22 August: gold’s (XAUUSD) fate to be decided in Jackson Hole

Ahead of Fed Chair Powell’s speech, XAUUSD prices may decline towards 3,315. Find out more in our analysis for 22 August 2025.

XAUUSD forecast: key trading points

- Speech by Federal Reserve Chairman Jerome Powell

- Gold continues to lose ground

- XAUUSD forecast for 22 August 2025: 3,315 and 3,375

Fundamental analysis

XAUUSD analysis for today indicates that gold is trading near 3,330 USD per ounce, pressured by economic uncertainty and a stronger US dollar.

The XAUUSD forecast for 22 August 2025 takes into account that Powell will deliver a speech today at the annual Jackson Hole Symposium – his last appearance at this forum as Fed Chair before his term ends in May 2026.

What to expect from Powell’s speech?

- The forum theme is labour markets in transition: demographics, productivity, and macroeconomic policy. Powell may outline his stance on interest rates under rising uncertainty

- He could hint at a return to a more traditional Fed strategy (inflation control as the core priority, less emphasis on average targeting), signalling a move away from the flexible approach of the 2020s

Any signals on rate cuts?

- Market expectations: the likelihood of a September rate cut is now 70-75%, down from 80-85% recently

- Investors anticipate Powell will either hint at rate cuts or remain cautious, stressing the need for more data before decisive action

How does the speech affect markets?

- Historically, Powell’s speeches have been market-moving, with 10-year Treasury yields often rising by about 20 basis points and the dollar index gaining more than 1.0% afterwards

- Tensions are rising: today, gold continues to lose ground as the US dollar strengthens and markets await Powell’s signals

- Powell’s remarks have traditionally triggered major moves. It is possible today will see the same, with XAUUSD quotes facing heightened volatility

XAUUSD technical analysis

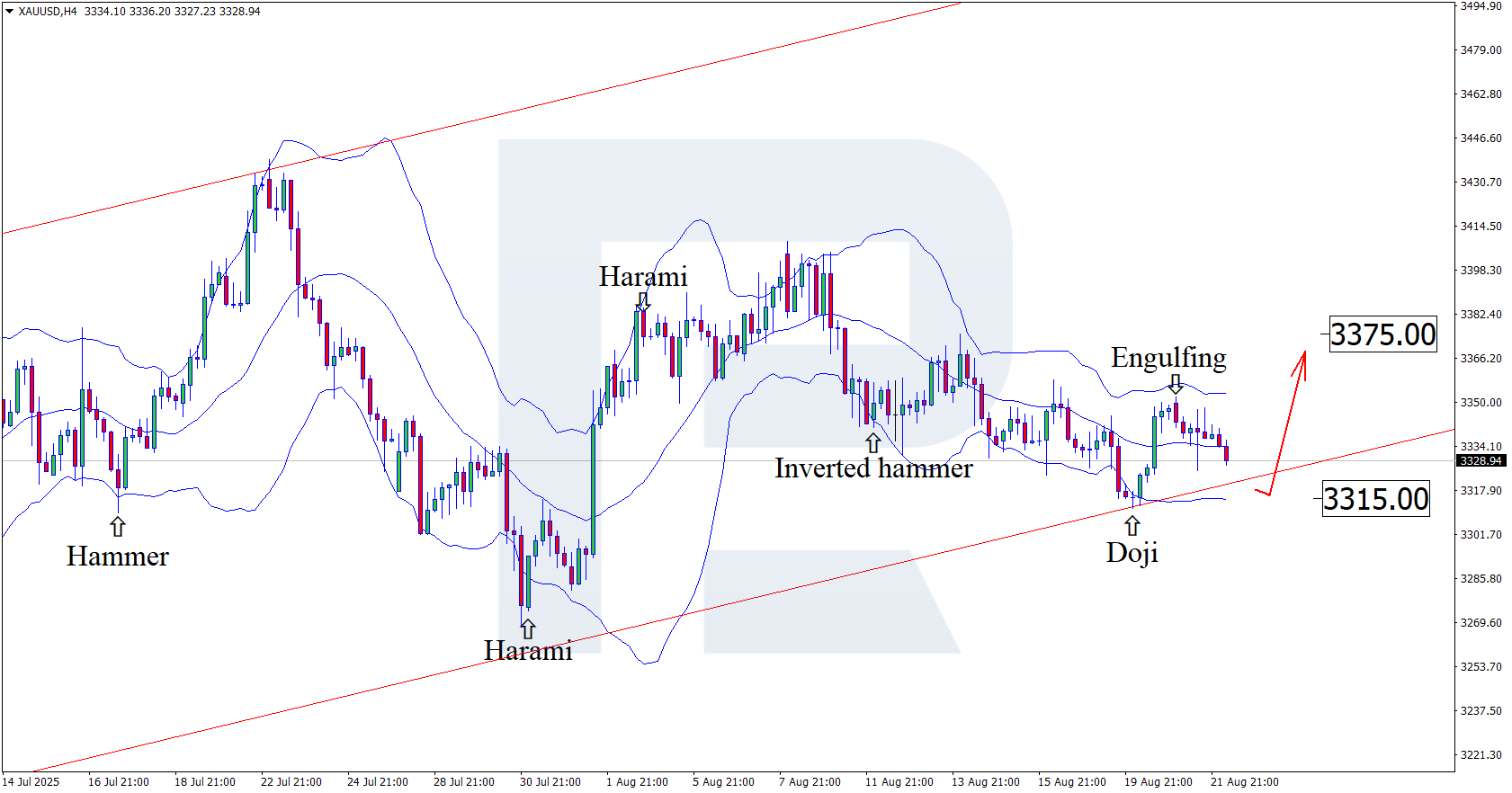

On the H4 chart, XAUUSD prices have formed an Engulfing reversal pattern near the upper Bollinger Band. The pair is currently in a corrective phase following this signal. Since XAUUSD quotes remain within an ascending channel, the uptrend will likely continue in the long term. However, for now, a correction towards the target level of 3,315 USD is expected.

At the same time, today’s XAUUSD technical analysis also suggests an alternative scenario, where prices advance to 3,375 USD without testing the support level.

The potential for further upward momentum remains, with XAUUSD prices possibly heading towards 3,500 USD in the near term.

Summary

Markets are awaiting signals from the Fed Chair. Against this backdrop, XAUUSD quotes continue to decline, although volatility may increase significantly during Powell’s speech.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.