Gold (XAUUSD) in positive territory as markets brace for US jobs data

Gold (XAUUSD) prices are hovering around 3,370 USD on Friday. As the US prepares to release its May labour market data, investors seek safe-haven assets. Find out more in our analysis for 6 June 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) prices rise on strong demand for safe havens

- Weak US data continues to support bullish sentiment for gold

- XAUUSD forecast for 6 June 2025: 3,388 and 3,403

Fundamental analysis

Gold (XAUUSD) quotes are consolidating around 3,370 USD at the end of the week. Markets are turning to safe-haven assets ahead of the US May employment data release.

US initial jobless claims reached their highest level since October 2024, exceeding expectations. Labour productivity for Q1 was revised downwards, while the trade deficit narrowed due to falling imports.

Earlier in the week, the ADP report revealed the weakest private sector job growth since March 2023. Additionally, the ISM services PMI showed the first contraction in nearly a year.

Gold has gained around 2% over the week.

The gold (XAUUSD) forecast is positive.

XAUUSD technical analysis

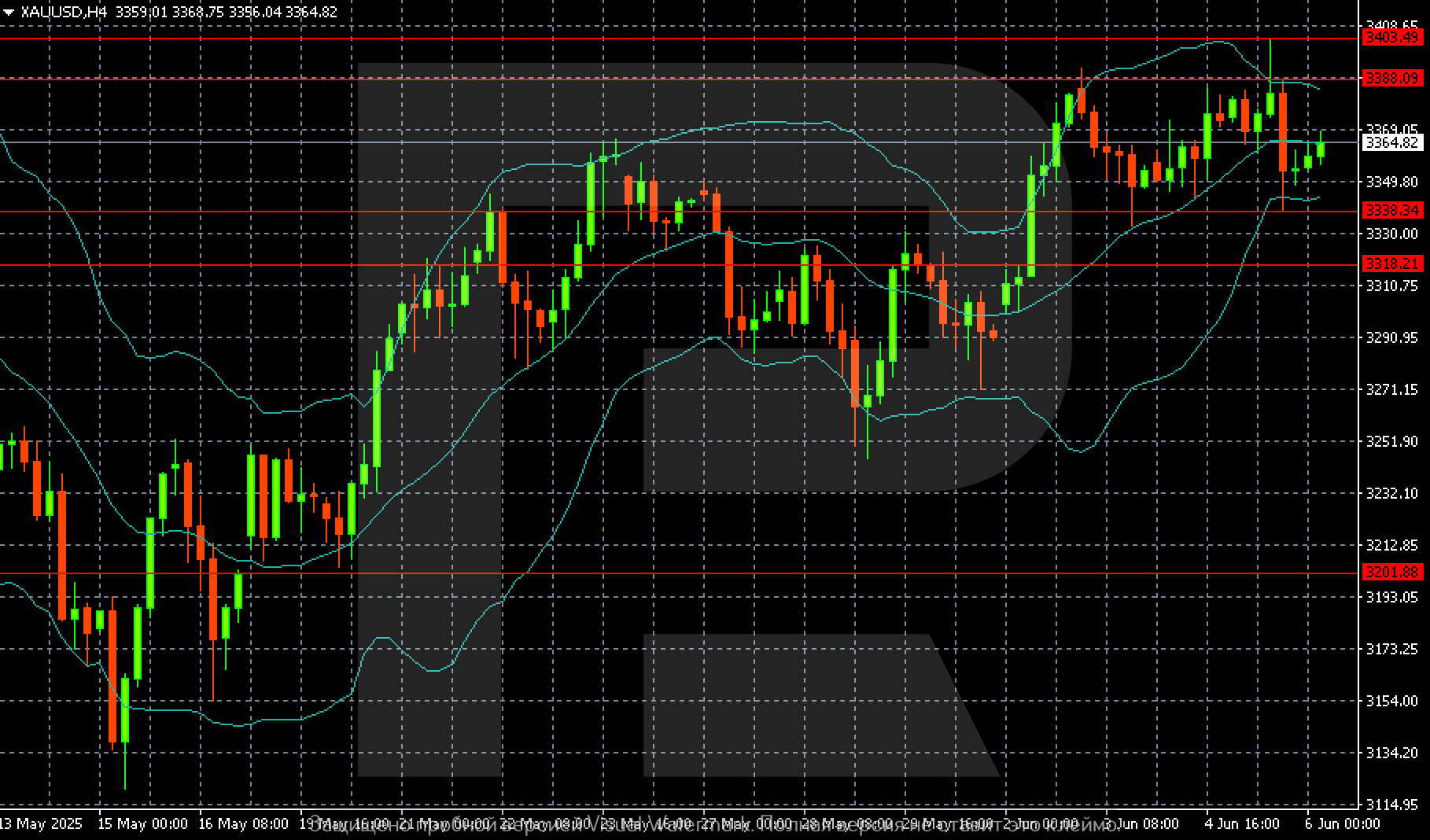

On the H4 chart, gold (XAUUSD) has a setup that supports a return to 3,388 USD, from where a move to retest 3,403 USD may follow.

Summary

Gold (XAUUSD) is poised to continue its upward trajectory as investors prioritise safe-haven assets amid economic uncertainty. Weak US data reinforces this trend. The gold (XAUUSD) forecast for 6 June 2025 anticipates the bullish momentum to persist, with targets at 3,388 and 3,403 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.