Brent surges upwards: correction may pave the way for a new price rally

Geopolitical risks and possible production increases are playing a tricky role with Brent quotes, which may rise to 68.00 USD. Discover more in our analysis for 19 August 2025.

Brent forecast: key trading points

- OPEC+ ends oil production cuts

- Growth outlook for Brent quotes remains in place

- Brent forecast for 19 August 2025: 68.00

Fundamental analysis

Brent fundamental analysis for today, 19 August 2025, takes into account that oil prices, in the process of correction, reached 65.70 USD per barrel. This eased the risks of trade escalations and revived positive expectations for demand from the world’s two largest economies. At this stage, quotes are forming another corrective wave, hovering near 67.50 USD.

OPEC+ decided to end production cuts by September, which has already started affecting global supply volumes and Brent prices.

Overall, the Brent forecast for 19 August 2025 appears positive. Despite economic and political factors, the growth outlook for Brent quotes remains intact.

Brent technical analysis

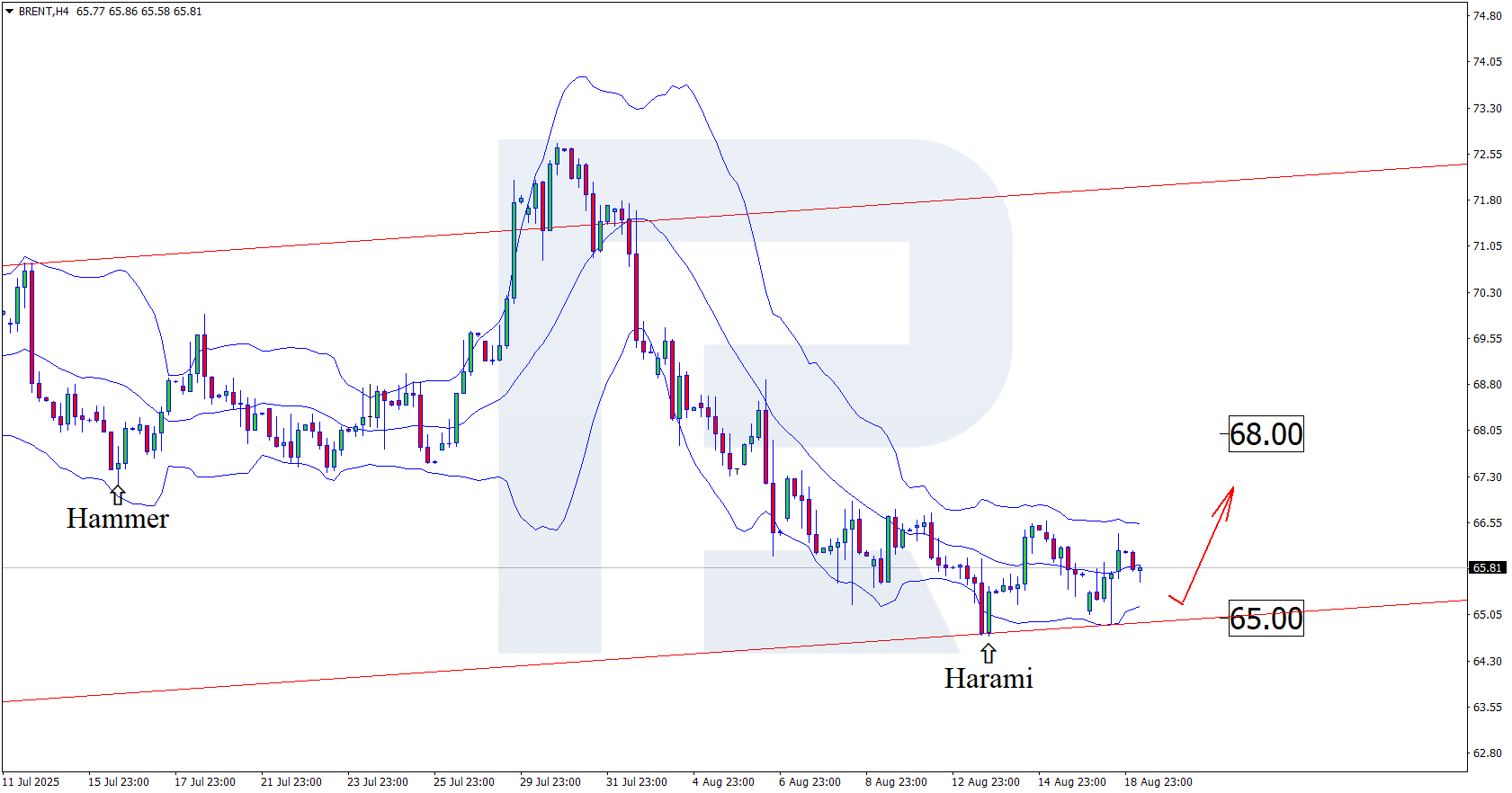

Having tested the lower Bollinger Band, Brent prices formed a Harami reversal pattern on the H4 chart. At this stage, prices are following the signal, moving higher.

The Brent forecast for 19 August 2025 suggests a growth target of 68.00 USD. A breakout above the resistance level would open the prospect of strengthening the upward wave.

However, an alternative scenario is also possible, where Brent quotes may undergo a correction towards 65.00 USD before resuming growth.

Summary

The increase in oil production from September may reduce prices in the future, but for now, Brent technical analysis suggests growth towards the 68.00 USD resistance area.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.