Brent in range: everything depends on sanctions and demand

Brent crude is consolidating near 64 USD as the market remains uncertain about supply prospects. Find out more in our analysis for 11 November 2025.

Brent forecast: key trading points

- Market focus: Brent remains uncertain due to supply concerns

- Current trend: focus is on the release of the OPEC report and annual forecast

- Brent forecast for 11 November 2025: 63.20

Fundamental analysis

Brent oil prices are hovering near 64 USD per barrel, showing sideways movement amid anticipation of key industry reports and growing fears of a potential global supply surplus.

On Wednesday, the OPEC monthly report and the International Energy Agency’s (IEA) annual forecast are expected to be released – both could set the tone for the oil market in the coming weeks.

In recent days, Brent quotes have come under pressure due to forecasts suggesting that supply may outpace demand, as OPEC+ countries led by Russia gradually ease production restrictions. Non-OPEC producers are also increasing output volumes.

US sanctions against Russian oil companies remain an additional factor of uncertainty. According to media reports, Lukoil has declared force majeure on oil supplies from the West Qurna-2 field in Iraq. US President Donald Trump stated that a trade agreement with India is nearing its final stage, as New Delhi continues to reduce imports of Russian oil.

The Brent outlook remains moderately negative.

Brent technical analysis

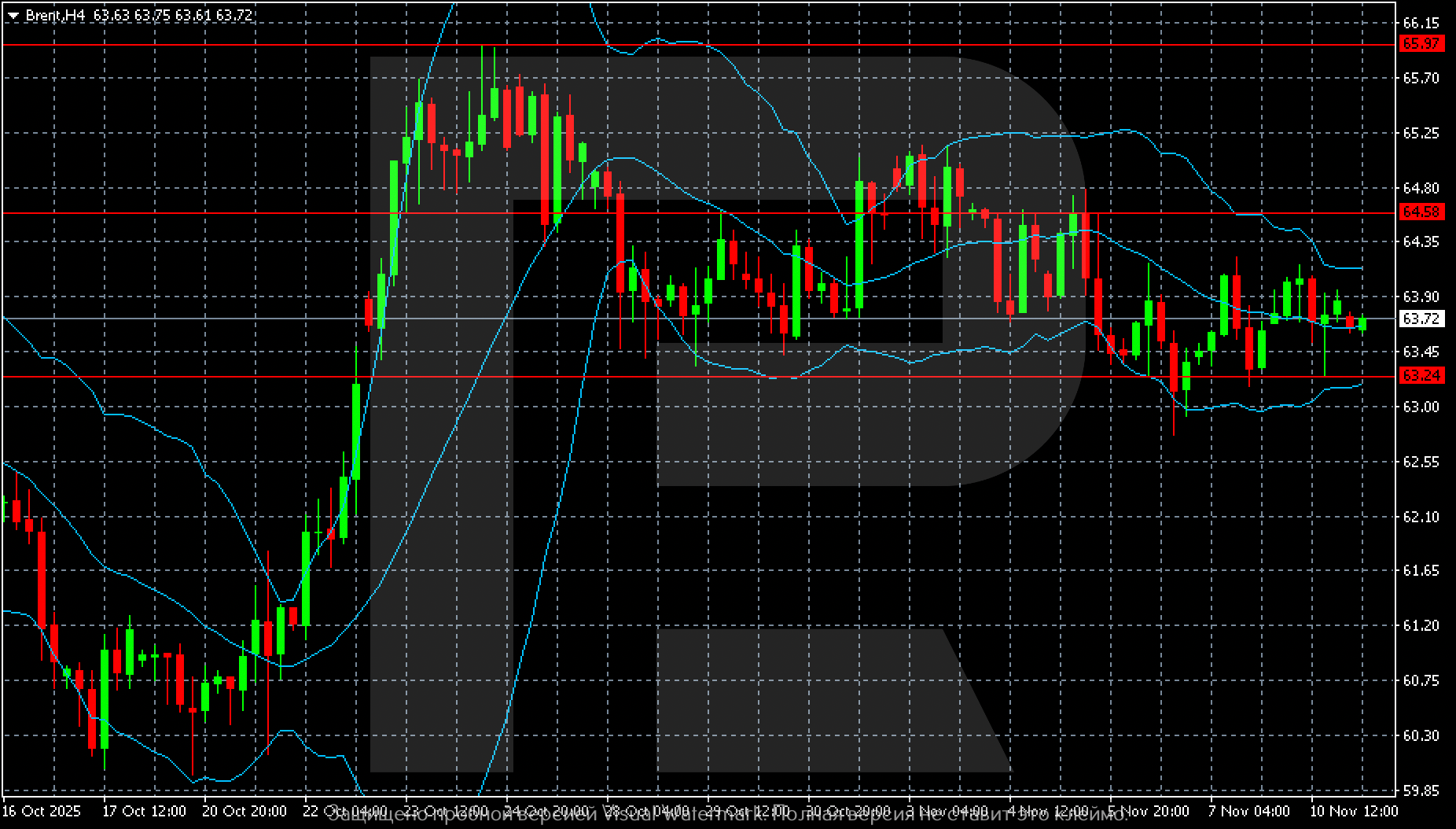

On the H4 chart, Brent prices are hovering near 64 USD per barrel, consolidating after a two-week decline. After a short-term rise to 64.60, quotes became stuck in a narrow 63.20–64.60 range, reflecting market uncertainty.

Bollinger Bands are narrowing, signalling declining volatility and a possible breakout from the range in the coming days. The indicator’s middle line is around 63.80, where prices are currently trading, confirming the balance between buyers and sellers.

The nearest support level lies at 63.20, followed by 62.00, where a local low previously formed. Resistance levels are located at 64.60 and 65.90; a breakout above these levels could signal renewed upward momentum.

Summary

Brent remains in a consolidation phase, reflecting market anticipation of fresh data from OPEC and the IEA. The Brent forecast for today, 11 November 2025, suggests a slight decline towards 63.20.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.