Gold (XAUUSD) halts its decline, but safe-haven demand remains weak

Gold (XAUUSD) stabilised near 3,306 USD after a decline, with a stronger US dollar weighing on the metal. Discover more in our analysis for 28 May 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) prices have fallen and are now stabilising as a strong US dollar puts pressure on the metal

- Risk appetite is growing across markets, reducing demand for safe-haven assets

- XAUUSD forecast for 28 May 2025: 3,280 USD

Fundamental analysis

Gold (XAUUSD) prices are hovering around 3,306 USD per troy ounce after a sharp decline the day before. The precious metal remains under pressure from a strengthening US dollar and a growing risk-on sentiment among investors.

The US dollar gained significant momentum following the release of data showing a sharp rise in US consumer confidence for May, signalling stronger prospects for the economy and labour market. Earlier, US President Donald Trump announced a delay in imposing tariffs on EU imports. This move reduced fears of an immediate trade confrontation, giving diplomats more time to seek solutions through negotiation.

Minneapolis Fed President Neel Kashkari called for keeping interest rates unchanged until there is more clarity on the inflationary impact of high tariffs. Against this backdrop, markets are now awaiting the release of the FOMC meeting minutes today.

The gold (XAUUSD) forecast remains negative.

XAUUSD technical analysis

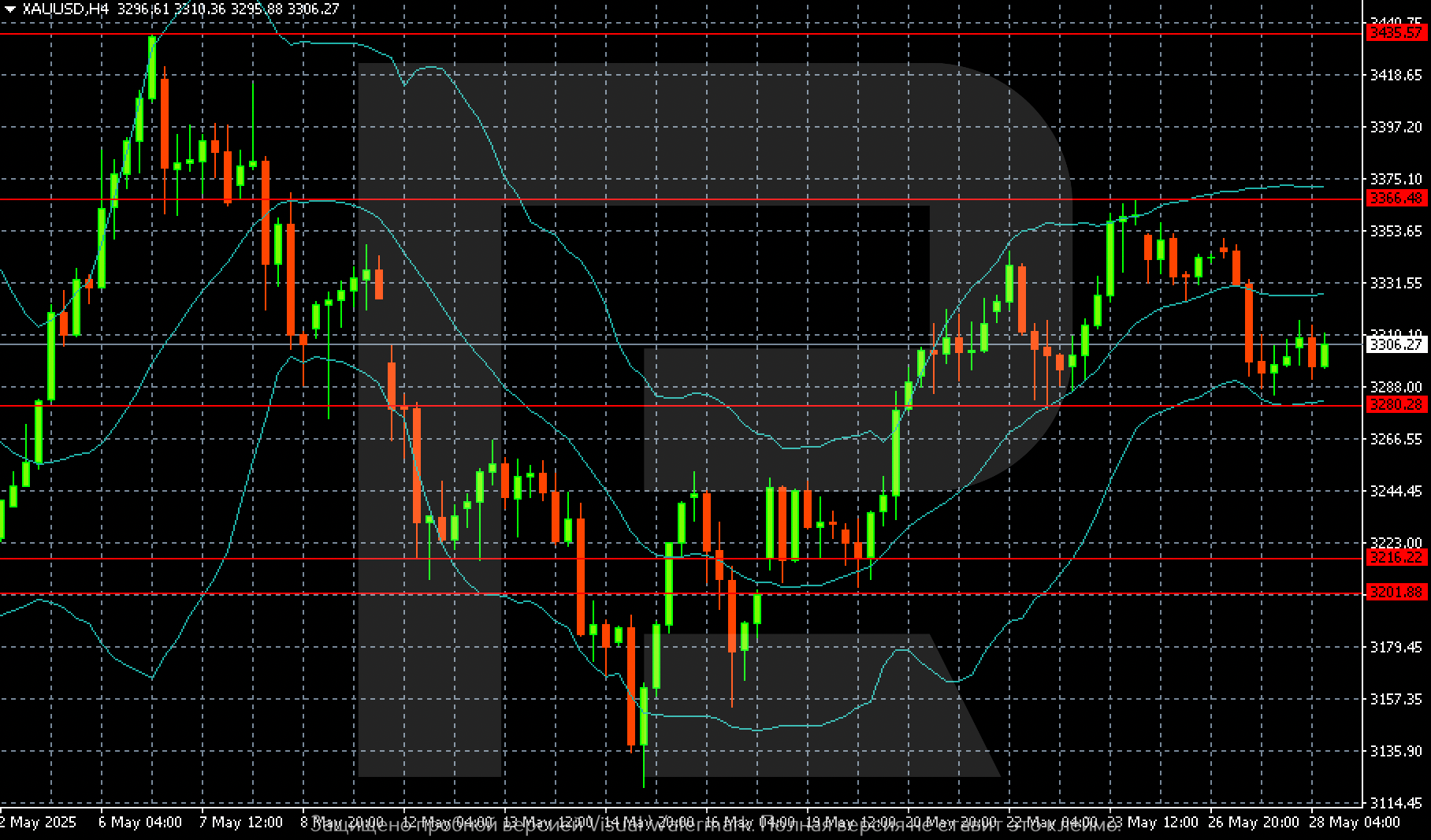

On the H4 chart, gold (XAUUSD) prices may slide further towards 3,280 USD if bearish momentum persists. However, if the downside move has already played out and bulls return to the market, a recovery towards 3,325 and potentially 3,350 USD could follow.

Summary

Gold (XAUUSD) remains under pressure due to the stronger US dollar and reduced interest in safe-haven assets. Market confidence in the US economy and a solid labour market are currently outweighing demand for gold. The gold (XAUUSD) forecast for today, 28 May 2025, suggests a potential move down to 3,280 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.