Brent prices fall to support at 60.00 USD

Brent crude prices have declined towards the 60.00 USD level, with market focus today on US oil inventory data from API. Find more details in our analysis for 21 October 2025.

Brent forecast: key trading points

- Market focus: US crude oil inventory data from API will be released today

- Current trend: moving downwards

- Brent forecast for 21 October 2025: 58.50 or 61.30

Fundamental analysis

Brent prices are moderately declining as growing concerns over a global oil supply glut and ongoing uncertainty surrounding US-China trade negotiations keep the market under pressure.

Traders are closely monitoring the upcoming talks between US and Chinese officials in Malaysia, which are viewed as a key precursor to the expected summit between President Donald Trump and President Xi Jinping later this month.

Brent technical analysis

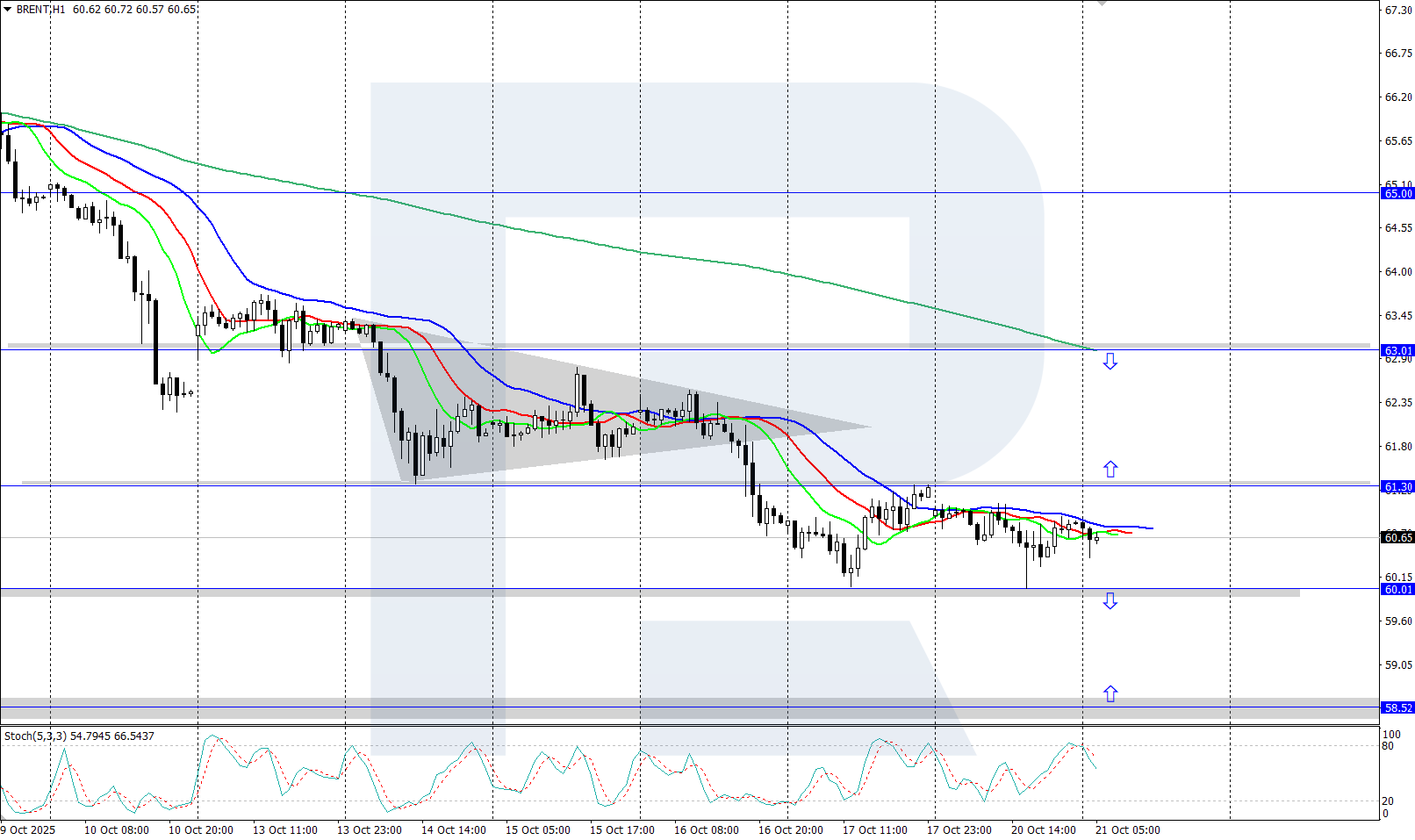

On the H4 chart, Brent continues to move within a clear downtrend. The Alligator indicator also points downwards, confirming the persistence of bearish momentum. The 60.00 USD mark currently acts as the key support level.

The short-term Brent forecast suggests growth towards 63.00 USD if buyers push prices above 61.30 USD. However, if sellers succeed in driving the price below 60.00 USD, the decline could extend towards the next support level at 58.50 USD.

Summary

Brent crude oil continues to trade in a downtrend, testing the key support level at 60.00 USD. Today, market attention is focused on the API report on US crude oil inventories.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.