Gold (XAUUSD) falls below 3,400 USD amid correction

XAUUSD prices reversed downwards and dropped below 3,400 USD amid optimism surrounding trade agreements between the US and its key partners. Discover more in our analysis for 24 July 2025.

XAUUSD forecast: key trading points

- Market focus: today, the market is awaiting the ECB rate decision and the US S&P Global manufacturing PMI data

- Current trend: correcting downwards

- XAUUSD forecast for 24 July 2025: 3,350 or 3,438

Fundamental analysis

XAUUSD prices declined on Thursday as optimism over trade deals between the US and its key partners reduced gold's appeal as a safe-haven asset. The European Union is pushing for a trade agreement with Washington, proposing a broad 15% tariff on EU goods imported into the US to avoid a steeper 30% levy scheduled to take effect on 1 August.

On the monetary policy front, markets are focused on next week’s Federal Reserve meeting, where rates are expected to remain unchanged. However, the possibility of a cut in October remains on the table.

Today, the spotlight is on the ECB interest rate decision and the US S&P Global manufacturing PMI data.

XAUUSD technical analysis

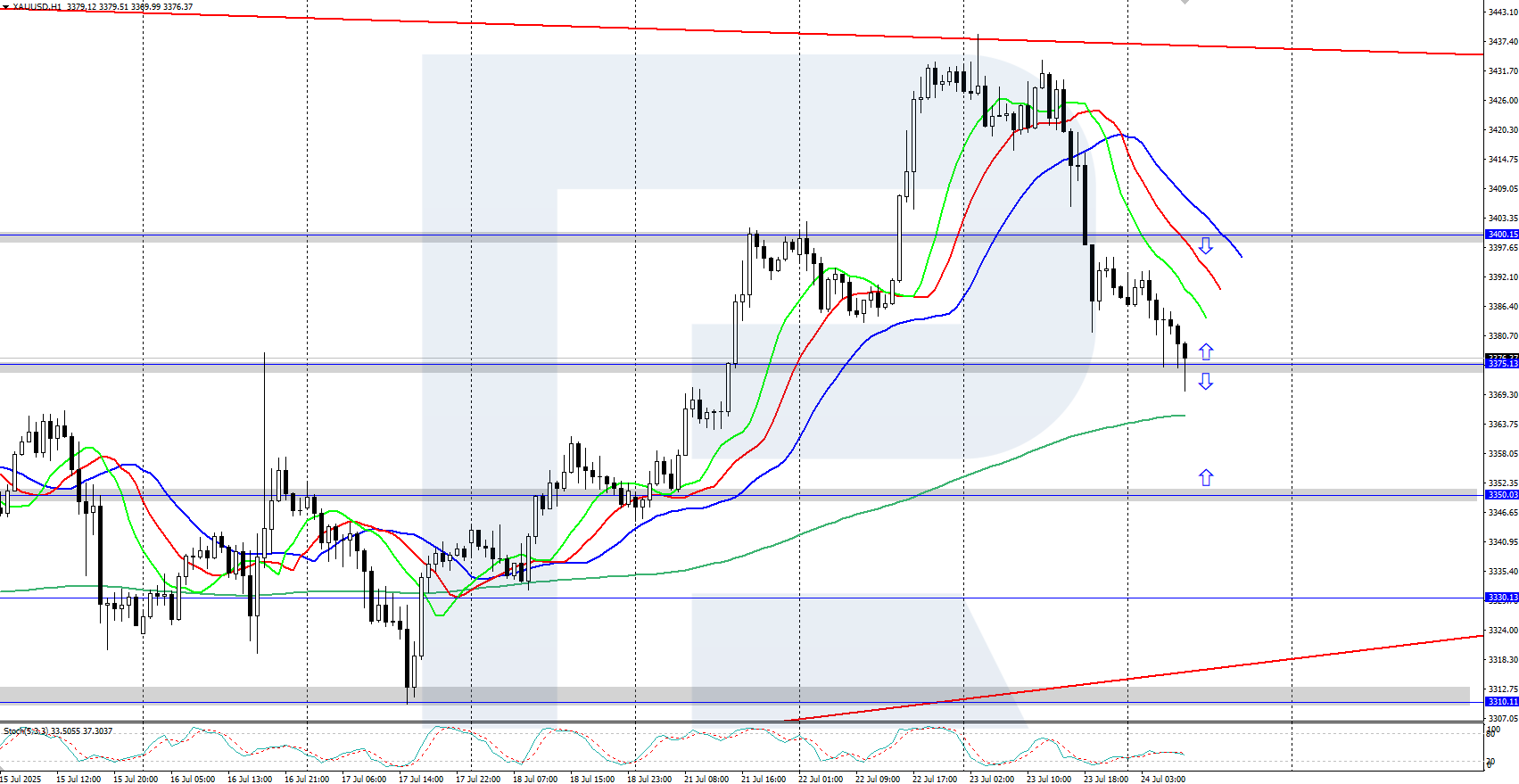

XAUUSD quotes are in a downward correction, having fallen below 3,400 USD. Earlier this week, gold reversed from a local daily high at 3,438 USD. Once the correction is complete, the uptrend may resume.

The short-term XAUUSD price forecast suggests further downside towards 3,350 USD if bears retain control. However, if bulls regain momentum, a rally towards the 3,438 USD resistance level may follow.

Summary

Gold entered a downward correction, slipping below 3,400 USD. Today’s market focus is on the ECB rate decision and the US S&P Global manufacturing PMI data.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.