Brent prices on the edge: OPEC+ floods the market

Brent quotes may regain ground and test the resistance level around the 70.70 USD mark. Discover more in our analysis for 22 July 2025.

Brent forecast: key trading points

- OPEC+ continues to ramp up production

- Brent crude prices are undergoing a correction

- Brent forecast for 22 July 2025: 70.70

Fundamental analysis

The fundamental analysis of Brent for today, 22 July 2025, takes into account that after hitting new July highs, Brent formed a corrective wave and made another attempt to regain ground, but unsuccessfully. Currently, prices are in a new correction phase, trading near 69.90 USD.

The key factors influencing oil prices include:

- Rising tensions between the US and the EU, including threats of 30-100% tariffs. New US tariffs targeting countries like Brazil, the Philippines, Iraq, South Korea, and Japan increase global economic uncertainty and may weaken fuel demand

- OPEC+ is actively ramping up oil output. Saudi Arabia has been exporting record volumes in recent months. The de-escalation of the Iran-Israel conflict has eased fears over supply disruptions

- A weakening US dollar is partially supporting oil prices, but Brent’s upward momentum remains constrained by weak global demand

- The EU has approved its 18th sanctions package, including the potential for a lower oil price cap, but this is having only a moderate effect on supply

Brent technical analysis

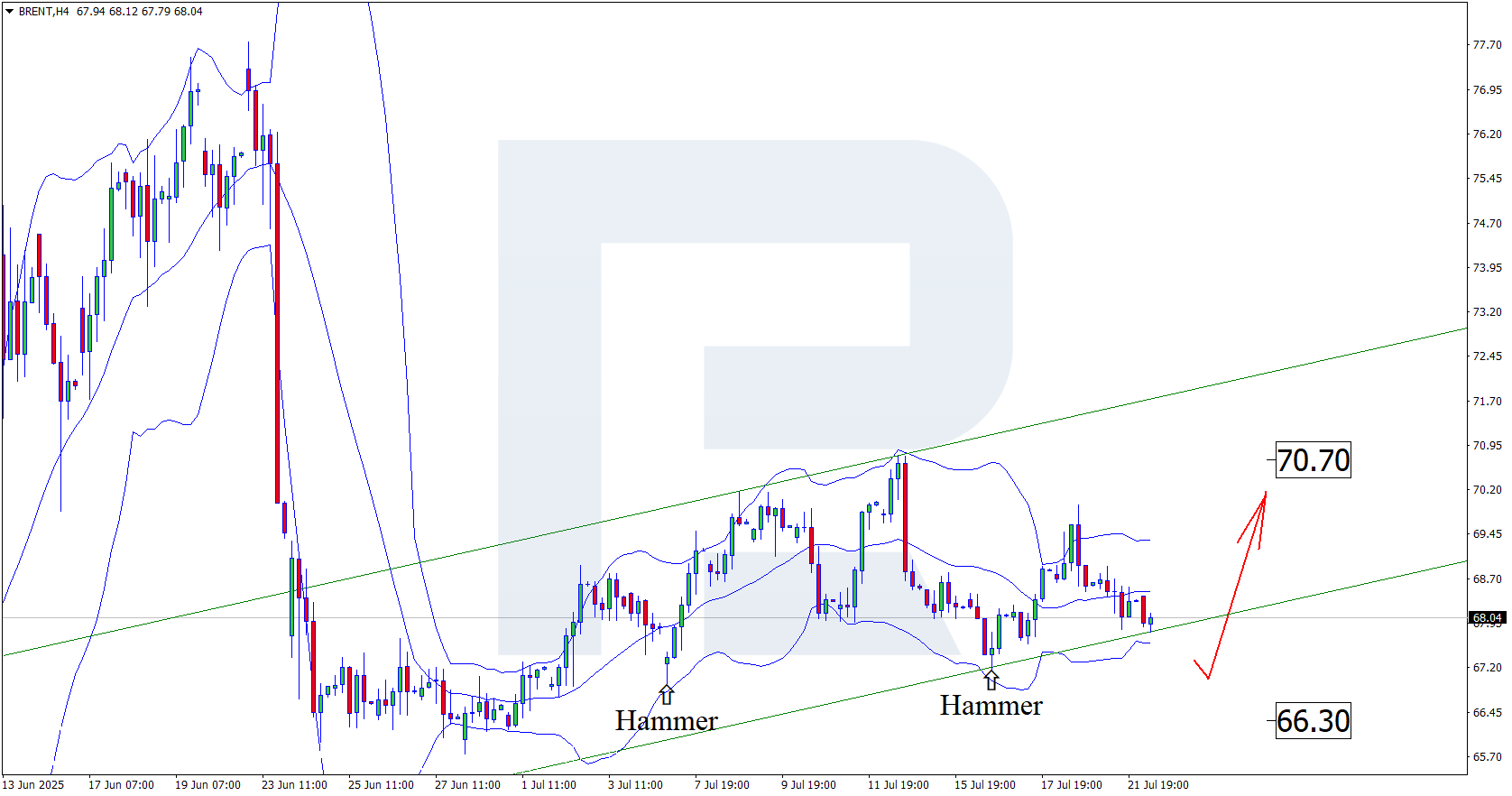

On the H4 chart, Brent prices tested the lower Bollinger Band and formed a Hammer reversal pattern. Having partially fulfilled the signal, quotes are now undergoing a correction.

The Brent price forecast for 22 July 2025 suggests a growth target at 70.70 USD. A breakout above the resistance level would open the door to a stronger upward wave.

However, an alternative scenario remains possible where Brent quotes may extend their correction to 66.30 USD before initiating a new bullish wave.

Summary

Brent prices are testing the lower boundary of the ascending channel and may be gearing up for another bullish wave amid geopolitical tensions.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.