Fed delays decision, gold (XAUUSD) prepares a surprise

In anticipation of the Federal Reserve’s interest rate decision, XAUUSD prices have started to rise and are testing the 3,355 USD level. Discover more in our analysis for 18 August 2025.

XAUUSD forecast: key trading points

- Gold regains ground

- The market expects a Federal Reserve rate cut in September

- XAUUSD forecast for 18 August 2025: 3,385

Fundamental analysis

Today’s XAUUSD analysis shows gold trading near 3,355 USD per ounce, climbing after a correction. Amid economic uncertainty, falling US Treasury yields, and geopolitical tensions, gold continues to regain ground despite occasional pullbacks.

The acceleration in wholesale price growth (the US PPI rose by 3.3% year-on-year in July) weakened expectations of a Fed rate cut, adding moderate pressure on gold. However, reduced demand has still allowed it to maintain positive momentum.

Amid these economic figures, investors and analysts expect the Federal Reserve to cut rates in September. If this happens, the market will see increased volatility.

XAUUSD technical analysis

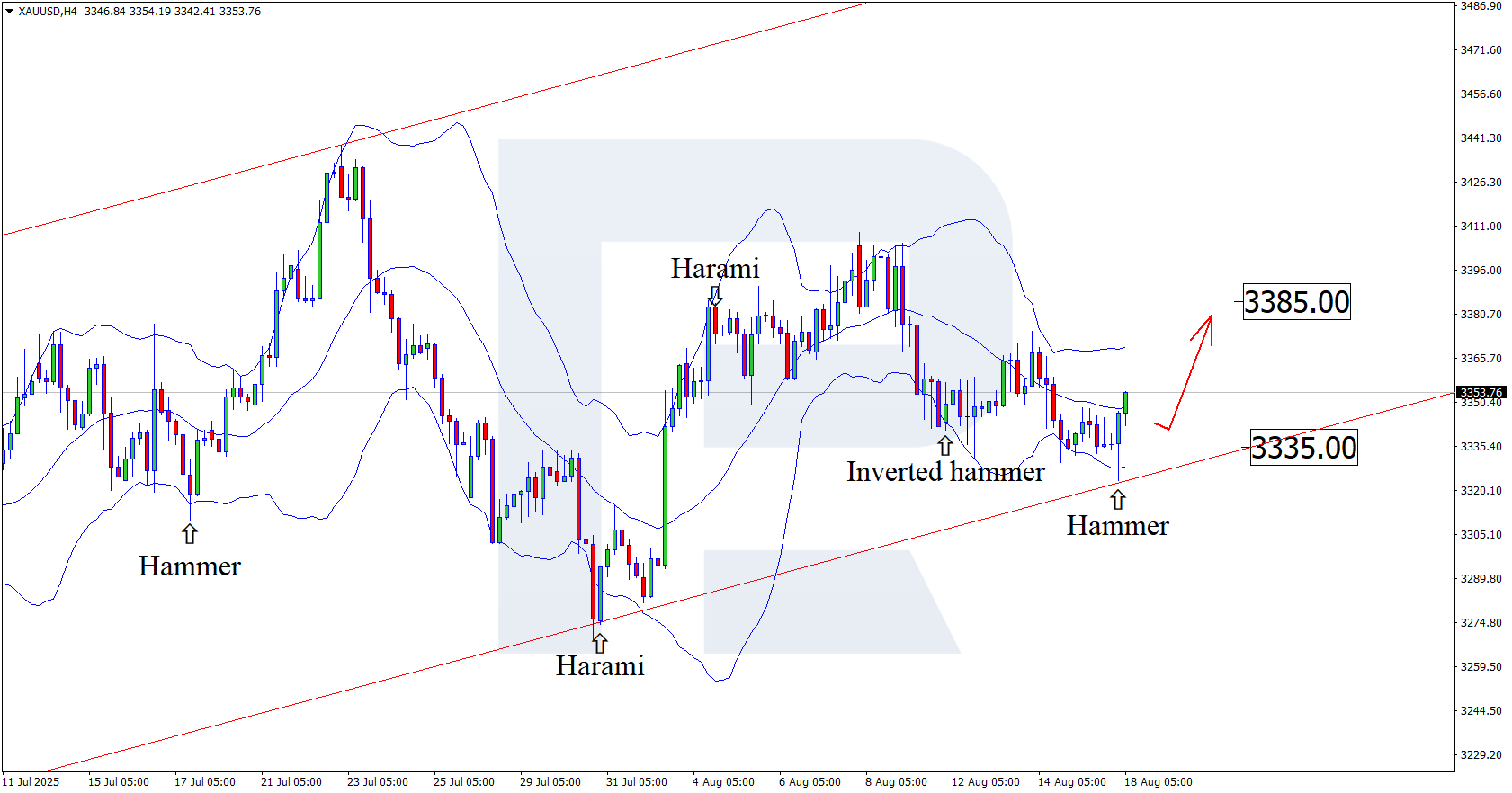

On the H4 chart, XAUUSD prices have formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, gold is developing an upward wave following the signal from the pattern. The uptrend will likely continue as XAUUSD quotes remain within the ascending channel. The near-term upside target is the 3,385 USD resistance level.

However, today’s technical analysis of XAUUSD outlines a second possible scenario, where prices correct towards 3,335 USD before further growth.

The potential for continuation of the uptrend remains, and XAUUSD may head towards the 3,500 USD level in the near term.

Summary

The XAUUSD forecast for today, 18 August 2025, favours gold, with technical analysis suggesting growth towards the 3,385 USD resistance level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.