A surprise from the Fed and US: Brent heads towards 71.70 USD

Brent oil quotes continue their upward trend and may test the 71.70 USD level. Details – in our analysis for 10 July 2025.

Brent forecast: key trading points

- Brent oil price is forming a correction

- US initial jobless claims: previous value – 233,000, forecast – 236,000

- Brent forecast for 10 July 2025: 71.70

Fundamental analysis

The fundamental analysis for Brent today, 10 July 2025, takes into account that the Brent price, having updated June's highs, rose to 77.75 USD per barrel before forming a correction. At this stage, quotes remain around 69.70 USD.

Key factors influencing Brent's price include:

- Trade risks and US tariffs – new American tariffs (including on countries such as Brazil, the Philippines, Iraq, South Korea, and Japan) increase global economic uncertainty. Investors fear this will reduce oil demand

- Federal Reserve and inflation – the Fed minutes showed only a few members supporting rate cuts in the near term – many expect rates to remain tight. This supports the US dollar's value and threatens oil demand

US initial jobless claims for 10 July are forecast to rise to 336,000. The increase compared to the previous period is not critical but higher unemployment negatively affects purchasing power and may impact energy demand.

Brent technical analysis

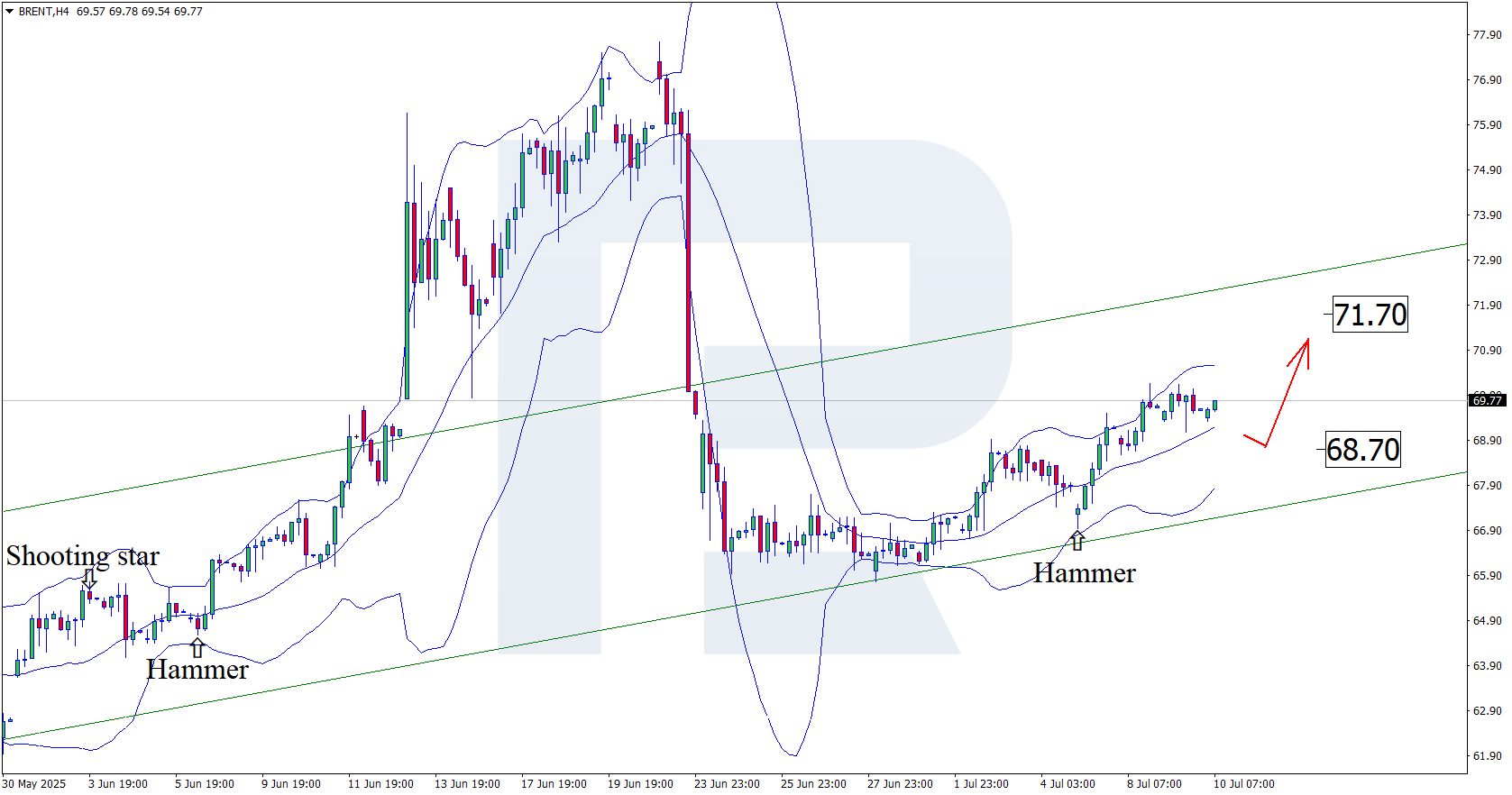

On the H4 chart, Brent's price, after testing the lower Bollinger Band, formed a Hammer reversal pattern. At this stage, it continues an upward wave within the pattern's realisation.

The Brent price forecast for 10 July 2025 indicates a target growth level of 71.70 USD. If resistance is broken, this will open prospects for a stronger upward wave.

At the same time, an alternative market scenario should not be excluded, where Brent quotes may form a correction towards 68.70 before continuing the upward trend.

Summary

The Brent forecast for 10 July can generally be considered positive; after completing its correction, quotes may continue the upward trend and test resistance around 71.70 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.