Gold (XAUUSD) corrected slightly after a rapid surge

XAUUSD prices are moderately declining after a strong rally that set a new all-time high of 3,791 USD. Today, the market focus is on US inflation. Find more details in our analysis for 26 September 2025.

XAUUSD forecast: key trading points

- Market focus: the US PCE price index will be released today

- Current trend: trending upwards

- XAUUSD forecast for 26 September 2025: 3,700 or 3,791

Fundamental analysis

XAUUSD quotes corrected from the all-time high at 3,791 USD amid strong US economic data. GDP figures were revised upwards, showing 3.8% growth in Q2, while durable goods orders also grew by 2.9%.

Today, market participants are awaiting US inflation data for August, with the PCE price index scheduled for release. The indicator is expected to rise by 2.7% year-on-year. The Federal Reserve takes inflation trends into account when making interest rate decisions.

XAUUSD technical analysis

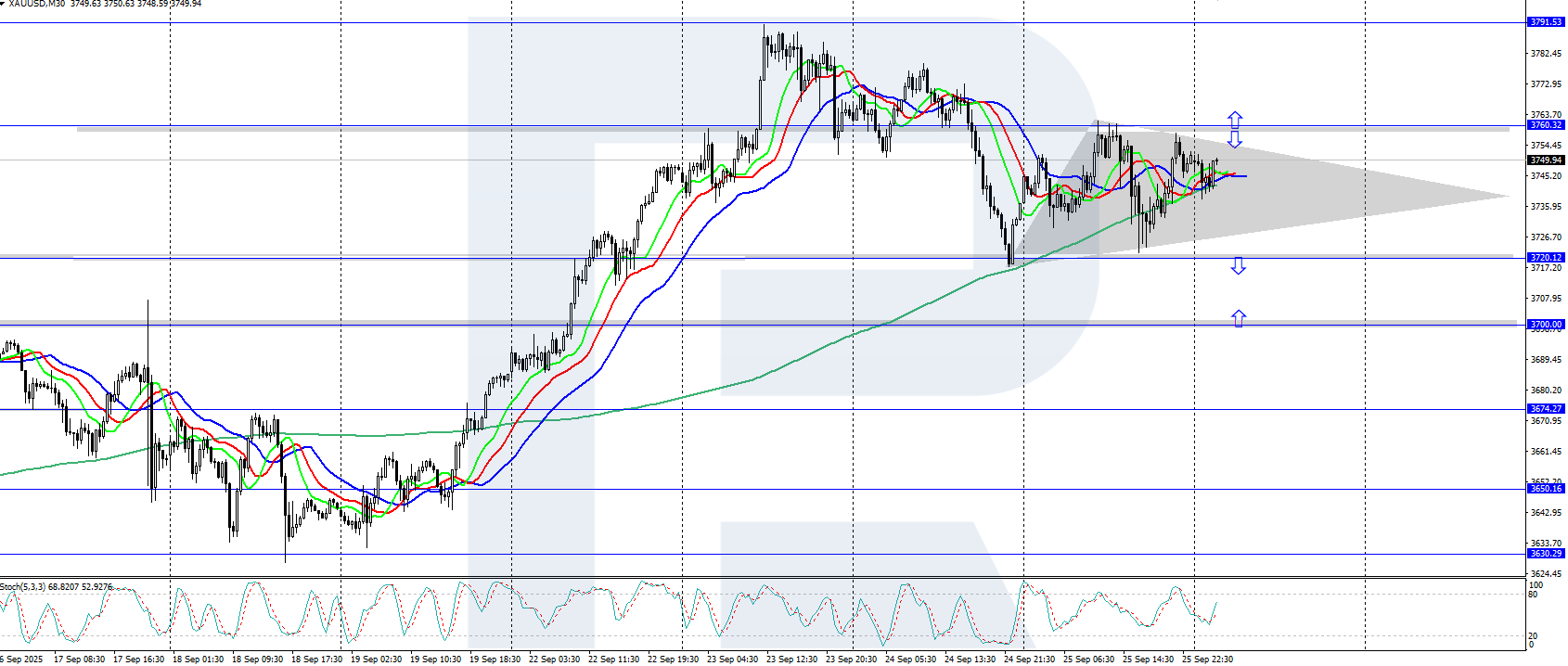

On the daily chart, XAUUSD prices show a strong upward rally, hitting a new all-time high at 3,791 USD. The Alligator indicator is also moving upwards, indicating a possible continuation of the bullish trend after a minor correction.

The short-term XAUUSD forecast suggests further growth towards the high of 3,791 USD and above if the bulls maintain control. If, however, the bears push prices below 3,720 USD, a decline towards the support level at 3,700 USD is likely.

Summary

Gold is moderately correcting after a rapid rally and hitting a new all-time high of 3,791 USD. Today, US PCE price index data may add momentum to the price dynamics.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.