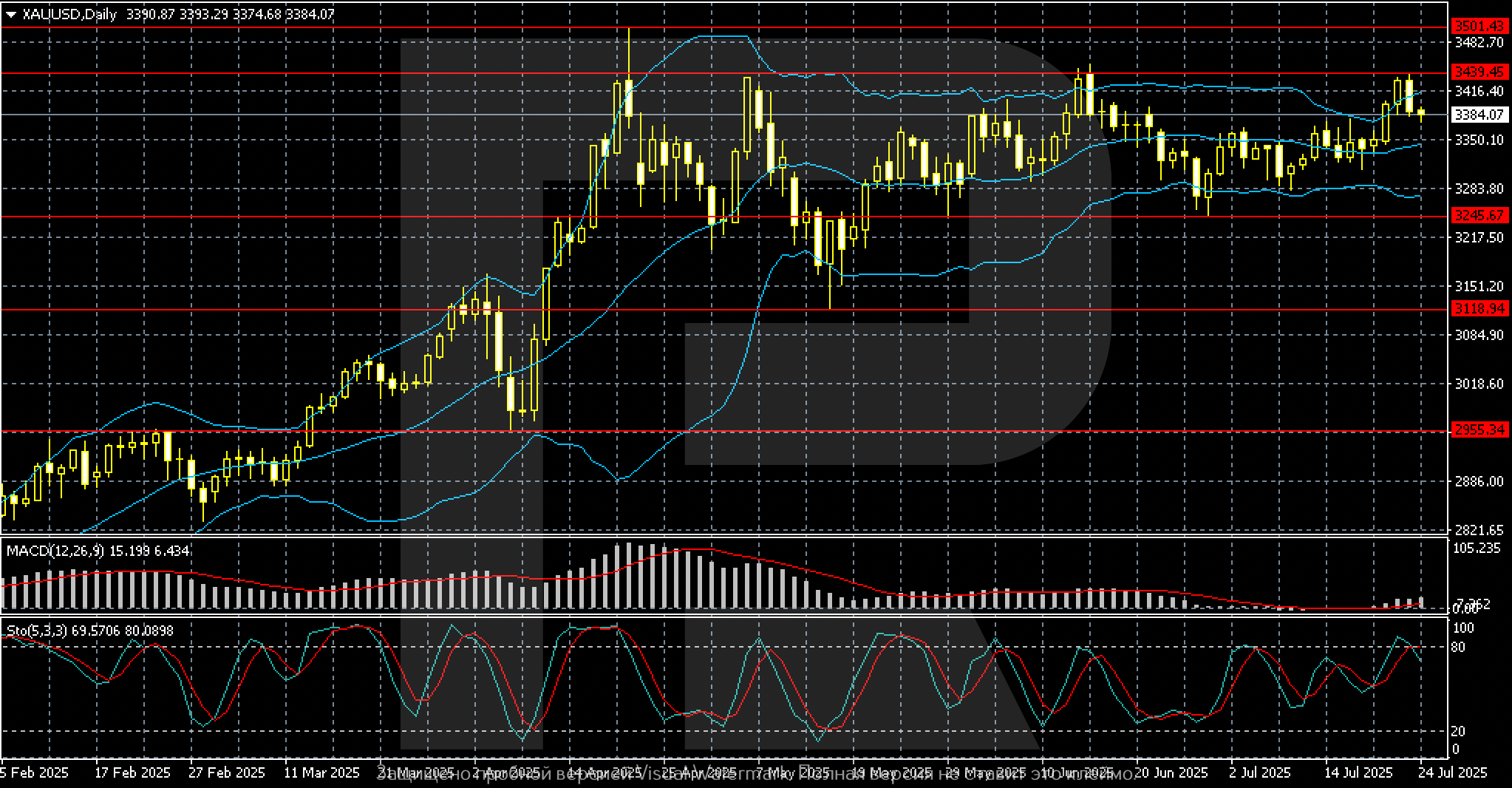

On the daily chart, Gold (XAUUSD) is consolidating within a range and trading near 3,384 per ounce. Prices have pulled back from the recent local high of 3,439 and remain below the key resistance level, showing no clear momentum.

The Bollinger Bands are gradually narrowing, indicating lower volatility and the possible approach of a directional move. The nearest resistance levels are at 3,439 and 3,501 – the local highs of the spring rally. The support level lies at 3,245 and then at 3,119.

The MACD oscillator maintains a weak bullish signal: the histogram remains positive, and the MACD line is slightly above the signal line, but without a clear impulse. The Stochastic is approaching overbought territory; a downward crossover could lead to a correction.

Overall, Gold (XAUUSD) is trading sideways between 3,350 and 3,440. A breakout of either boundary will signal a directional move. A rise above 3,439 will open the path to 3,500, while a fall below 3,245 will increase pressure on the metal.

Key drivers in the coming days will be news on international trade and the outcome of the Fed meeting.

XAUUSD trading scenarios

The fundamental backdrop remains mixed. On one hand, demand for gold as a safe-haven asset has declined amid optimism over US trade deals with key partners – Japan and the EU. On the other hand, persistent uncertainty in talks with China, threats of higher tariffs for several countries, and expectations of Fed policy easing in October continue to support demand for the metal. In this environment, gold consolidates below the 3,440 level, showing restrained dynamics.

- Buy scenario

Long positions can be considered if gold holds above the 3,350-3,360 area. This would confirm the resilience of the support level and market readiness to recover towards 3,435 and then 3,500. A consolidation above 3,440 on the daily chart would open the way to the spring highs near 3,500-3,520.

The optimal entry point remains a pullback to the 3,350 area with confirmation in the form of a candlestick pattern or a bounce from the Bollinger midline. This scenario is preferable in case of a weakening dollar, rising inflation expectations, and signs of cooling in the US economy.

- Sell/short scenario:

Short positions become relevant if prices break below the 3,350 support level and consolidate below 3,320. This would signal weakening bullish momentum and the start of a downward exit from the range.

Downside targets include the 3,245 and 3,120 levels. The correction could continue if US bond yields rise, the dollar strengthens, and the Fed signals a pause in its easing cycle.

The market is balancing between technical consolidation and fundamental risk reassessment. As long as gold holds above 3,350, a neutral-positive bias remains.

Summary

Gold (XAUUSD) remains in a consolidation mode within the 3,350-3,435 range, staying sensitive to fundamental news. Investors assess the prospects of Fed policy easing, the progress of US trade agreements with key partners, and the general state of global demand for safe-haven assets. Despite local pressure from the dollar and rising Treasury yields, the metal finds support from geopolitical and trade uncertainty.

The current sideways corridor reflects the market’s wait-and-see stance. A consolidation below 3,350 or above 3,440 will serve as a technical signal for a new impulse. Until then, movement remains limited with moderate volatility.

In an uncertain environment, short-term traders may focus on range-bound trading – rebounds from boundaries and confirmed reversal signals at key levels. It is worth paying increased attention to the Fed’s rhetoric and the course of negotiations with China.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.