Gold (XAUUSD) rises to the 3,400 USD area

XAUUSD prices continue to strengthen, climbing to the 3,400 USD area amid dollar weakness driven by US President Trump’s pressure on the Fed. Discover more in our analysis for 27 August 2025.

XAUUSD forecast: key trading points

- Market focus: Trump attempts to remove Fed Governor Lisa Cook

- Current trend: moving upwards

- XAUUSD forecast for 27 August 2025: 3,400 or 3,350

Fundamental analysis

XAUUSD prices reached a two-week high on the back of mounting concerns over the Federal Reserve’s independence. President Trump signalled the start of legal proceedings after his attempt to dismiss Fed Governor Lisa Cook over alleged legal violations.

This raised investor fears about the Fed’s autonomy and its vulnerability to political pressure. Analysts warn that Cook’s removal could accelerate rate cuts in line with Trump’s push for looser policy. Markets are currently pricing in about an 80% probability of a 25-basis-point Federal Reserve rate cut in September.

XAUUSD technical analysis

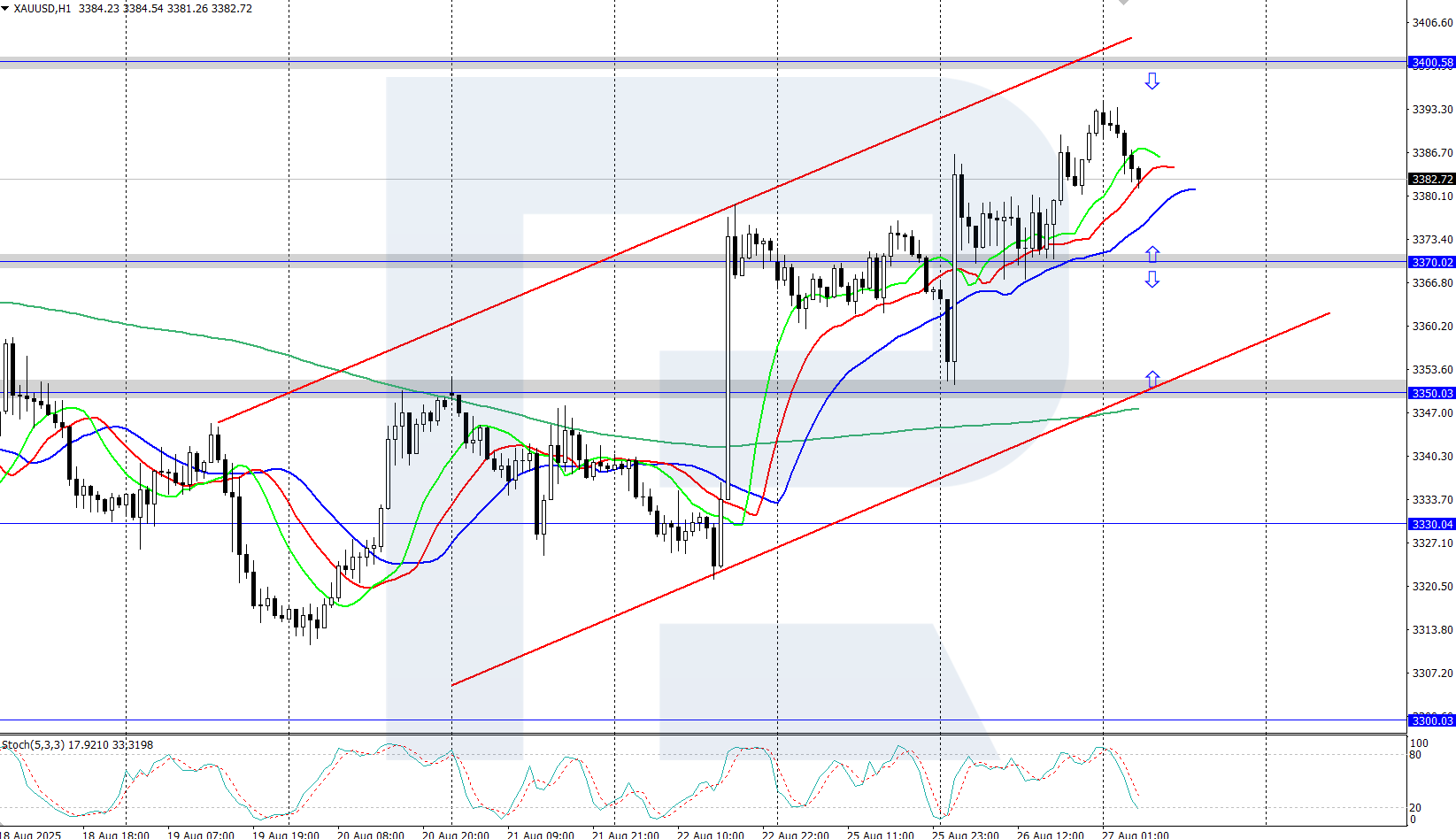

XAUUSD prices are on the rise after rebounding from the 3,300 USD area. The Alligator indicator has turned upwards, confirming potential continuation of the uptrend after a minor correction.

The short-term XAUUSD price forecast suggests further growth towards 3,400 USD and higher if bulls keep control. However, if bears reverse momentum and push prices below 3,370 USD, a decline towards the 3,350 USD support level is possible.

Summary

Gold confidently rose to the 3,400 USD area amid ongoing dollar weakness. Market participants fear that the Federal Reserve may become increasingly influenced by US President Donald Trump’s political agenda.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.