Central banks stay active: gold (XAUUSD) maintains bullish potential

After completing a correction, gold (XAUUSD) may resume its uptrend, with the 3,400 USD resistance level as the next target. Discover more in our analysis for 26 May 2025.

XAUUSD forecast: key trading points

- Moody’s downgraded the US credit rating from Aaa to Aa1

- Current trend: moving upwards

- XAUUSD forecast for 26 May 2025: 3,310 and 3,400

Fundamental analysis

Today’s XAUUSD analysis shows gold trading around 3,350 USD per ounce, undergoing a correction after reaching a two-week high of 3,365 USD last week. This pullback is largely due to easing trade war concerns after US President Donald Trump postponed 50% tariffs on EU goods.

Nevertheless, underlying fundamentals continue to support gold. Moody’s recent downgrade of the US credit rating from Aaa to Aa1 intensified concerns over fiscal sustainability, weakening the dollar and boosting gold’s appeal as a safe-haven asset.

The XAUUSD price forecast remains positive, driven by continued central bank purchases and rising demand from investors seeking protection from inflation and market instability.

Overall, despite the current correction, gold maintains bullish momentum, supported by macroeconomic and geopolitical factors.

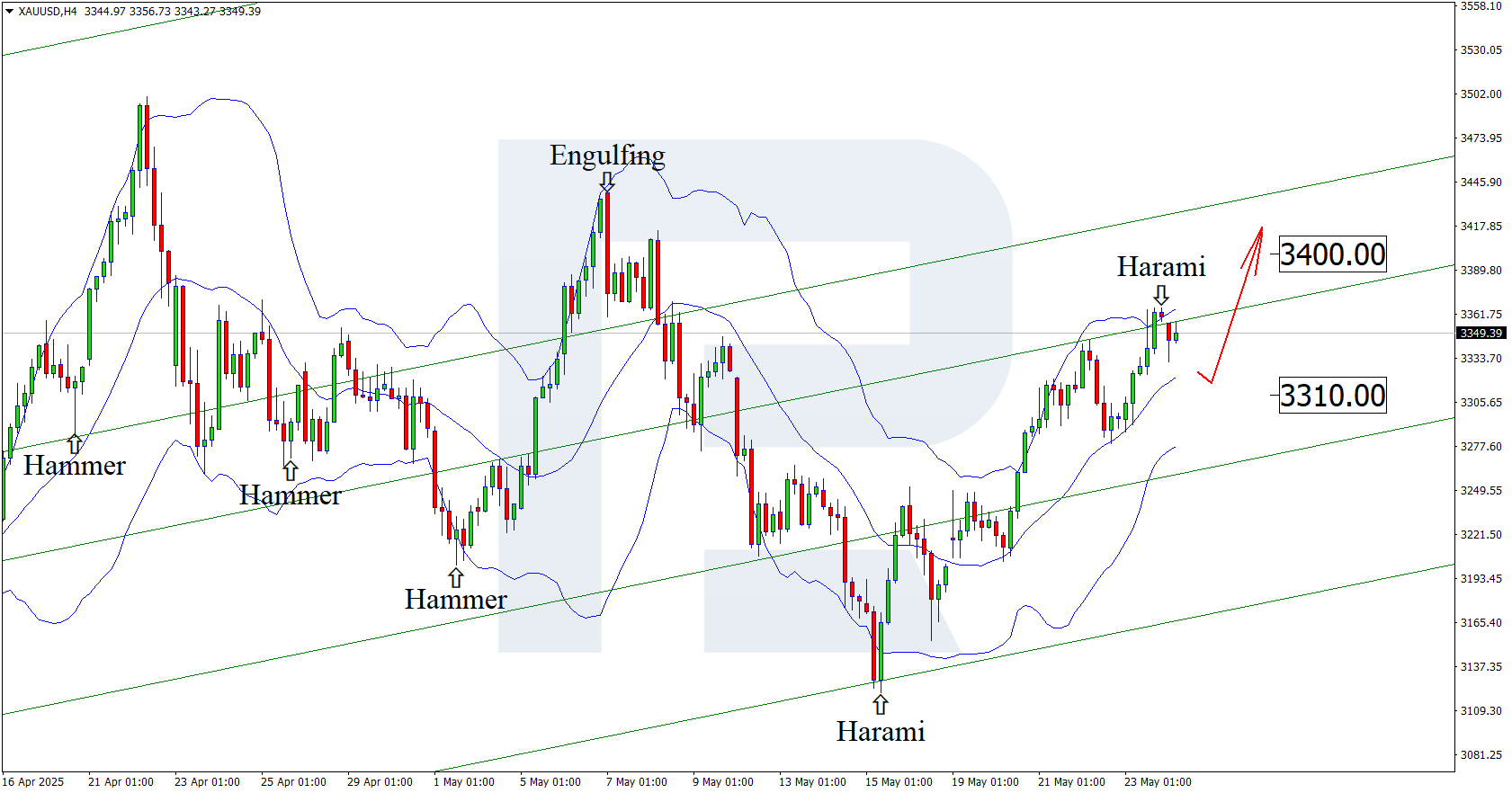

XAUUSD technical analysis

On the H4 chart, XAUUSD prices formed a Harami reversal pattern near the upper Bollinger Band. Quotes are currently developing a corrective wave based on this signal. However,

since they remain within an ascending channel, further growth is expected. The target for the correction could be the 3,310 USD support level.

However, today’s XAUUSD technical analysis also allows for an alternative scenario, where prices rise towards 3,400 USD.

After completing the current correction, XAUUSD quotes may attempt to set a new all-time high and aim for the 3,900 USD mark in the near term.

Summary

Despite a short-term correction, gold remains strongly supported by fundamental drivers. Central bank demand, declining confidence in the US dollar, and global uncertainty continue to shape a solid bullish trend for XAUUSD. In the short term, the metal may strengthen further and move towards new local highs.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.