Gold (XAUUSD) takes a pause, but not for long

Gold (XAUUSD) dipped towards 4,020 USD as part of a correction. This looks like a pause within a strong rally. Discover more in our analysis for 9 October 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) paused its rise amid easing geopolitical tensions

- Risks related to the ongoing US government shutdown remain

- XAUUSD forecast for 9 October 2025: 4,100

Fundamental analysis

Gold (XAUUSD) prices retreated to around 4,020 USD per ounce on Thursday, breaking a streak of record highs amid profit-taking and signs of reduced geopolitical tension.

President Donald Trump announced that Israel and Hamas had agreed on the first stage of a peace plan that could end the two-year conflict and include the release of hostages. The agreement was confirmed by representatives of Israel, Hamas, and Qatar, which acted as a mediator.

Despite the short pause, the bullish momentum in gold remains strong due to economic uncertainty and the Federal Reserve’s dovish stance.

The ongoing US government shutdown, now in its second week, continues to delay key macroeconomic data releases and raises the risk of federal workforce cuts. Private reports have reflected a decline in employment in the ADP and ISM PMI indicators.

The latest FOMC meeting minutes pointed to the likelihood of further rate cuts due to labour market fragility. Meanwhile, inflationary risks continue to support demand for precious metals over dollar-denominated assets.

The gold (XAUUSD) forecast is positive.

XAUUSD technical analysis

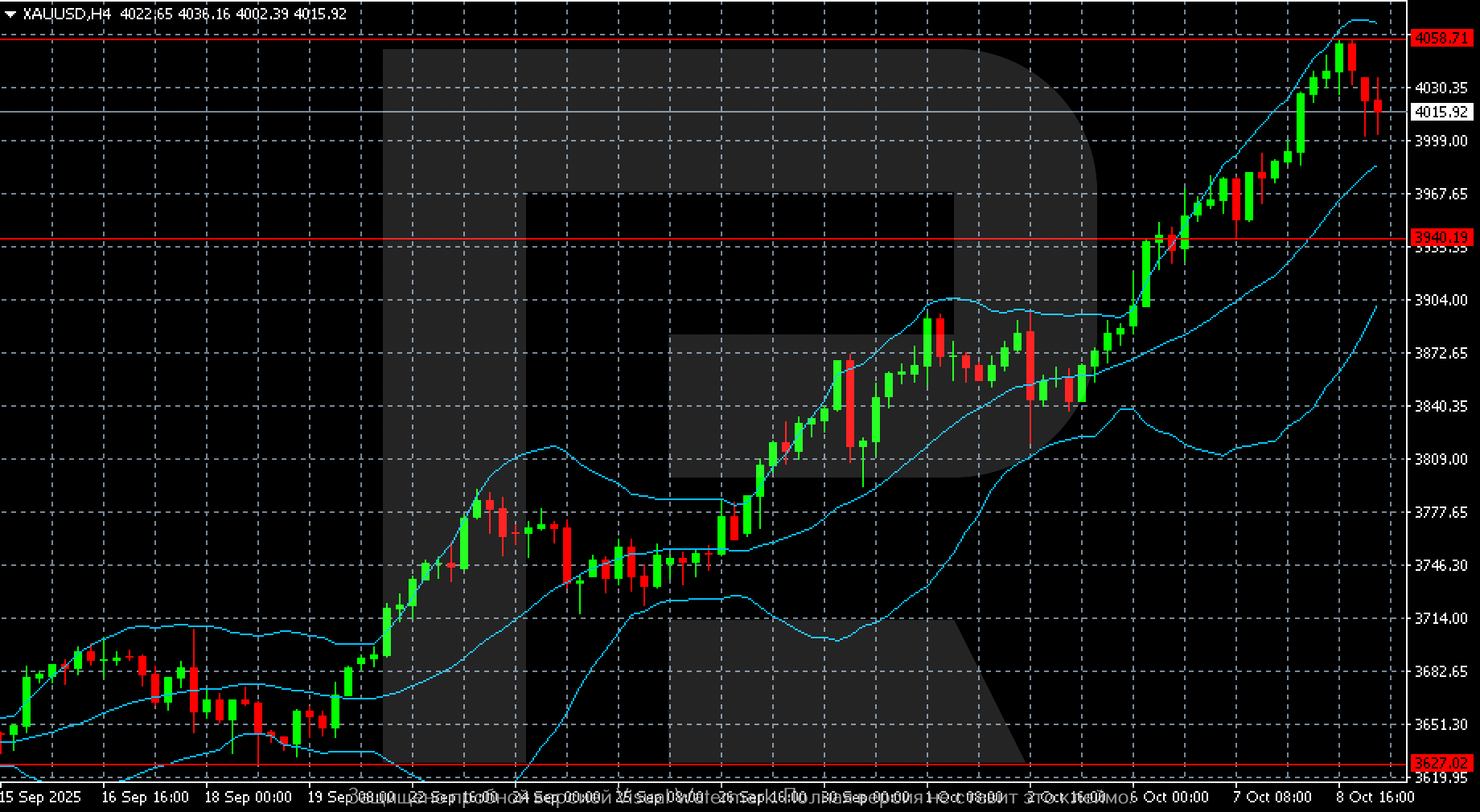

On the XAUUSD H4 chart, after a period of consolidation in late September, prices broke above the resistance level near 3,940 and transitioned into a strong upward phase. At the start of October, the asset reached a new all-time high of 4,058, followed by a mild correction to 4,015–4,020.

Bollinger Bands show a wide expansion, confirming increased volatility and the strength of the bullish momentum. Prices remain above the indicator’s middle line, signalling the dominance of buyers.

The nearest support zone is located around 3,940, while key resistance lies at 4,058. A firm breakout above this level would open the potential for movement towards 4,100–4,120. A decline below 3,940 could deepen the correction into the 3,870–3,820 range.

Summary

Gold is undergoing a minor correction following its rally. The gold (XAUUSD) forecast for today, 9 October 2025, anticipates a return to growth with a target of 4,100 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.