Gold (XAUUSD): everything depends on risk and news

Gold (XAUUSD) is hovering around 3,350 USD as the market is awaiting clarity on tariffs and is closely following the Fed’s rate outlook. Discover more in our analysis for 13 August 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) remains range-bound amid mixed signals

- The Federal Reserve is now expected to cut rates in September – this could support gold prices

- XAUUSD forecast for 13 August 2025: 3,359 and 3,380

Fundamental analysis

On Wednesday, gold (XAUUSD) quotes are hovering around 3,350 USD per ounce as investors assess the Fed’s monetary policy outlook following the latest US inflation data.

In July, headline inflation stood at 2.7%, below the forecast of 2.8%, while core inflation rose to 3.1% from 2.9%. These figures eased concerns about inflationary pressure from tariffs and increased expectations for a 25-basis-point Federal Reserve rate cut in September. They also boosted demand for gold as a non-yielding asset.

Focus now shifts to upcoming reports on the Producer Price Index, weekly jobless claims, and retail sales.

Traders are also awaiting clarification on the tariff status of gold imports after conflicting signals. On Monday, President Donald Trump stated that there would be no tariffs, yet last week, the US Customs and Border Protection classified one-kilo and 100-ounce bars under a code implying tariffs.

Market sentiment also received support from the US extending the tariff truce with China by 90 days. Investors are also paying attention to the upcoming US-Russia negotiations.

The gold (XAUUSD) forecast is moderate.

XAUUSD technical analysis

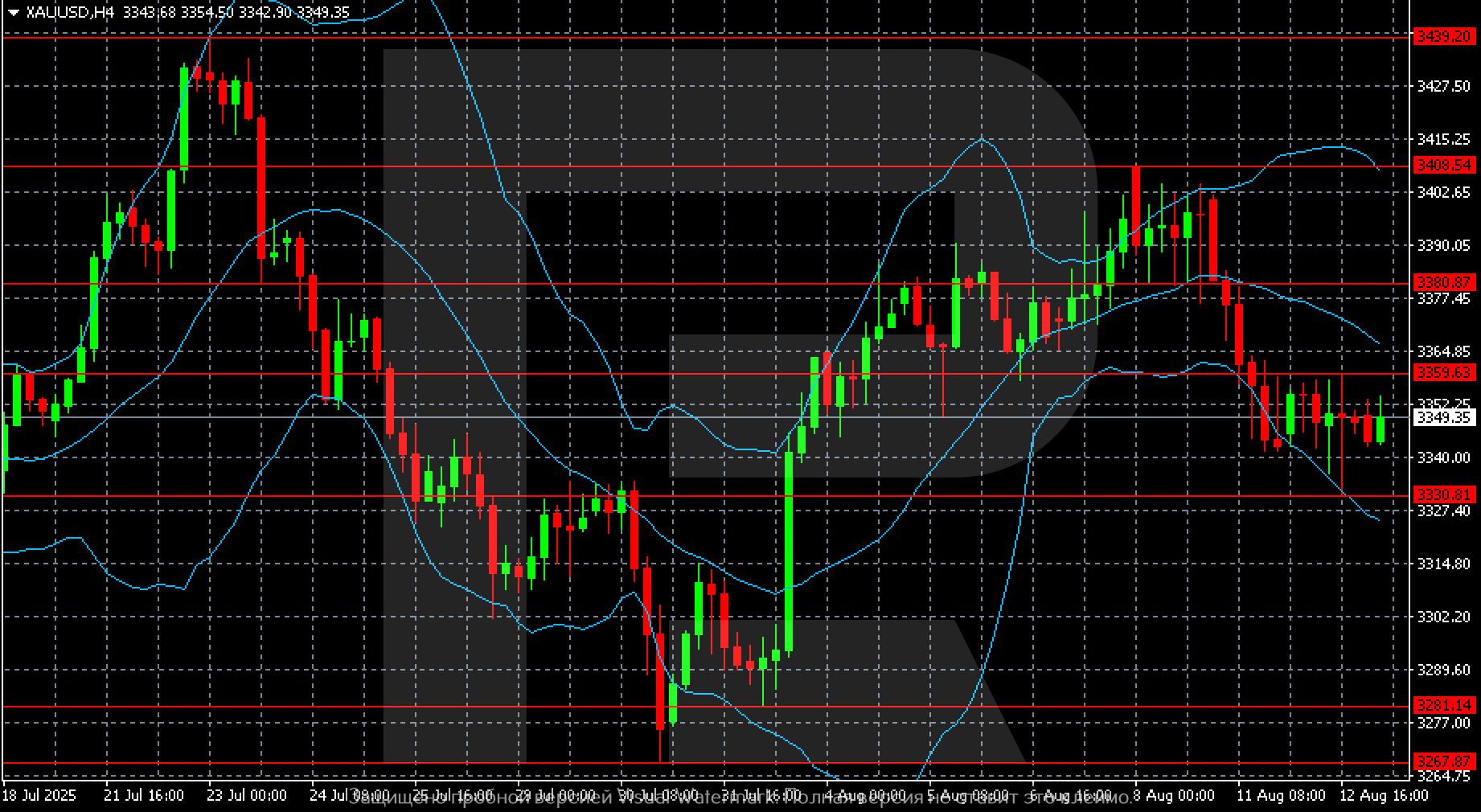

On the H4 chart, gold (XAUUSD) prices are trading near 3,350 USD per ounce, remaining below the key resistance level of 3,359. After failing to secure a foothold above the 3,380-3,408 area in early August, quotes retreated.

Since 11 August, prices have been consolidating in a narrow 3,340-3,355 range, below the middle Bollinger Band. The narrowing of the bands signals a potential drop in volatility before a breakout from the range.

The nearest support levels are 3,330 and 3,281, while resistance levels are 3,359 and 3,380.

Summary

Gold (XAUUSD) appears stable but remains locked within a sideways range. The gold (XAUUSD) forecast for today, 13 August 2025, suggests a possible attempt to rise to 3,359, with an extension towards 3,380 later.

Open AccountForecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.