Gold (XAUUSD) declines after Nonfarm Payrolls

XAUUSD prices have fallen towards the 4,030 USD area following the release of US labour market data. Find out more in our analysis for 21 November 2025.

XAUUSD forecast: key trading points

- Market focus: US Nonfarm Payrolls increased by 119 thousand in September

- Current trend: correcting downwards

- XAUUSD forecast for 21 November 2025: 4,100 or 4,000

Fundamental analysis

On Friday, XAUUSD prices are declining amid weakening expectations of a Federal Reserve rate cut in December after the release of the employment report.

The long-awaited report from the US Department of Labor, delayed due to the government shutdown, showed that the number of nonfarm jobs increased by 119 thousand in September, exceeding the forecast of 50 thousand.

Analysts note that these figures confirm the Fed’s October assessment that the labour market is cooling but remains stable. Meanwhile, the unemployment rate rose to 4.4%, the highest level since October 2021, surpassing the expected 4.3%, while wage growth came in slightly above forecasts at 3.8%.

XAUUSD technical analysis

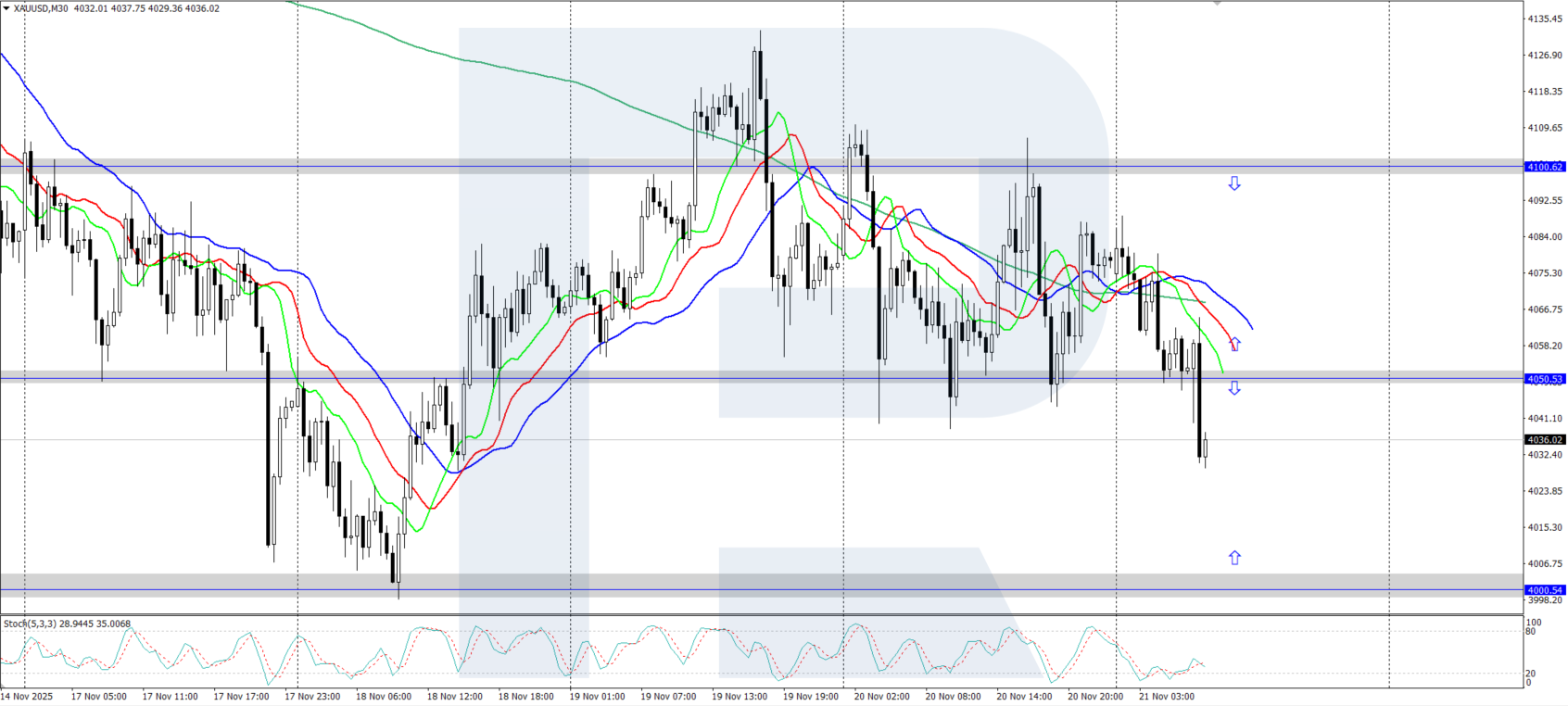

XAUUSD quotes corrected towards the area around 4,030 USD amid growing doubts about a further Federal Reserve rate cut this year. The Alligator indicator is pointing downwards, meaning the corrective movement may continue.

The short-term XAUUSD price forecast suggests further growth towards 4,100 USD and higher if buyers regain control and find a foothold above 4,050 USD. Conversely, if sellers keep prices below 4,050 USD, a decline towards the 4,000 USD support level is possible.

Summary

Gold continues its downward correction, dropping to the 4,030 USD area as market participants doubt the Fed will cut rates at the December meeting.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.