Gold (XAUUSD) losing strength: investors bet on good news from tariffs

Gold (XAUUSD) price falls to 3,305 USD on Monday. The market awaits positive outcomes from trade negotiations. Details – in our analysis for 7 July 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) price declines as interest in safe-haven assets fades

- Strong US labour market data pushed back expectations of monetary policy easing, adding pressure on gold

- XAUUSD forecast for 7 July 2025: 3,305

Fundamental analysis

Gold (XAUUSD) price at the start of the new July week fell to 3,305 USD, thus almost nullifying last week’s five-day growth. Investors are assessing developments on the trade front, where efforts to reach deals are putting pressure on demand for safe-haven assets.

Key US trading partners are striving to finalise agreements by 9 July or secure an extension. Treasury Secretary Scott Bessent stated that negotiations might be extended, giving countries a few more weeks to conclude dialogues.

The prospect of progress in negotiations and possible postponement of tariff deadlines reduced interest in gold as a safe-haven asset. However, the price decline remains limited: Donald Trump confirmed that if deadlines are missed, from 1 August large-scale retaliatory tariffs will come into force, with higher tariffs affecting countries that fail to reach agreements.

An additional factor pressuring gold is the strong US labour market data released last week, which reduced the likelihood of the Federal Reserve easing policy in July.

The forecast for Gold (XAUUSD) remains mixed.

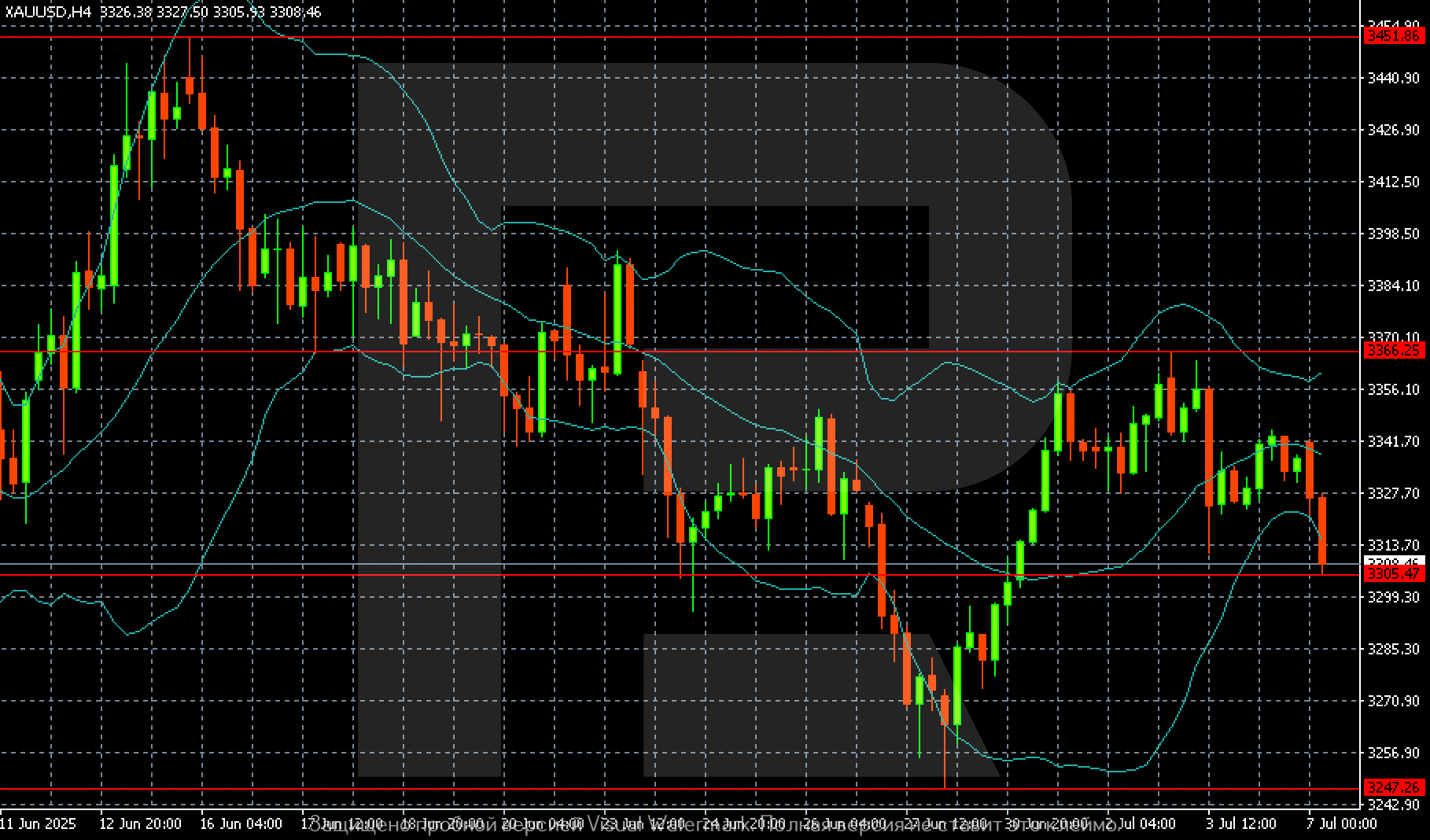

XAUUSD technical analysis

On the H4 chart for Gold (XAUUSD), a correction phase is evident following an attempt to rise in early July. The market is testing the short-term support zone near 3,305 USD. This level already acted as a support on 2 July and 5 July, making it important for buyers.

Above lies resistance at 3,366, where downward reversals repeatedly occurred earlier. The upper Bollinger Band also indicates a locally overbought state, limiting the potential for a rapid upward breakout.

Overall dynamics remain moderately downwards. At the same time, the market maintains signs of sideways consolidation within the 3,305–3,366 range. A break below the lower boundary will open the way to the next support at 3,247, while a confident rebound from 3,305 could lead to a return to 3,340–3,360.

The key factor for the short-term scenario will be the price’s reaction to the current support level: its break will confirm weakness, while holding may trigger a new upward wave.

Summary

Gold (XAUUSD) price came under pressure on Monday as the market anticipates positive news from US trade negotiations with partners. The forecast for Gold (XAUUSD) today, 7 July 2025, does not rule out a decline to 3,305 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.