Gold (XAUUSD) weekly forecast: consolidation remains, but growth is possible

Gold (XAUUSD) maintains a neutral outlook, hovering within a sideways range. Expectations of Fed policy easing support prices, despite pressure from a strong dollar and rising bond yields.

Interest in gold as a safe-haven asset stays limited but could increase amid trade risks and political rhetoric directed at the Federal Reserve. Technically, gold remains above the key support level at 3,300 USD, keeping the potential for a move towards 3,400 USD and beyond.

Let’s examine what factors could support XAUUSD this week and what could limit its growth.

XAUUSD forecast for this week: quick overview

- Weekly dynamics:

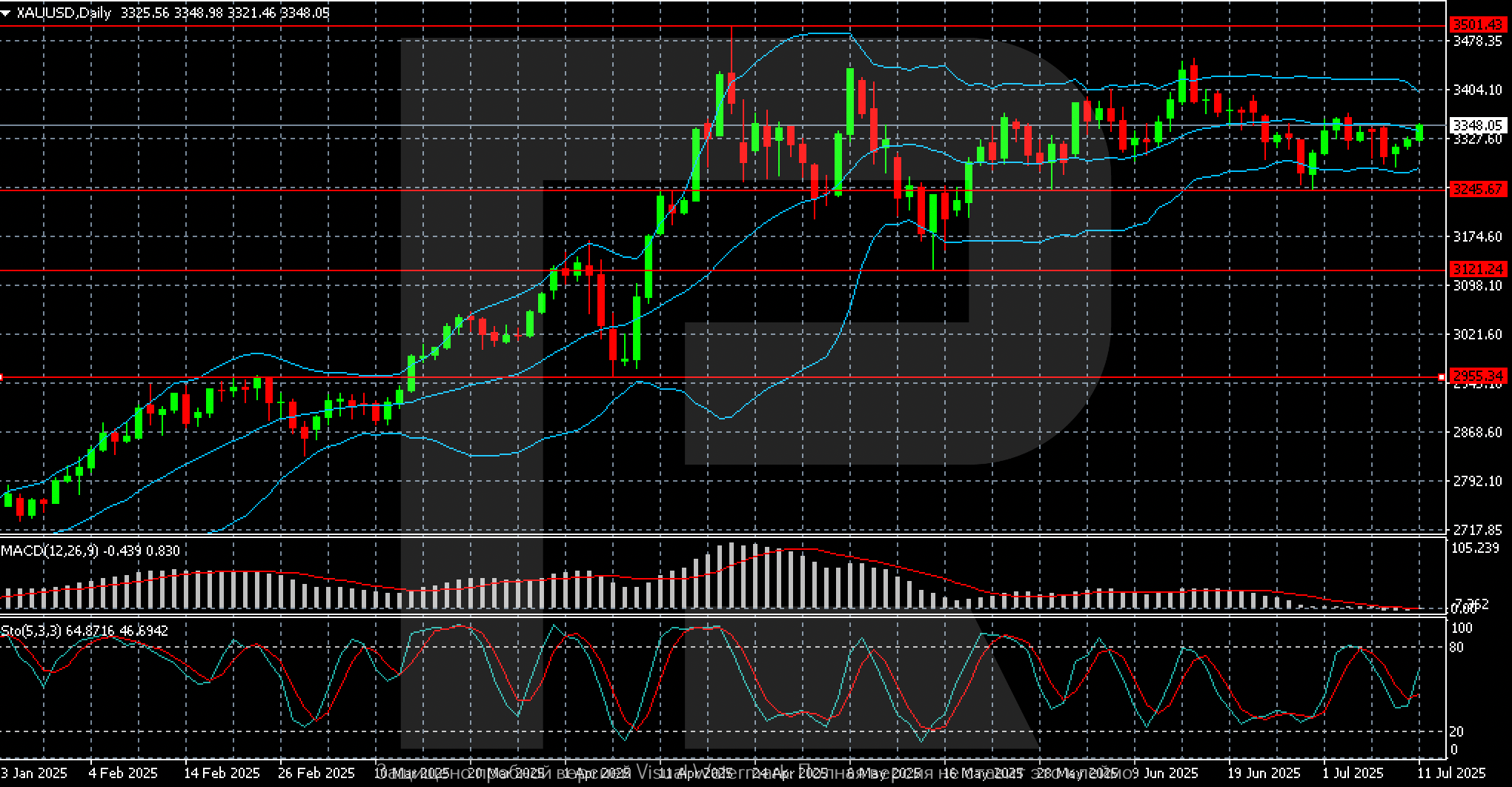

Gold (XAUUSD) traded between 3,245 and 3,400, pressured by a strong dollar and rising government bond yields. The weekly low was 3,245, and the high reached around 3,348. Despite local attempts to rally, quotes remain sideways. The market has taken a wait-and-see approach as it anticipates new signals from the Fed and progress in trade talks.

- Key support level:

3,300 is the nearest level to hold positions. A breakout below this level would open the way towards the 3,245 area, and below that, support lies at 3,120 and 2,955, where stabilisation occurred previously.

