Gold (XAUUSD) corrects after rapid growth

XAUUSD prices are moderately declining after a sharp rally and a new all-time high at 3,674 USD. Today, the market focus is on US inflation. Find out more in our analysis for 10 September 2025.

XAUUSD forecast: key trading points

- Market focus: the US Producer Price Index (PPI) is scheduled for release today

- Current trend: trending upwards

- XAUUSD forecast for 10 September 2025: 3,674 or 3,600

Fundamental analysis

XAUUSD quotes are trading near record highs as investors expect a Federal Reserve interest rate cut in September. On Tuesday, the Bureau of Labour Statistics reported that the US economy created 911 thousand fewer jobs over the 12 months ending in March.

Combined with the weak August employment report released last week, this data strengthened expectations of a 25-basis-point Federal Reserve rate cut next week, although some analysts predict a larger reduction of 50 basis points.

This week, market participants’ attention is focused on key US inflation indicators: the PPI for August will be published today, followed by the Consumer Price Index (CPI) on Thursday.

XAUUSD technical analysis

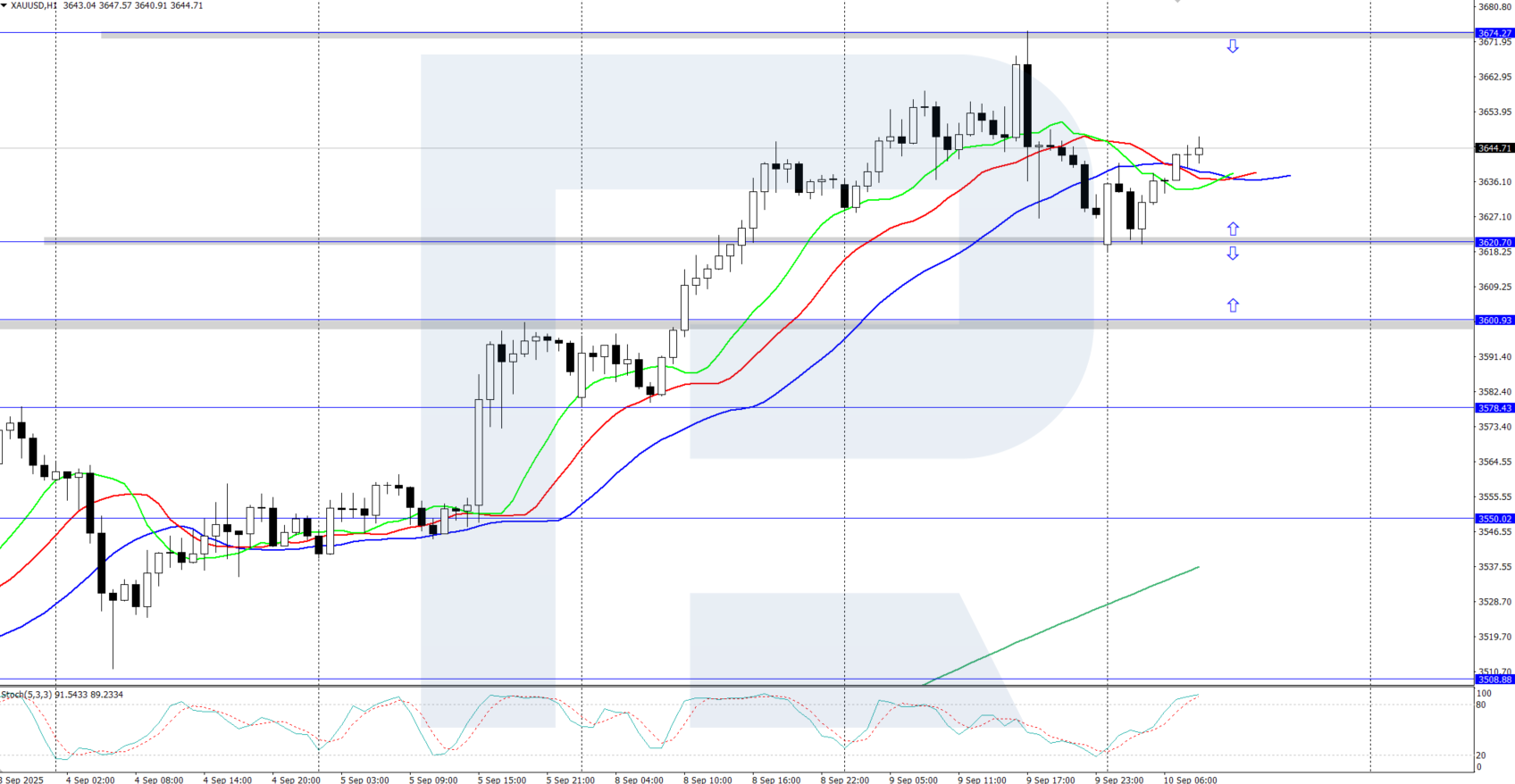

XAUUSD prices show strong growth on the daily chart, reaching a new all-time high at 3,674 USD. The Alligator indicator is also trending upwards, suggesting a possible continuation of the bullish move after a minor correction.

The short-term XAUUSD forecast suggests further growth towards the 3,674 USD peak and higher if the bulls maintain their current initiative. If, however, the bears push the quotes below 3,620 USD, the pair could dip to the 3,600 USD support level.

Summary

Gold is moderately correcting after a sharp rally and a new all-time high at 3,674 USD. Today’s market dynamics may be influenced by US PPI statistics.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.