Gold (XAUUSD) extends its correction

Gold (XAUUSD) continues to trade below 4,000 USD as doubts grow over the likelihood of further Fed rate cuts. Discover more in our analysis for 5 November 2025.

XAUUSD forecast: key trading points

- Market focus: US ADP employment report in focus today

- Current trend: ongoing downward correction

- XAUUSD forecast for 5 November 2025: 3,900 or 4,000

Fundamental analysis

XAUUSD prices remain in a correction phase amid waning expectations for additional rate cuts from the Federal Reserve. On Monday, three Fed officials expressed doubts about the need for further monetary easing next month.

This follows last week’s rate cut, which Federal Reserve Chairman Jerome Powell signalled could be the final reduction this year. As a result, markets now estimate the likelihood of a December rate cut at 65%, down from over 90% a week ago.

Traders will be closely watching the ADP private sector employment report today for clues about the Federal Reserve’s future monetary policy direction.

XAUUSD technical analysis

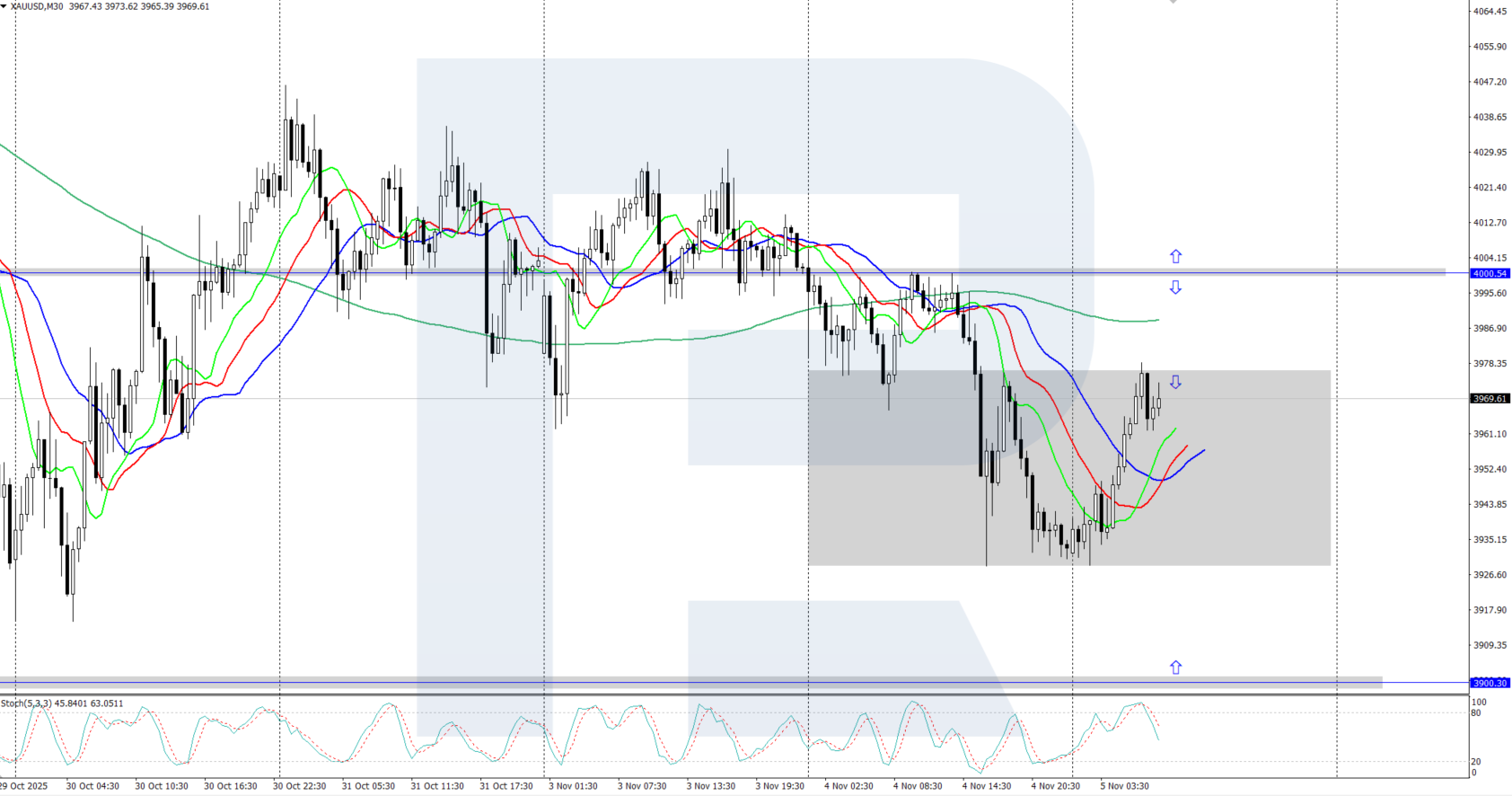

XAUUSD quotes have corrected below 4,000 USD amid concerns about further Fed rate cuts this year. The Alligator indicator is pointing downwards, confirming the potential for further downside.

The short-term XAUUSD price forecast suggests further growth to a high of 4,380 USD and higher if bulls regain control. However, if bears keep prices below 4,000 USD, a decline to the 3,900 USD support level and lower is possible.

Summary

Gold remains in a correction phase, trading below the key psychological level of 4,000 USD as investors await the US ADP employment report, due today.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.