Trump and OPEC+ surprise: what is next for Brent this week?

Brent prices fell to around 63.80 USD amid expectations of increased oil production. Find out more in our analysis for 27 May 2025.

Brent forecast: key trading points

- OPEC+ may increase oil production by 411 thousand barrels per day

- Current trend: a corrective wave is forming

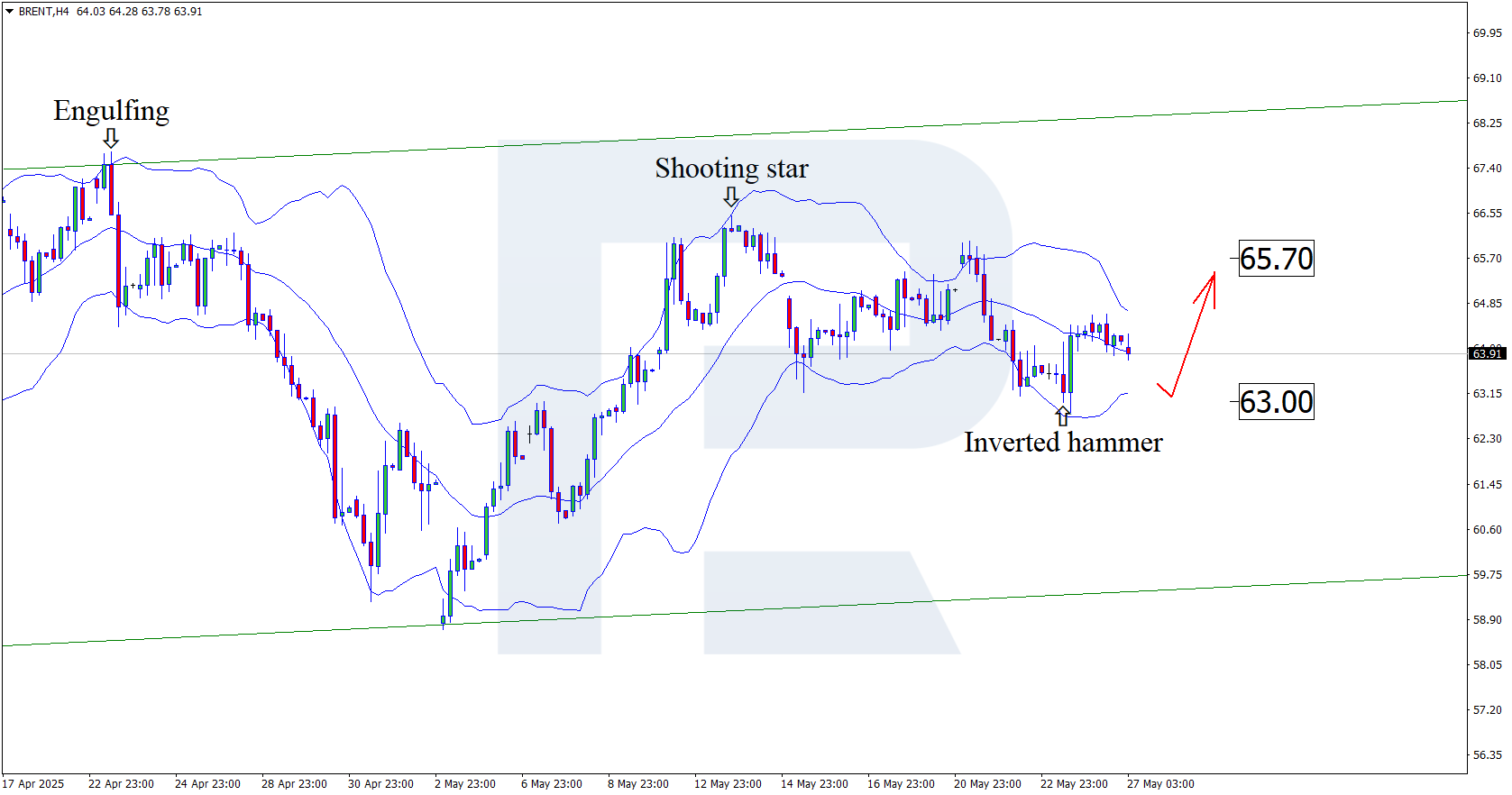

- Brent forecast for 27 May 2025: 63.00 and 65.70 USD

Fundamental analysis

Fundamental analysis of Brent for today, 27 May 2025, takes into account that quotes are trading around 63.80 USD per barrel, reflecting mild weakness driven by expectations that OPEC+ may boost production. At the upcoming 31 May meeting, eight OPEC+ member countries that previously implemented voluntary cuts are expected to discuss raising output by 411 thousand barrels per day starting in July.

Additional pressure on Brent prices comes from a stronger US dollar and concerns about slowing economic growth in China, which could curb energy demand. However, US President Donald Trump’s decision to delay 50% tariffs on EU goods until 9 July has eased fears of an immediate demand drop.

Overall, Brent's outlook for 27 May 2025 remains clouded by uncertainty surrounding upcoming OPEC+ decisions and global economic indicators.

Brent technical analysis

Having tested the lower Bollinger Band, Brent prices formed an Inverted Hammer reversal pattern on the H4 chart. This setup suggests a potential upward wave as the pattern plays out.

The Brent price forecast for 27 May 2025 suggests the 65.70 USD level as an upside target. A breakout above resistance could pave the way for a more substantial upward movement.

However, an alternative scenario also remains possible, where Brent quotes continue to correct towards 63.00 USD before growth.

Summary

The Brent oil market remains under pressure from multiple factors such as expectations of increased OPEC+ output, a strong US dollar, and signs of slowing demand in China. However, technical analysis points to a potential upward move towards 65.70 USD once the correction is complete.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.