Brent prices rise above 66.00 USD

Brent quotes are edging higher, moving above 66.00 USD despite a rise in US inventories according to EIA data. Discover more in our analysis for 9 October 2025.

Brent forecast: key trading points

- Market focus: US crude oil inventories rose by 3.7 million barrels last week

- Current trend: moving upwards

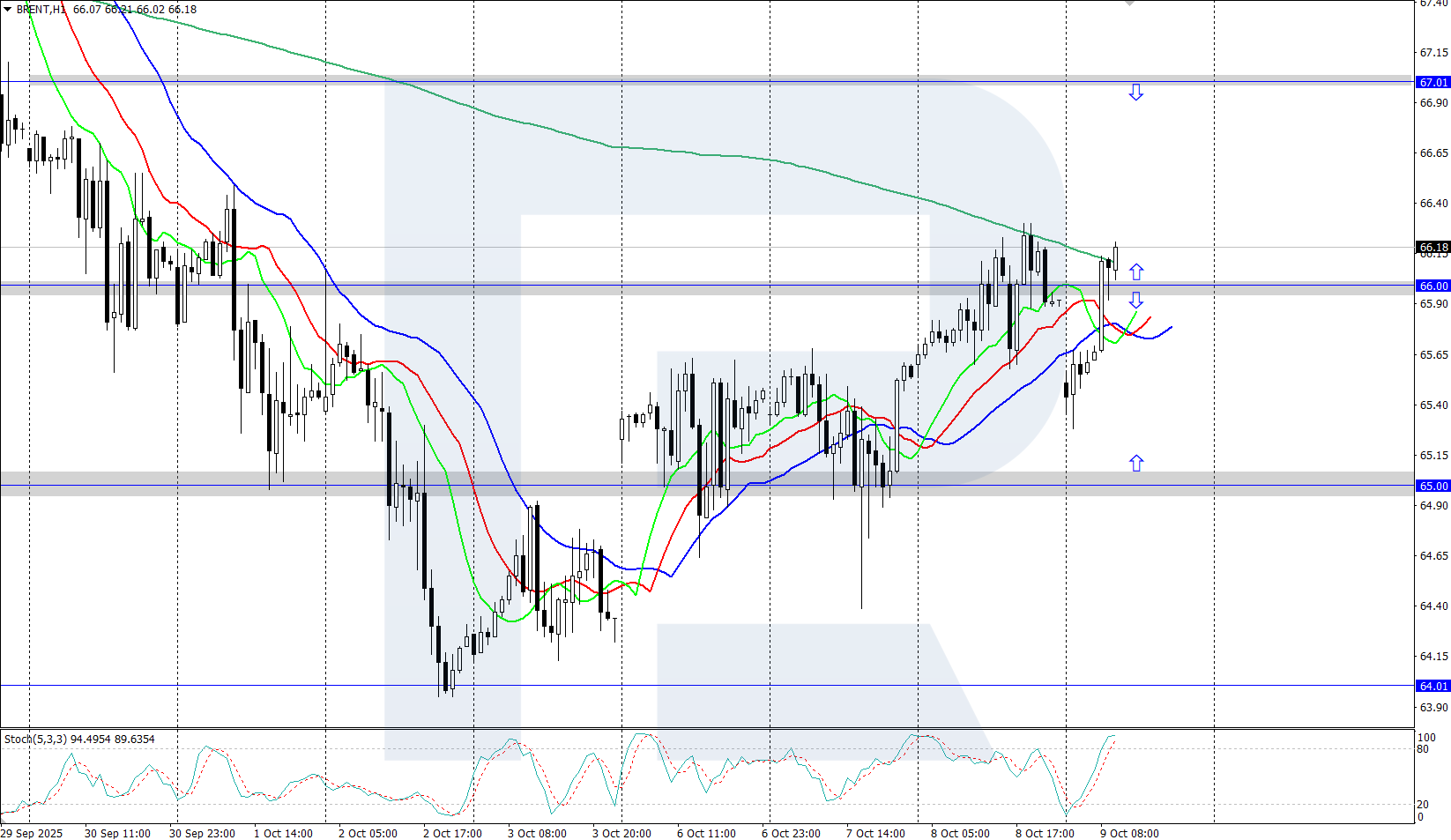

- Brent forecast for 9 October 2025: 65.00 or 67.00

Fundamental analysis

Brent is trading near 66.00 USD following news of a ceasefire agreement between Israel and Hamas in the Gaza Strip. President Donald Trump stated that the first phase of the peace plan, confirmed by Israeli and Hamas officials along with mediator Qatar, could end the two-year conflict and ensure the release of hostages.

Additional pressure on oil prices came from a larger-than-expected increase in inventories: EIA data showed that US crude stocks rose by 3.7 million barrels last week, exceeding market expectations of a 2.3 million barrel increase, driven by higher production and imports.

Brent technical analysis

On the H4 chart, Brent shows an upward movement after reversing from a daily low near 64.00 USD. The Alligator indicator has also turned upwards and is showing growth, suggesting that the bullish momentum may persist.

The short-term Brent price forecast suggests further growth towards 67.00 USD if bulls hold above 66.00 USD. Conversely, if bears push prices confidently below 66.00 USD, a correction towards the 65.00 USD support level could follow.

Summary

Brent quotes are showing moderate growth, moving above 66.00 USD. According to EIA statistics, US crude oil inventories increased by 3.7 million barrels last week.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.