Gold (XAUUSD) recovered: supportive factors in place

Gold (XAUUSD) price rose to 3,310 USD. A weak dollar and the possibility of a Fed rate cut support prices. Details – in our analysis for 1 July 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) is rising in price for the second day in a row

- The weakness of the US dollar and the possibility of a Fed interest rate cut act as support

- XAUUSD forecast for 1 July 2025: 3,336 and 3,350

Fundamental analysis

On Tuesday, Gold (XAUUSD) prices rose to 3,310 USD per troy ounce. The main support factor was the weak dollar, which continues to lose ground amid growing concerns over the US budget deficit.

Investors are closely monitoring progress on a large-scale bill aimed at cutting taxes and increasing spending. The document is moving very slowly through Senate discussions.

Additional uncertainty arises from the lack of final agreements in trade negotiations with several key countries. US President Donald Trump threatened to introduce new tariffs against Japan – less than two weeks before the deadline (9 July), when higher tariffs could take effect.

Another driver of demand for gold remains expectations of a Fed rate cut in the second half of the year. Investors’ focus is now on upcoming US labour market data.

Ahead are reports on job openings, ADP employment, and non-farm payrolls. These figures may clarify the regulator’s next steps.

The forecast for Gold (XAUUSD) is neutral.

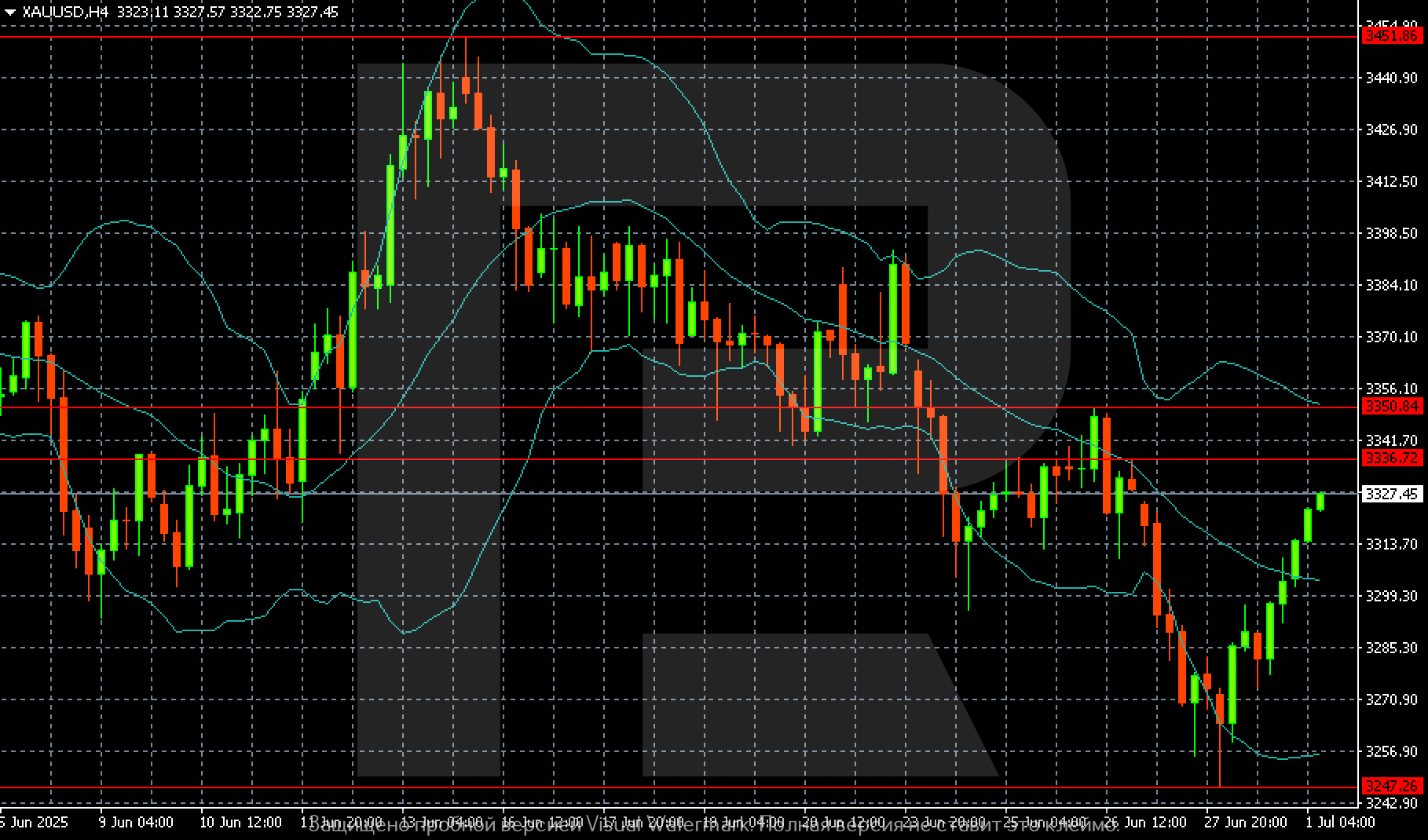

XAUUSD technical analysis

On the H4 chart for Gold (XAUUSD), a reversal attempt is forming. The price has broken through the lower Bollinger Bands boundary and is confidently moving towards the indicator’s middle line, indicating renewed buying interest. The Bollinger Bands range has started to expand – signalling increased volatility and a possible market phase shift.

The nearest resistance stands at 3,336 USD. Breaking it will open the way to the next target near 3,350 USD. This is a key level from which upward impulses previously formed. Successfully consolidating above this zone will signal the end of the correction phase and open potential for growth towards June highs around 3,451 USD.

If the price fails to overcome resistance at 3,336–3,350 USD, the risk of returning to the 3,285–3,290 USD area and a re-test of support near 3,247 USD will emerge.

Summary

Gold (XAUUSD) is in a balance zone, rising in price for the second day and showing the possibility of further gains. The forecast for Gold (XAUUSD) for today, 1 July 2025, does not rule out growth to 3,336 and further to 3,350.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.