Gold (XAUUSD) enters correction as investors await Trump’s decision

XAUUSD prices dropped to the 3,350 USD area on Friday amid a pause from President Trump regarding potential US military action against Iran. Discover more in our analysis for 20 June 2025.

XAUUSD forecast: key trading points

- Market focus: gold declines as markets await Trump’s decision on Iran

- Current trend: correcting downwards

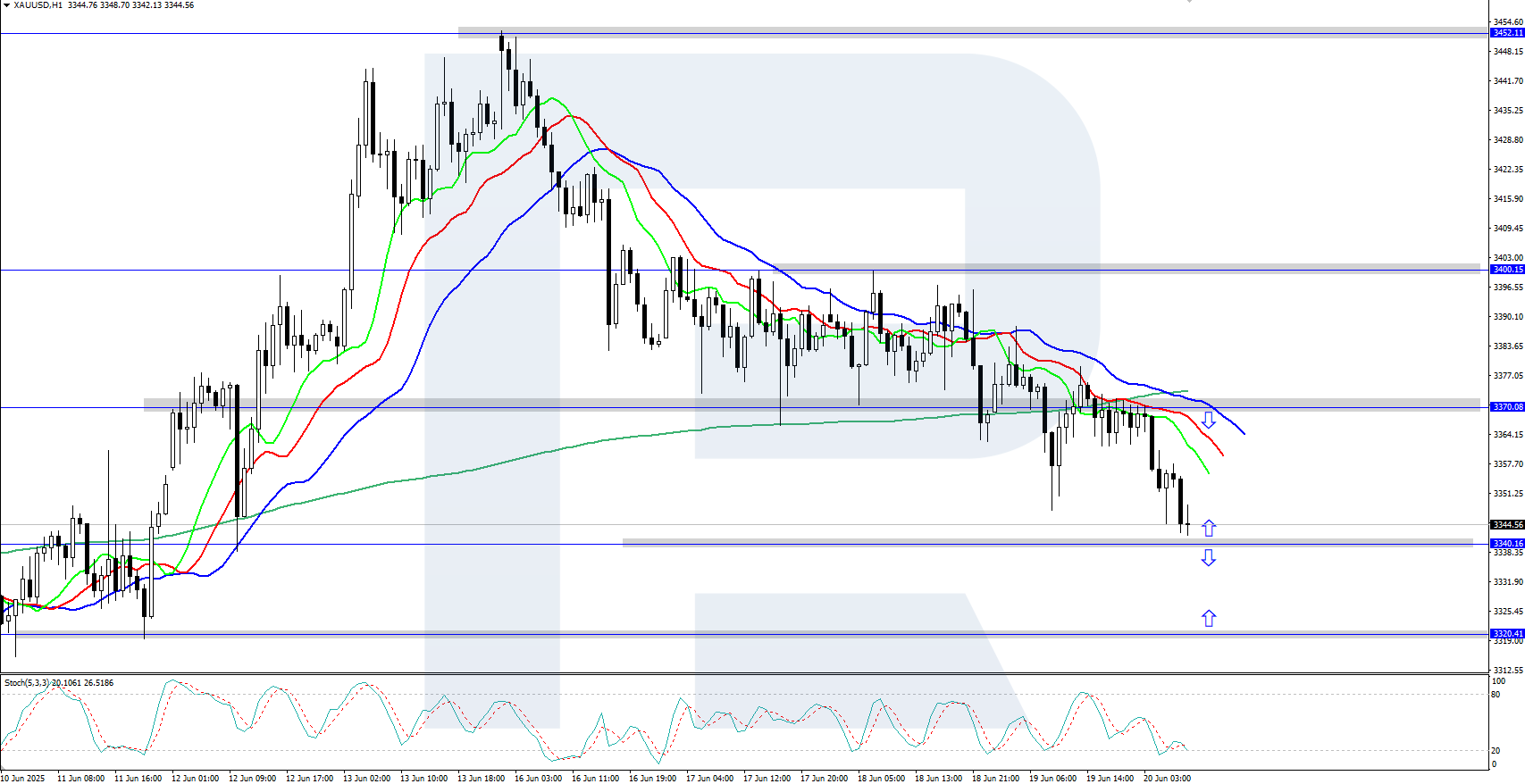

- XAUUSD forecast for 20 June 2025: 3,340 and 3,400

Fundamental analysis

The Federal Reserve held rates steady this week and signalled two rate cuts by year-end, although Chairman Jerome Powell warned that new tariffs could continue to push inflation higher. The Fed’s latest forecasts point to weaker growth, higher inflation, and lower employment in 2025.

Israel and Iran have continued to exchange strikes. Israel intensified attacks on strategic and government targets in Tehran following reports of an Iranian missile hitting a major hospital in Israel. Investors also focused on the White House, where President Donald Trump is weighing direct military intervention against Iran, with a decision expected within the next two weeks.

XAUUSD technical analysis

XAUUSD quotes are undergoing a downward correction, dropping to the 3,350 USD support level. The Alligator indicator is pointing down, confirming the current bearish momentum. Once the correction is complete, gold prices could continue their upward trajectory.

The short-term XAUUSD price forecast suggests a further decline to 3,300 USD if bears retain control. However, if bulls reverse prices and gain a foothold above 3,370 USD, a move towards 3,400 USD is possible.

Summary

Gold prices are declining on Friday as markets await President Trump’s decision on possible US military involvement in Iran. Investors are closely watching for a resolution from the White House.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.