Brent prices dipped to around 63.00 USD

Brent prices have fallen to around 63.00 USD amid concerns about oversupply in the global oil market. Discover more in our analysis for 18 November 2025.

Brent forecast: key trading points

- Market focus: OPEC countries are increasing oil production amid slowing demand growth

- Current trend: trading sideways

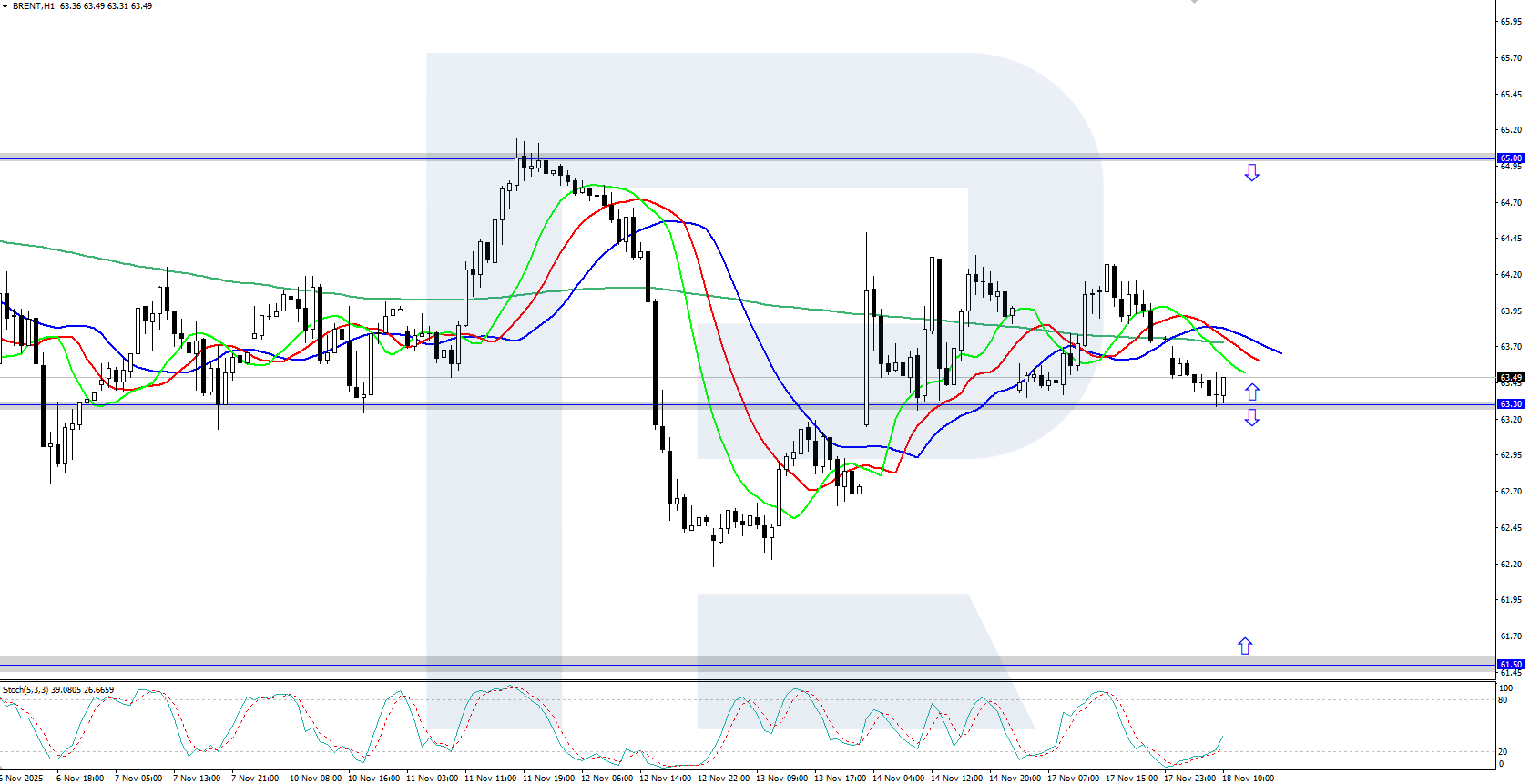

- Brent forecast for 18 November 2025: 61.50 or 65.00

Fundamental analysis

Brent quotes are declining as fears of oversupply outweigh the impact of upcoming sanctions on Russian oil. OPEC and non-OPEC countries are increasing production while demand growth slows.

Prices also weakened after reports that Russia’s Novorossiysk port resumed oil shipments on Sunday following a two-day shutdown caused by a Ukrainian attack.

Meanwhile, traders closely follow US sanctions against Russian oil giants Rosneft and Lukoil, which are set to take effect on 21 November. These sanctions have already prompted large buyers such as China, India, and Turkey to suspend purchases and seek alternative sources.

Brent technical analysis

On the H4 chart, Brent quotes are moderately declining within a limited sideways range between 63.30 and 65.00 USD. The direction of the breakout from this price range will determine the asset’s subsequent movement.

The short-term Brent price forecast suggests further growth towards 65.00 USD if buyers hold above 63.30 USD. If sellers push quotes below 63.30 USD, a decline towards the 61.50 USD support level is possible.

Summary

Brent crude has dropped to the support level near 63.00 USD. Market participants remain concerned about growing oversupply in the global oil market.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.