Will inflation shock the markets? Bowman’s speech today may determine gold’s (XAUUSD) fate

While markets await the FOMC member's speech, XAUUSD prices may rise towards 3,415 USD. Find out more in our analysis for 15 July 2025.

XAUUSD forecast: key trading points

- US Consumer Price Index (CPI): previously at 2.4%, projected at 2.6%

- Speech by Federal Open Market Committee (FOMC) member Michelle Bowman

- XAUUSD forecast for 15 July 2025: 3,415

Fundamental analysis

The Consumer Price Index reflects changes in the cost of goods and services for consumers and helps assess trends in purchasing behaviour and signs of stagnation in the economy. Typically, if the reading comes in below expectations, it tends to weigh on the national currency.

The XAUUSD forecast for 15 July 2025 assumes the index will be higher than the previous figure of 2.4%, likely reaching around 2.6%. Today’s fundamental analysis of XAUUSD suggests a higher CPI figure compared to the previous period, which would likely support the US dollar.

Federal Reserve’s Vice Chair for Supervision Michelle Bowman is one of the few FOMC members who has previously voiced support for a possible rate cut in July, should macro data allow it. She is scheduled to speak on 15 July, and her remarks may serve as a key signal of current sentiment within the committee.

Key topics to watch in the speech:

- Inflation: if Bowman confirms that disinflation continues and tariff-driven pressure remains moderate, this could reinforce expectations of monetary easing in the second half of the year

- Labour market: she has previously expressed concern about signs of slowdown. If her speech signals continued labour market weakness, it would strengthen her case for a rate cut

- Trade policy and tariffs: Bowman had earlier noted minimal inflationary impact from tariffs. Today, she might clarify whether that assessment holds or if new risks have emerged

- Diverging views within the FOMC: her position aligns with broader commentary, including Christopher Waller’s statements. The tone of her speech will help markets gauge whether the Fed leans towards a July rate cut or prefers to wait until September

If Bowman sounds cautious or takes a more diplomatic tone, markets might interpret that as a delay in rate cuts until September – a signal that could impact XAUUSD prices.

XAUUSD technical analysis

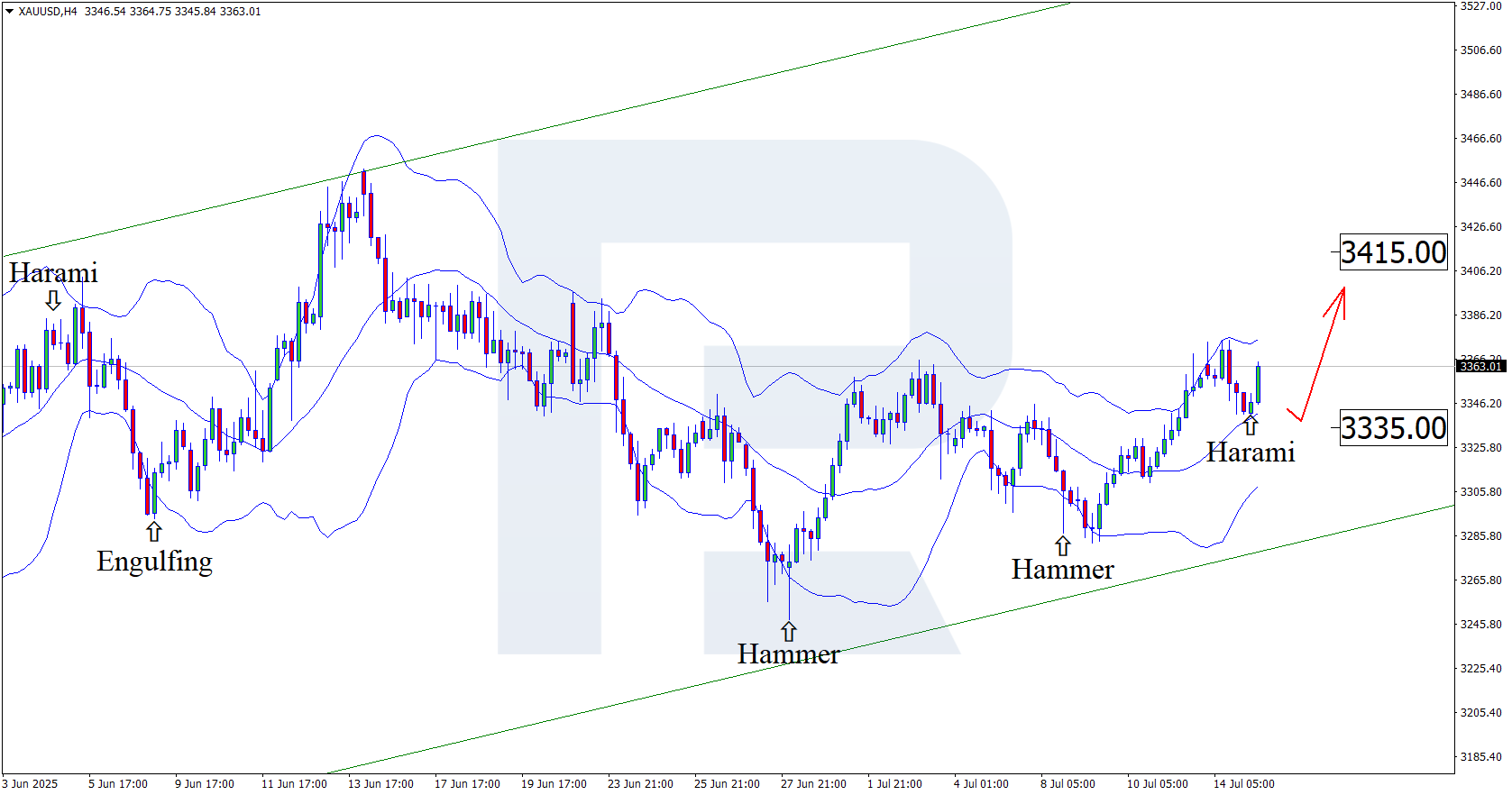

On the H4 chart, XAUUSD quotes formed a Harami reversal pattern near the middle line of the Bollinger Bands. At this stage, the price is forming an upward wave as the pattern unfolds. Since XAUUSD remains within an ascending channel, bullish momentum will likely continue. The current upside target is the 3,415 USD resistance level.

At the same time, today’s technical outlook for XAUUSD considers an alternative scenario involving a correction towards 3,335 USD before resuming the upward movement.

The potential for further bullish momentum remains, and in the near term, XAUUSD quotes may aim for the 3,500 USD level.

Summary

Anticipation surrounding the FOMC member’s speech, combined with XAUUSD technical analysis, supports the view of XAUUSD moving towards the 3,415 USD resistance level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.