Gold (XAUUSD) drops to 3,300 USD; is this a correction?

XAUUSD quotes are experiencing a downward momentum, having fallen to the 3,300 USD area, suggesting the possibility of a continued correction. Discover more in our analysis for 27 May 2025.

XAUUSD forecast: key trading points

- Market focus: gold weakens amid US-EU trade negotiations

- Current trend: correcting downwards

- XAUUSD forecast for 27 May 2025: 3,280 and 3,325

Fundamental analysis

XAUUSD prices are declining on Tuesday as safe-haven demand weakens amid investor optimism over improved trade relations between the US and the EU. However, market sentiment remains cautious as attention shifts to global developments, including the widening US budget deficit and ongoing geopolitical tensions in the Middle East.

This week, investor focus turns to the release of the FOMC meeting minutes on Wednesday and the US PCE inflation data due on Friday. This data will help investors assess the prospects for future interest rate cuts by the Federal Reserve.

XAUUSD technical analysis

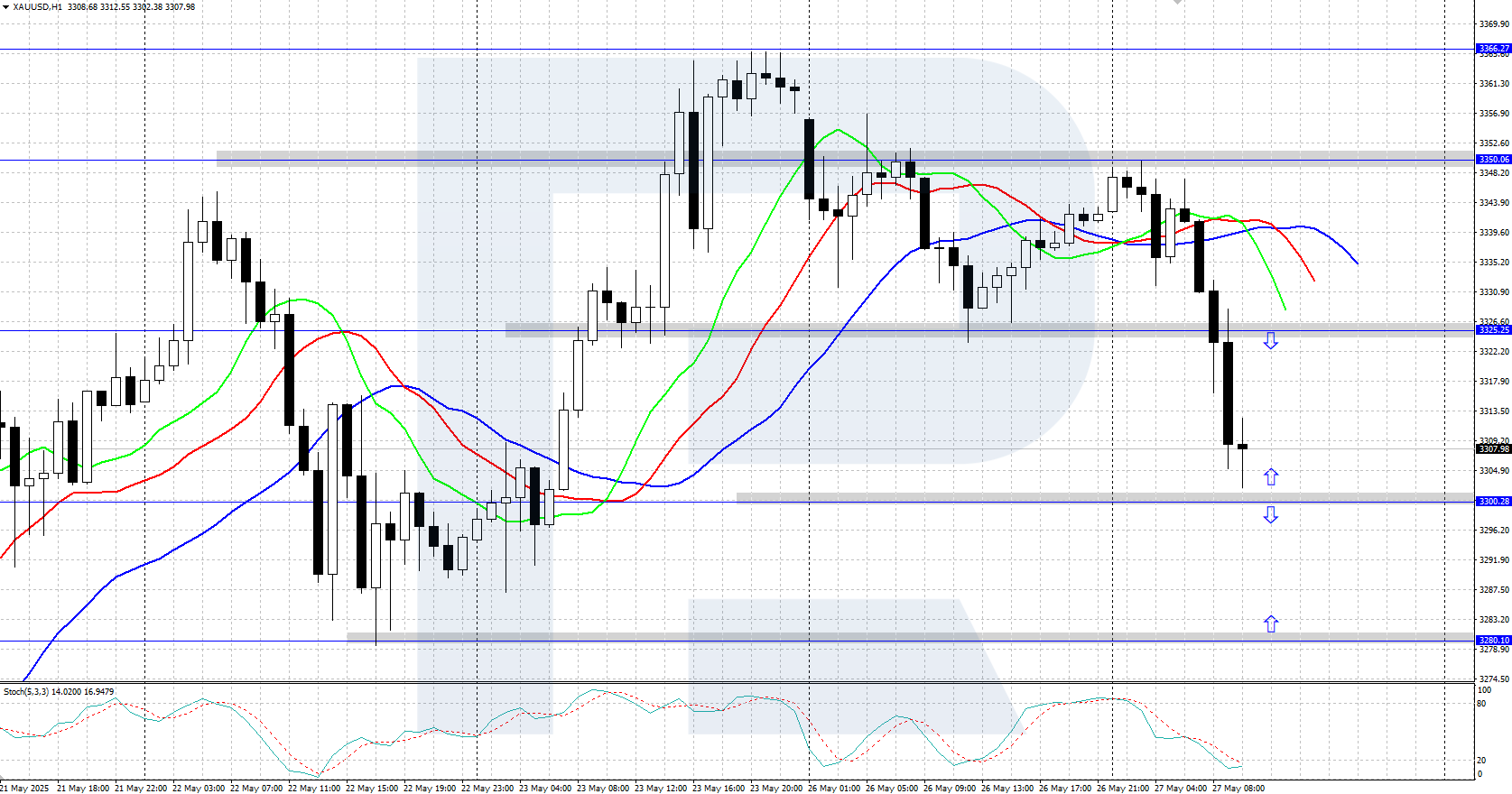

Gold is showing a bearish impulse after reversing from the daily resistance level at 3,366 USD. The Alligator indicator is trending downwards, confirming the ongoing correction. In the near term, this corrective phase may continue.

The short-term XAUUSD price forecast suggests a decline to 3,280 USD if bears retain control. However, if bulls reverse the move and gain a foothold above 3,325 USD, prices could climb to 3,350 USD.

Summary

XAUUSD quotes have fallen to the 3,300 USD level as hopes rise over better US-EU trade relations. Investors are now awaiting the FOMC minutes on Wednesday and the US PCE inflation data on Friday.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.