Gold (XAUUSD) is being sold for the fourth consecutive day: the market awaits signals from the Fed

Gold (XAUUSD) prices are declining towards 4,030 USD as the market is losing interest in safe-haven assets. Discover more in our analysis for 18 November 2025.

XAUUSD forecast: key trading points

- Market focus: gold (XAUUSD) is falling due to shifting expectations regarding the Fed’s actions

- Current trend: the market is focused on upcoming US statistics

- XAUUSD forecast for 18 November 2025: 4,006

Fundamental analysis

Gold (XAUUSD) prices fell to 4,030 USD per ounce on Tuesday, marking the fourth consecutive decline. Pressure is intensifying as expectations for a December Fed rate cut continue to fade, while traders await a series of postponed US macroeconomic releases. All of this should clarify the future course of monetary policy.

For the past six weeks, the market has been operating without key economic data. Hawkish comments from Fed officials further reduce the odds of December easing. Fed Vice Chair Philip Jefferson highlighted rising risks to the labour market but stressed that the regulator should proceed cautiously when considering additional rate cuts.

Now the market’s attention is focused on the September jobs report, due on Thursday, and the FOMC minutes, scheduled for release on Wednesday.

The likelihood of a 25-basis-point rate cut in December is currently estimated at around 43%, down from over 60% earlier this month.

The gold (XAUUSD) outlook is moderate.

XAUUSD technical analysis

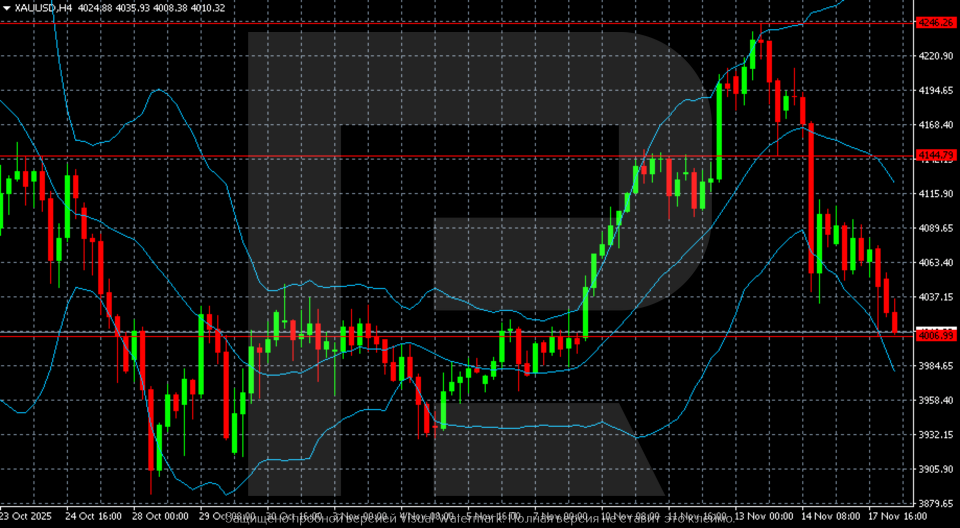

On the gold (XAUUSD) H4 chart, the structure has shifted from growth to a gradual decline. After a sharp rise to the 4,240–4,246 area, gold formed a local peak and reversed downwards. Around the 4,145 level, prices faced resistance multiple times – this level became the key boundary from which selling pressure accelerated.

The quotes then broke below intermediate support zones and fell to the crucial 4,006–4,010 area, which is now being tested. This is a level where sideways consolidations previously formed, and its defence is critical for buyers. The lower Bollinger Band is pointing downwards, confirming the strengthening bearish momentum. Candlesticks are predominantly bearish, and attempts at corrective rebounds fade quickly, as the movement structure remains weak.

Gold (XAUUSD) quotes are under pressure while testing the key support level near 4,006. A downward breakout would open the way towards 3,960–3,930. Holding this level may trigger a short-term rebound, but there are no reversal signals yet.

Summary

Gold may edge even lower as market conditions stabilise. The gold (XAUUSD) forecast for today, 18 November 2025, suggests a decline towards 4,006.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.