Gold (XAUUSD) dropped to the 3,350 USD area, but the rally may continue

While gold (XAUUSD) prices declined to the 3,350 USD area amid a downward correction, the trend remains bullish, and growth may resume. Find out more in our analysis for 14 July 2025.

XAUUSD forecast: key trading points

- Market focus: US inflation data (Consumer Price Index) is due tomorrow

- Current trend: correcting downwards

- XAUUSD forecast for 14 July 2025: 3,350 or 3,374

Fundamental analysis

Gold (XAUUSD) prices are moving moderately lower on Monday after last week's strong rally. US President Donald Trump has imposed a 30% tariff on imports from Mexico and the EU, calling the US trade deficit a "serious threat" to national security. Both the EU and Mexico described these tariffs as unfair and destructive.

This move follows a broader tariff package announced last week, affecting more than 20 countries, including Japan, South Korea, Canada, and Brazil, as well as a 50% duty on copper imports. These new measures are scheduled to take effect on 1 August.

Meanwhile, investors will closely monitor key US economic data this week, with the Consumer Price Index (CPI), Producer Price Index (PPI), industrial production, and retail sales data scheduled for release. The data may influence the Federal Reserve’s interest rate decision at its upcoming meeting.

XAUUSD technical analysis

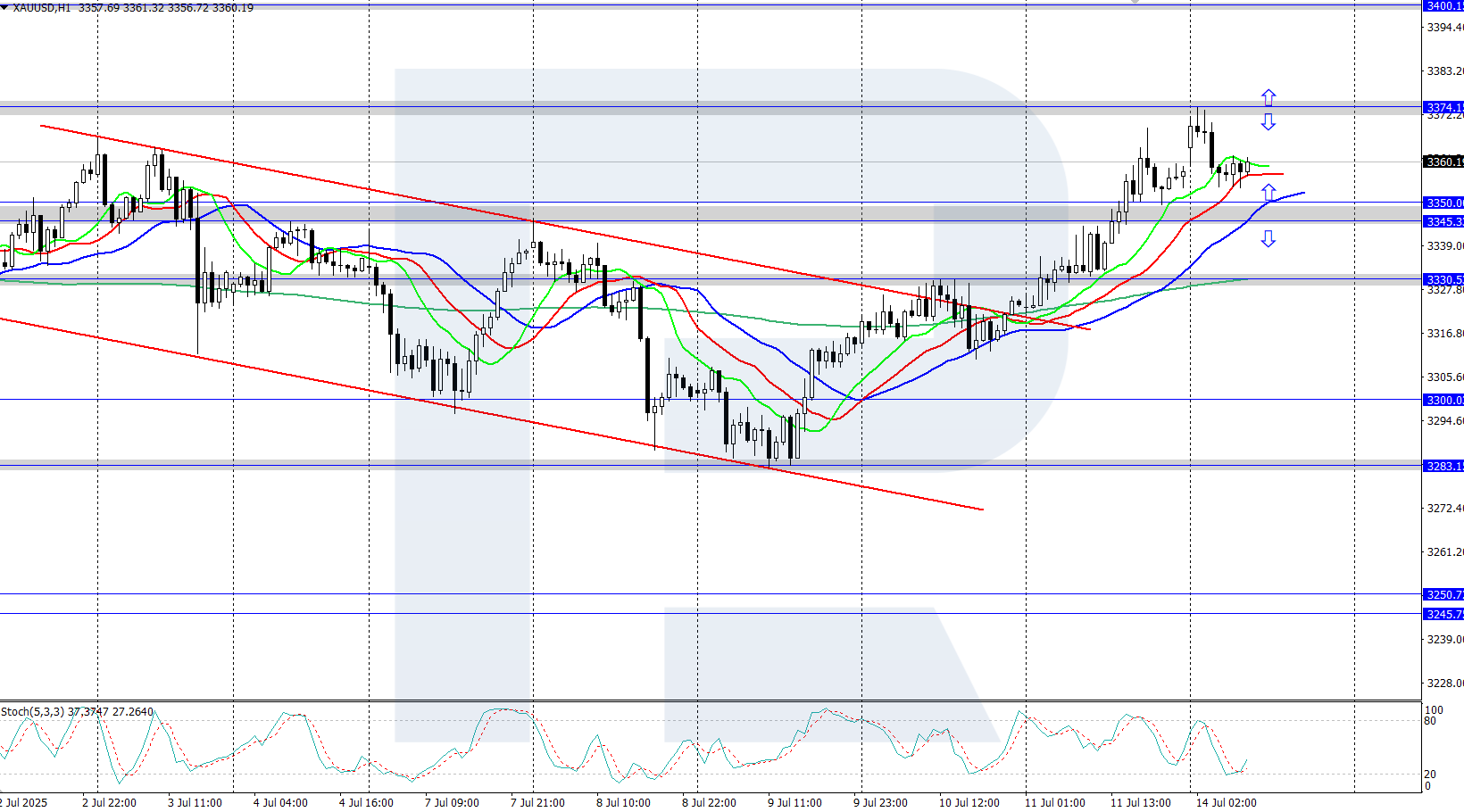

XAUUSD quotes are undergoing a downward correction, falling to the 3,350 USD support level. Last week, gold reversed to the upside, breaking out of the downward price channel. After the correction is complete, the upward movement could resume.

The short-term XAUUSD price forecast suggests a further correction towards 3,330 USD if bears retain control. If bulls regain momentum, prices could rebound towards the 3,374 USD resistance level.

Summary

Gold has pulled back to the 3,350 USD support level amid a downward correction. Market participants await tomorrow’s US inflation data (Consumer Price Index).

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.