Brent at a three-week low: selling pressure persists

Brent crude has fallen to 62.15 USD. The sector is in turmoil as producers push for higher output. Find out more in our analysis for 13 November 2025.

Brent forecast: key trading points

- Market focus: global producers signal increasing supply

- Current trend: EIA and IEA project higher energy demand

- Brent forecast for 13 November 2025: 62.15 and 61.20

Fundamental analysis

Brent crude oil prices plunged to 62.15 USD per barrel on Thursday, losing nearly 4% in a single day and hitting a three-week low. Pressure intensified after OPEC indicated a favourable supply outlook. According to the cartel’s latest forecast, by 2026, global oil output will fully meet demand – a sharp shift from earlier deficit expectations. Production already exceeded consumption in the third quarter.

Additional downward pressure came from the US EIA’s higher production forecast and the International Energy Agency’s (IEA) more relaxed stance, now anticipating global oil demand to continue rising until 2050.

Traders are holding back ahead of the IEA’s monthly report due today, which could reinforce bearish sentiment.

Industry data also added to the pressure: US crude inventories rose by 1.3 million barrels in the week ending 12 November. If confirmed by official statistics, this would mark a second consecutive weekly increase.

The Brent outlook is bearish.

Brent technical analysis

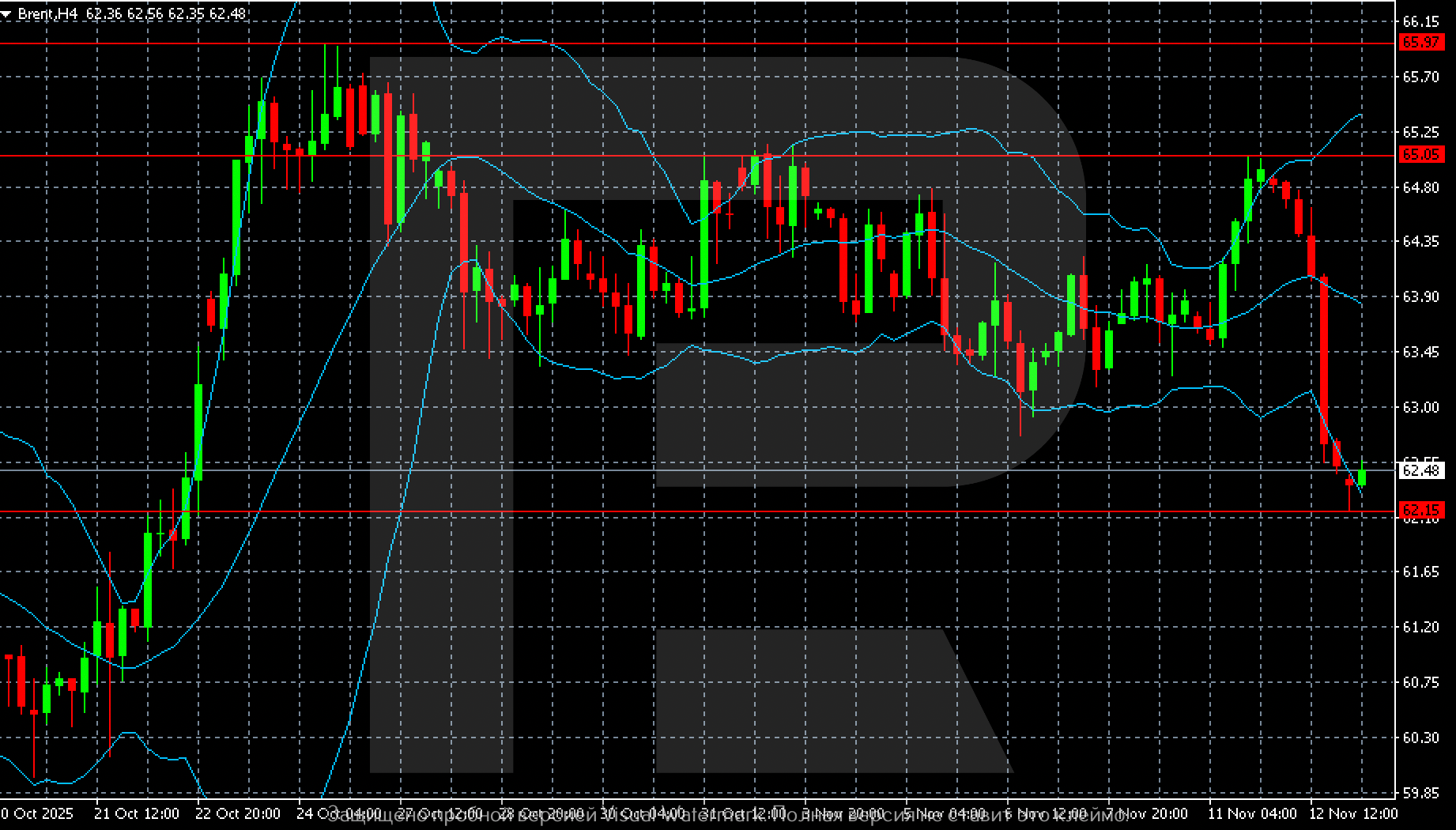

On the H4 chart, Brent shows a sharp increase in its downward momentum. After a prolonged consolidation phase within the 63.50–65.00 range, prices broke below the lower boundary and dropped to 62.15, a key support area. The current value reflects a mild local rebound following a steep decline.

The candlesticks are large and pointing downwards, indicating aggressive selling. Prices have moved below the lower Bollinger Band, confirming oversold conditions and suggesting a possible short-term bounce. However, the overall structure remains bearish, with a consistent sequence of lower highs and lower lows maintaining selling pressure.

The nearest resistance zone lies between 63.00 and 63.50, where the lower consolidation boundary was previously located. The support level is seen at 62.15; a downward breakout will open the path towards 61.20–60.80. For Brent to recover, prices must return above 63.50 – only then would the current downtrend begin to ease.

Summary

Brent remains weak after a midweek sell-off. The Brent forecast for today, 13 November 2025, suggests an extended decline towards 62.15 and lower.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.