Gold (XAUUSD) in consolidation: safe-haven assets out of favour for now

Gold (XAUUSD) prices are hovering around 3,340 USD. Interest in the US dollar continues to rise. Find more details in our analysis for 17 July 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) quotes rose in response to uncertainty and fell once doubt was removed

- A rebound in the US dollar reduces gold's appeal for investors

- XAUUSD forecast for 17 July 2025: 3,360

Fundamental analysis

Gold (XAUUSD) prices retreated to 3,340 USD per ounce, reversing the previous session’s gains. The metal came under pressure as the US dollar rebounded following reduced uncertainty surrounding the Federal Reserve Chairman: rumours about Jerome Powell’s possible dismissal were not confirmed. Donald Trump called such a move unlikely, although he again expressed dissatisfaction with current interest rate levels.

Another factor was the neutral US Producer Price Index (PPI) data for June. The reading remained unchanged, signalling stable wholesale prices and easing concerns about strong inflationary pressure from tariffs. These new figures contrast with the previously recorded rise in consumer inflation.

Globally, tensions are easing. The European Union sent a delegation to Washington for tariff talks, and US-China relations improved slightly after the lifting of the AI chip export ban and the signing of a trade agreement with Indonesia.

Reduced global risks and the dollar’s recovery make gold less attractive as a safe-haven asset.

The gold (XAUUSD) forecast is mixed.

XAUUSD technical analysis

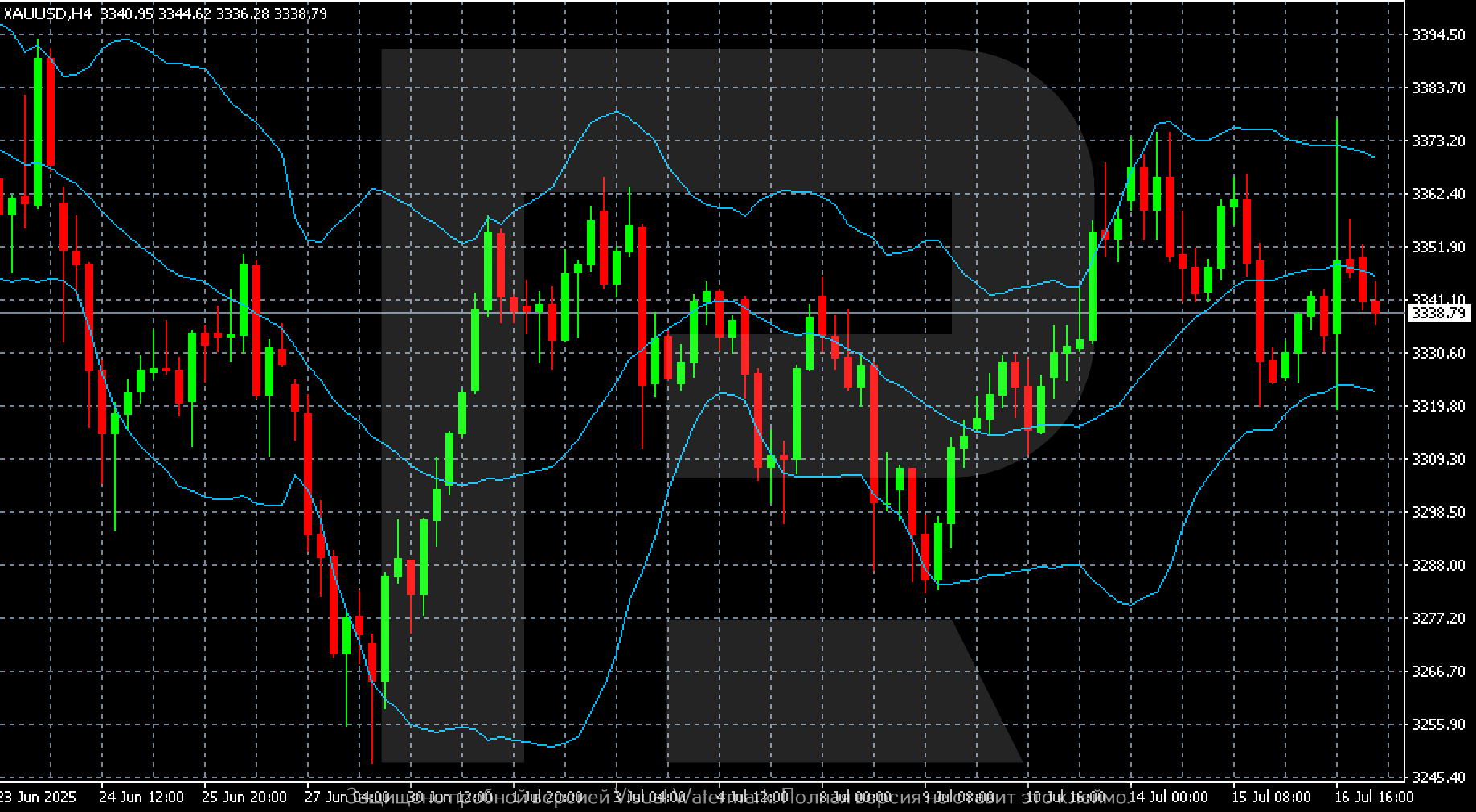

The gold (XAUUSD) H4 chart shows sideways movement within the 3,310-3,360 USD range. Prices have tested both the upper and lower boundaries multiple times but failed to secure a breakout. This behaviour signals a lack of clear direction in the short term.

Candlesticks with long wicks in both directions suggest market indecision and a lack of dominance by bulls or bears. The price remains within the Bollinger Bands, which have started narrowing – often an indicator of an upcoming sharp move. A breakout from the current range may trigger a strong trend in the direction of the breakout.

If the price breaks above 3,360, the next target will be 3,383. If it breaks below and falls under 3,310, the key support area will be at 3,277-3,280, the late June low.

Overall, the chart shows a consolidation phase.

Summary

Gold (XAUUSD) has priced in recent developments and returned to a consolidation phase. The gold (XAUUSD) forecast for today, 17 July 2025, does not rule out a retest of the 3,360 level, which could pave the way for a move towards 3,383.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.