Gold (XAUUSD) hits new all-time high

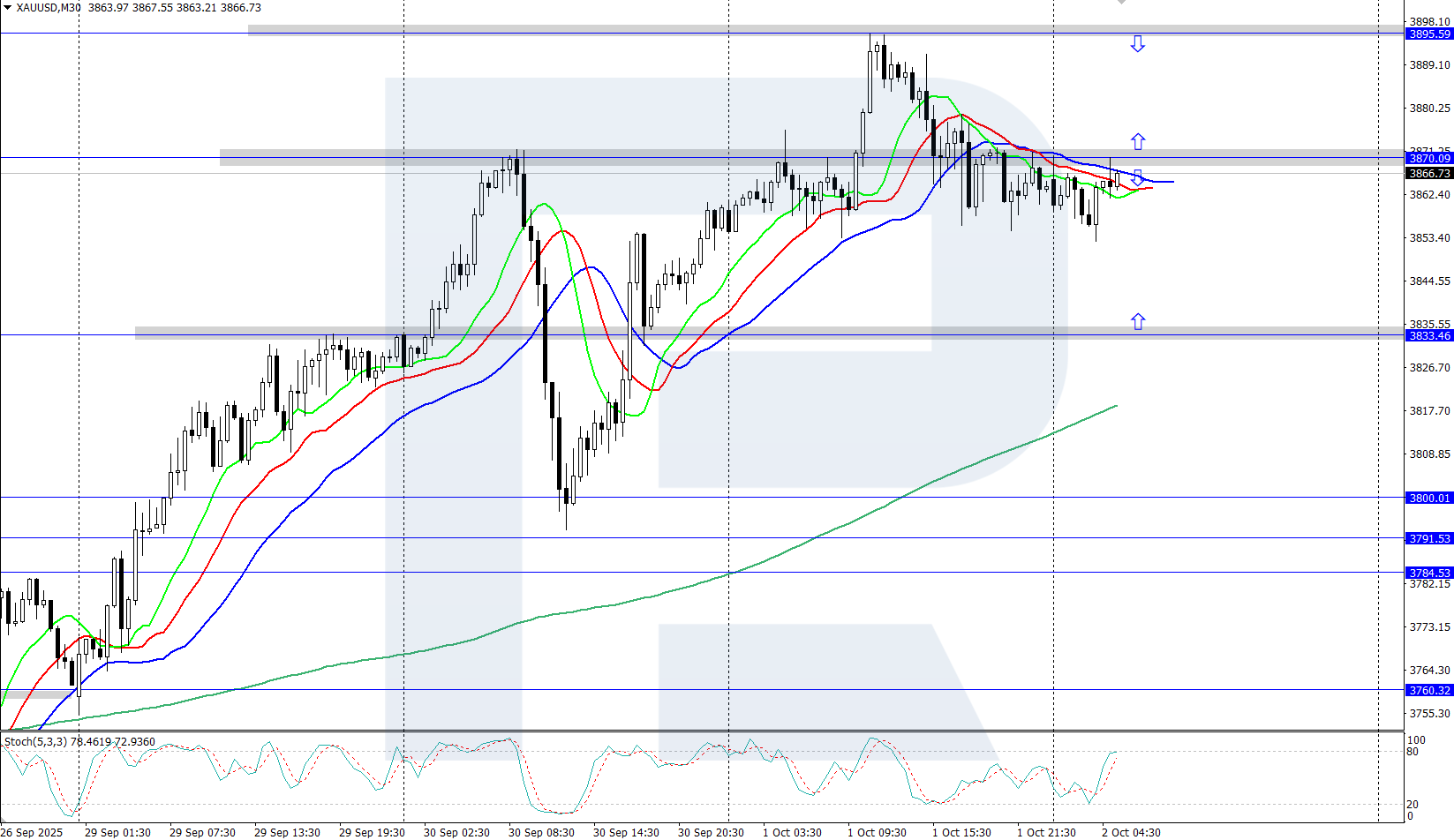

XAUUSD prices are moderately declining after a sharp rally and a new all-time high at 3,895 USD. Find more details in our analysis for 2 October 2025.

XAUUSD forecast: key trading points

- Market focus: US ADP employment data showed a drop of 32 thousand against an expected increase of 52 thousand

- Current trend: trending upwards

- XAUUSD forecast for 2 October 2025: 3,833 or 3,895

Fundamental analysis

XAUUSD quotes corrected slightly from the area of the new all-time high at 3,895 USD, reached on the back of weaker-than-expected US employment data. ADP reported an unexpected decline of 32 thousand private sector jobs in September compared to an expected gain of 52 thousand, citing data revisions.

This week, the US dollar has also come under pressure due to the government shutdown, the first in nearly seven years, after lawmakers failed to reach a deal on temporary funding. The deadlock, expected to last at least three days, will delay the release of key data, including the September Nonfarm Payrolls report.

XAUUSD technical analysis

Gold (XAUUSD) prices continue their strong upward momentum on the daily chart, setting a new all-time high at 3,895 USD. The Alligator indicator is also pointing firmly upwards, indicating the potential for further gains after a minor correction.

The short-term XAUUSD price forecast suggests further growth towards the high of 3,895 USD and above if bulls can maintain control. Conversely, if bears seize momentum, a pullback towards the 3,833 USD support level is possible.

Summary

Gold (XAUUSD) is showing a moderate correction after a sharp rally to a record high at 3,895 USD. Market participants remain focused on the US government funding issue.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.