Gold (XAUUSD) enters consolidation: everyone is watching the future Fed rate decision

Gold (XAUUSD) prices have declined to 4,050 USD, with the market uneasy about future prospects. Find more details in our analysis for 24 November 2025.

XAUUSD forecast: key trading points

- Market focus: gold (XAUUSD) is tracking shifts in sentiment regarding the Fed interest rate

- Current trend: despite the pullback, gold remains one of the year’s top performers with a 54% gain

- XAUUSD forecast for 24 November 2025: 4,040 or 4,100

Fundamental analysis

Gold (XAUUSD) fell to 4,050 USD per ounce on Monday, extending Friday’s decline.

The market is awaiting new US data that could clarify the Federal Reserve’s monetary policy outlook. This week’s key releases include retail sales and the Producer Price Index for September, due on Tuesday, and weekly jobless claims, scheduled for release on Wednesday.

Expectations for a December rate cut shifted noticeably after New York Fed President John Williams expressed support for another reduction in the coming months. The market now estimates the likelihood of a 25-basis-point rate cut in December at roughly 70%, up from about 40% on Thursday after strong labour market data.

At the same time, gold remains one of the top performers of the year, with XAUUSD quotes up roughly 54% since the beginning of 2025. Support comes from trade and geopolitical uncertainty, steady central bank buying, and investor demand for safe-haven assets amid fiscal risks.

The gold (XAUUSD) forecast is mixed.

XAUUSD technical analysis

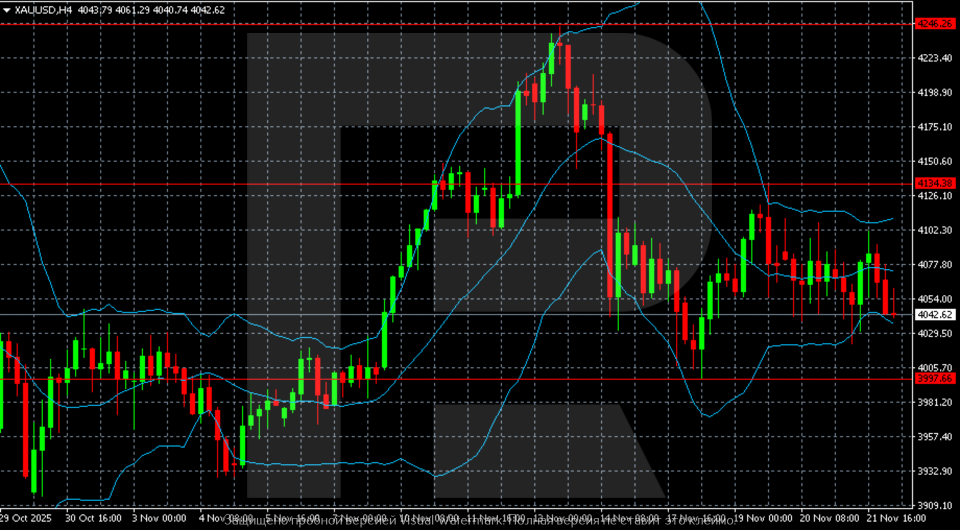

On the H4 chart, gold (XAUUSD) is in a phase of sideways consolidation after a steep drop from the local peak around 4,246. Most of the movement takes place within the 4,040–4,100 range, where prices have repeatedly reversed in both directions.

The upper resistance boundary is near 4,134, from where a sharp decline started on 14 November. Since then, gold has failed to return above this level, signalling weak buying momentum. The lower support level lies in the 3,997–4,000 area. In recent days, prices have approached this level more frequently, suggesting gradually increasing selling pressure.

Candlesticks fluctuate around the middle Bollinger Band, indicating the absence of a clear trend. The upper band forms dynamic resistance around 4,100–4,130, while the lower band provides support near 4,000.

The current structure looks neutral-to-bearish: recovery attempts quickly fade, and each new upswing becomes shorter. Prices remain in the lower half of the range, increasing the likelihood of another test of the 4,000 level. A breakout below this area would open the way towards 3,950–3,920. A move back above 4,134 would be the first sign of renewed bullish momentum.

Summary

Gold (XAUUSD) remains under moderate pressure, although there are plenty of signals. The gold (XAUUSD) forecast for today, 24 November 2025, suggests continued sideways movement within the 4,040–4,100 range.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.