US consumer demand slowdown supports XAUUSD strength

XAUUSD prices are gaining momentum amid weakening US economic indicators and growing expectations of a December Fed rate cut, currently trading at 4,162 USD. Discover more in our analysis for 26 November 2025.

XAUUSD forecast: key trading points

- US retail sales rose 0.2% in September after a stronger increase in August

- ADP Research reported an average private-sector job loss of 13.5 thousand

- US data releases boost expectations of a Fed rate cut in December

- XAUUSD forecast for 26 November 2025: 4,240

Fundamental analysis

XAUUSD quotes continue to strengthen, approaching a two-week high. The rise is driven by US data releases that reinforce expectations of a Federal Reserve rate cut in December.

Recent figures show a slowdown in consumer demand. Retail sales increased only 0.2% in September, following a more confident rise in August, while analysts had expected a 0.4% gain. This result indicates a decline in consumer spending and supports the scenario of a more accommodative monetary policy.

Markets are now pricing in an 84.9% likelihood of a 25-basis-point Fed rate cut, up from just 50% a week ago. This shift in expectations creates additional support for gold.

The ADP Research report shows further signs of labour market cooling. Private sector employment for the four weeks ending 8 November decreased by an average of 13.5 thousand jobs per week. The weakening labour market boosts expectations of Fed easing and drives demand for XAUUSD.

XAUUSD technical analysis

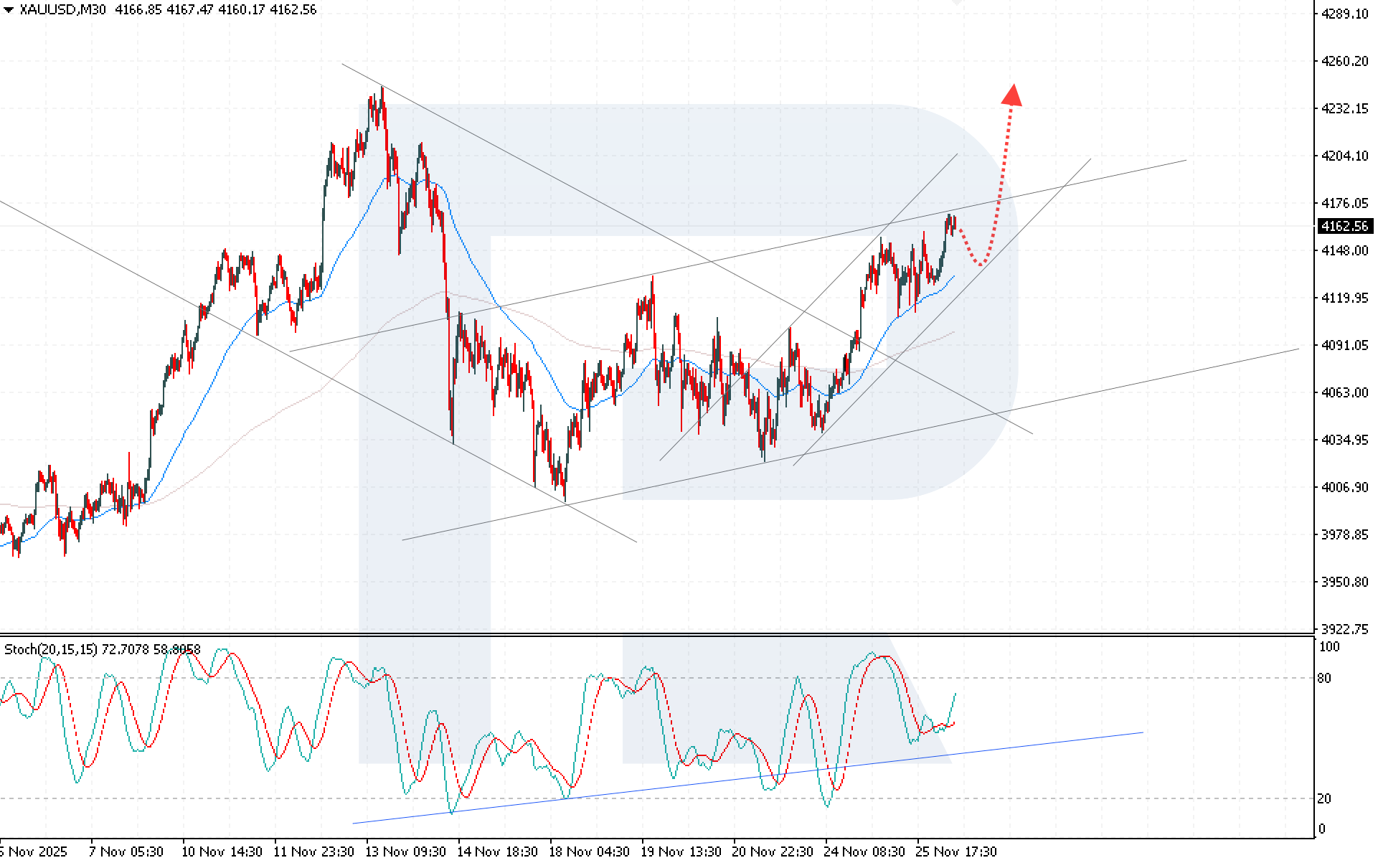

XAUUSD quotes are rising within an ascending channel. Buyers encountered resistance near its upper boundary, yet prices remain above the EMA-65 line, confirming steady buying pressure and supporting a bullish short-term outlook.

The XAUUSD price forecast suggests a minor bearish correction, followed by continued upward movement towards 4,240 USD. The Stochastic Oscillator reinforces the bullish scenario, with its signal lines rebounding from the support level, indicating increasing buyer activity.

A price consolidation above 4,185 USD will confirm the development of a full-scale bullish impulse.

Summary

A combination of weak US spending and employment data fuels expectations of a Federal Reserve rate cut and supports gold. The XAUUSD analysis for today indicates continued bullish momentum with upside potential towards 4,240 USD, provided prices hold above 4,185 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.