Gold (XAUUSD) rebounds from support at 3,300 USD

XAUUSD prices have halted their decline and are showing signs of a bullish reversal, receiving buying support near the 3,300 USD area. Today, the market is awaiting the Federal Reserve interest rate decision. Find more details in our analysis for 30 July 2025.

XAUUSD forecast: key trading points

- Market focus: today, all eyes are on the Fed’s rate decision and Powell’s accompanying comments

- Current trend: correcting upwards

- XAUUSD forecast for 30 July 2025: 3,300 or 3,350

Fundamental analysis

On Wednesday, gold prices hovered slightly above 3,300 USD per ounce, remaining close to a three-week low, as easing trade tensions reduced the metal’s appeal as a safe-haven asset. The US-EU agreement introducing 15% tariffs on most European goods helped avert a broader trade conflict.

Today, the market will learn the outcome of the Federal Open Market Committee (FOMC) meeting. While analysts widely expect the Fed to keep interest rates unchanged, investors will closely watch Chairman Powell’s press conference for signals about a potential rate cut in September.

XAUUSD technical analysis

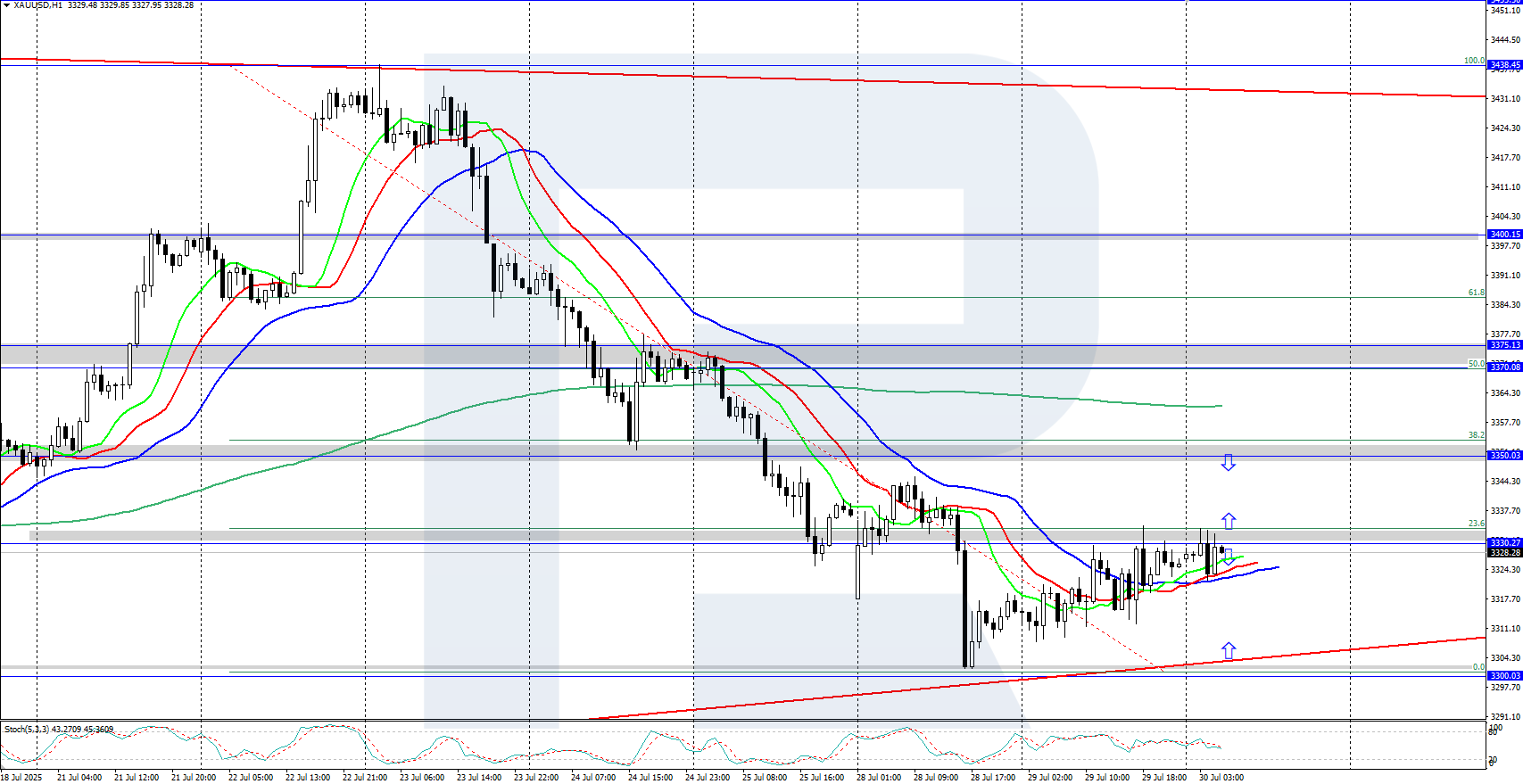

XAUUSD quotes show a bullish reversal from the 3,300 USD support level. The market is undergoing an upward correction following a sharp decline from the daily high at 3,438 USD. Once the correction completes, the downtrend could resume.

The short-term XAUUSD price forecast suggests further growth towards the 3,350 USD level if bulls maintain control. However, if bears reverse the momentum, gold could dip to the 3,300 USD support level again.

Summary

Gold has stopped falling, finding buyer support at the 3,300 USD level. Today, market focus will be on the Federal Reserve’s interest rate decision and Chairman Powell’s press conference.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.