- Key resistance level:

3,400-3,404 represents the main barrier to further growth. A breakout above this level on the daily chart would allow gold to move towards 3,450, with the potential to reach 3,500-3,550 under favourable external conditions.

- Fundamental factors:

Gold faces pressure from a stronger dollar and high US Treasury yields. However, interest in safe-haven assets persists amid US tariff threats, monetary policy uncertainty, and political pressure on the Fed. The market awaits confirmation of a shift towards easing – this could support gold.

- General sentiment:

Neutral to positive. As long as gold holds above 3,300, the bias leans towards growth. A breakout above 3,400 would signal a new phase of upward momentum. If bearish macro signals emerge, prices could pull back to the lower boundary of the range.

- XAUUSD weekly forecast:

The base upside target stands at 3,400, and if broken, a move to 3,450-3,500 could follow. The support level lies at 3,300, then 3,245 and 3,120 if pressure increases. The current scenario points to consolidation with upward potential.

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) remains under moderate pressure overall. Investors continue to react to changes in US tariff policy and the release of macroeconomic data. The US Consumer Price Index rose by 0.3% in June, in line with expectations, fuelling concerns about persistent inflationary pressure. Against this backdrop, demand for precious metals has remained limited.

Rising US Treasury yields have also reduced gold’s appeal. The yield on 10-year US bonds reached 4.477%, making them a more attractive alternative for conservative investors. At the same time, the US dollar strengthened to a three-week high, making gold more expensive for holders of other currencies, which has increased pressure on quotes.

Despite the correction, the overall market sentiment remains neutral to positive. Gold prices continue to hold within the range set back in May. The threat of new tariffs, including a possible 30% duty on imports from the EU and Mexico, sustains interest in safe-haven assets.

Another factor is rhetoric directed at the Federal Reserve. Donald Trump continues to pressure the regulator, insisting on a rate cut to 1%. Expectations of monetary policy easing in the second half of the year may again support gold if turbulence escalates.

XAUUSD technical analysis

Gold (XAUUSD) remains in a consolidation phase on the daily chart, trading within the narrow range of 3,245-3,400 per ounce. After a rapid rise in March and April, quotes slowed down and transitioned into a sideways trend, reflecting the market’s wait-and-see attitude.

Prices are currently hovering around 3,348, closer to the upper boundary of the range. Growth attempts are limited by the 3,400-3,404 resistance area, with key support at 3,245. Stronger support levels appear below – around 3,121 and 2,955, where previous stabilisation and corrections took place.

Technical indicators confirm the sideways dynamics. Bollinger Bands are gradually narrowing, indicating reduced volatility and a potential setup for an impulsive move. The MACD hovers near the zero line with no clear signal. The Stochastic has turned upwards, which could point to a short-term attempt to rise towards the channel’s upper boundary.

The gold market stands still, awaiting new macroeconomic and political triggers such as Fed decisions, US inflation data, and the progress of trade negotiations. A consolidation above 3,400 would open the path to retesting 3,500, while a breakout below 3,245 could trigger a wave of selling.

XAUUSD trading scenarios

Fundamental factors like uncertainty in US trade policy, expectations of monetary easing, and weak inflation dynamics continue to support gold as a safe-haven asset. At the same time, the technical picture signals medium-term consolidation without signs of a downward trend reversal.

- Buy scenario

Opening long positions is possible if gold holds above the 3,300 level. This confirms the current range remains intact and indicates market readiness to move towards 3,400. A consolidation above 3,400 on the daily chart would open the way to the next target near 3,450, and if demand for safety increases, to 3,500 and beyond, up to the 3,520-3,550 area.

The optimal entry point would be a pullback to the 3,320-3,300 area, with confirmation in the form of a candlestick signal, a reversal pattern, or a bounce from the Bollinger midline. This scenario is preferable if the dollar weakens and geopolitical tension persists.

- Short/sell scenario

Short positions may be considered if gold breaks and firmly consolidates below 3,300. This would be the first technical signal of weakening buyer activity and a potential downward breakout from the range.

Downside targets are the 3,245-3,220 area, followed by support at 3,120. A downtrend may develop if the US dollar strengthens, Fed rhetoric turns hawkish, or global demand for safe assets decreases.

The market remains in a state of anticipation, balancing between technical consolidation and fundamental uncertainty. However, as long as gold holds above 3,300, the bias still favours the bulls.

Summary

The Gold (XAUUSD) market remains in consolidation, moving within the 3,245-3,400 range. Investors assess the impact of US tariff policy, the outlook for Fed monetary easing, and signs of inflationary pressure. Despite rising Treasury yields and a stronger dollar, demand for gold persists due to interest in safe-haven assets amid trade and political uncertainty.

As long as prices stay within the range, movement remains limited and volatility is moderate. A breakout and consolidation below 3,245 or above 3,400 would be a technical signal for a new directional trend.

Until then, short-term traders should reasonably focus on intraday rebounds from the range boundaries. It is also worth tracking reversal signals within the established levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.