Gold (XAUUSD) prepares to break above its highs

Gold (XAUUSD) prices have resumed growth, reaching 4,190 USD. Further highs remain possible. Find more details in our analysis for 14 November 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) appears strong after a brief correction

- Demand for safe-haven assets will keep gold supported

- XAUUSD forecast for 14 November 2025: 4,245

Fundamental analysis

Gold (XAUUSD) prices climbed back to 4,190 USD per ounce on Friday after an earlier attempt to retest three-week highs. The market reversed amid a broad asset sell-off following the US government’s reopening.

The rally at the start of the week was driven by expectations that official data, delayed due to the shutdown, would reveal labour market weakness, reinforcing the case for a Federal Reserve rate cut. However, as Treasury yields rose, demand for non-yielding assets weakened, prompting some investors to take profits. Comments from Federal Reserve officials also cooled expectations, as most emphasised that a December rate cut is not guaranteed.

Markets are currently pricing in about a 50% probability of a 25-basis-point rate cut. Despite the pullback, gold remains up nearly 5% this week. The recent dip reflects an adjustment of expectations rather than a trend reversal.

The gold (XAUUSD) forecast is positive.

XAUUSD technical analysis

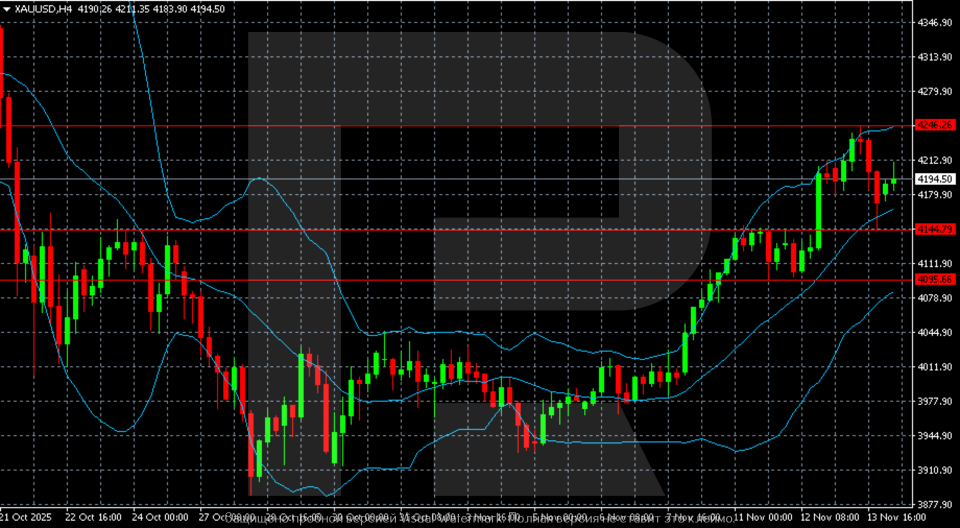

On the H4 chart, gold (XAUUSD) has consolidated above the local range and continues to move within an upward channel. After a sharp rise on 11–12 November, prices reached resistance at 4,245–4,250 USD, where buyers faced significant selling pressure for the first time. From this zone, quotes pulled back slightly but remained above the 4,170–4,180 USD support area, confirming strong bullish momentum.

Bollinger Bands have expanded upwards. In mid-November, prices are moving along the upper band, indicating sustained buying pressure. The middle band lies around 4,120–4,140 USD – the nearest dynamic support zone.

Key levels are as follows: resistance at 4,245–4,250 USD, followed by 4,370–4,380 USD. The support level is located at 4,145 USD, with a stronger one near 4,095 USD.

Summary

Gold maintains its upward structure. The gold (XAUUSD) forecast for today, 14 November 2025, suggests a move to retest the recent high and advance towards 4,245.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.