Gold (XAUUSD): statistics and geopolitics to shape trajectory

Gold (XAUUSD) is hovering at 3,640 USD, with a crucial inflation report from the US lying ahead. Find out more in our analysis for 11 September 2025.

XAUUSD forecast: key trading points

- The market sees grounds for a gradual reduction in the Federal Reserve’s interest rate

- Demand for gold is also rising due to the market’s need for safe-haven assets

- XAUUSD forecast for 11 September 2025: 3,618 or 3,675

Fundamental analysis

On Thursday, gold (XAUUSD) is hovering around 3,640 USD per ounce, close to its all-time high. Prices are supported by expectations of rate cuts in the US and rising geopolitical tensions.

The US Producer Price Index unexpectedly declined in August, with both the headline and the core PPI falling by 0.1% m/m against forecasts of a slight increase. Combined with weak labour market data, this has fuelled expectations of imminent Fed easing and boosted demand for gold as a non-yielding safe-haven asset.

Investors are now awaiting fresh consumer inflation statistics – the data will be released today.

Additional support for the precious metal comes from geopolitical factors. US President Donald Trump recently urged the EU to impose tariffs on China and India to put pressure on Russia. Meanwhile, the escalation of conflict in the Middle East is intensifying.

The gold (XAUUSD) forecast is positive.

XAUUSD technical analysis

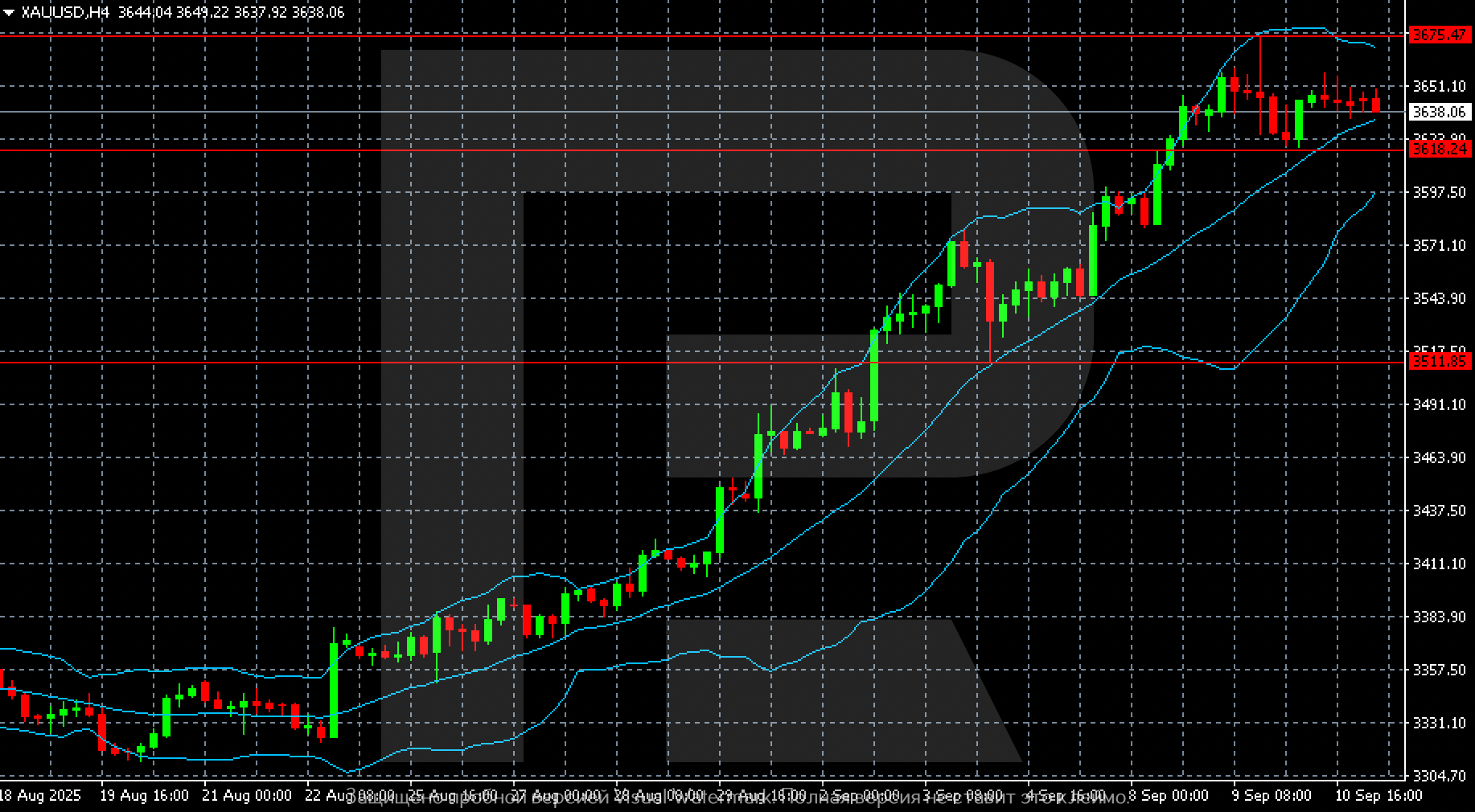

On the H4 chart, gold (XAUUSD) prices are consolidating around 3,638 per ounce after a sharp rise since late August. Quotes reached a high of 3,675 and have since been trading in a narrow range between 3,637 and 3,650.

The technical picture indicates a pause after a rapid climb. The nearest support level lies at 3,618, with a stronger zone near 3,511. The resistance level remains at the recent high of 3,675.

Staying above 3,618 gives the market a chance to retest all-time highs. A breakout below this level would signal a correction towards the 3,550–3,510 area.

Summary

Gold (XAUUSD) remains in a strong position but has entered sideways trading for now. The gold (XAUUSD) forecast for today, 11 September 2025, suggests a move towards 3,618 or 3,675, depending on sentiment.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.