Top 3 trade ideas for 22 August 2025

Trade ideas for EURJPY, USDCAD, and EURUSD are available today. The ideas expire on 22 August 2025 at 11:00 PM (GMT +3).

EURJPY trade idea

On the intraday chart, the EURJPY pair shows consolidation within a sideways range. The main support is located at 171.00. Buying at current prices is inefficient due to a low risk-to-reward ratio. A breakout of the 172.50 level will confirm a bullish impulse, with the nearest upside target at 173.50. Today’s EURJPY trade idea suggests placing a pending Buy Limit order.

Market sentiment for EURJPY shows a slight bullish advantage – 51% vs 49%. The risk-to-reward ratio exceeds 1:2. The potential profit is 150 pips at the first take-profit level and 175 pips at the second, while possible losses are limited to 75 pips.

Trading plan

- Entry point: 172.00

- Target 1: 173.50

- Target 2: 173.75

- Stop-Loss: 171.25

USDCAD trade idea

The USDCAD pair continues its strong rally for the fourth consecutive session. The short-term RSI indicator signals a bullish sentiment, confirming the potential for further strengthening of the pair. There are no signs of the current upward move ending yet, although a short-term bearish correction cannot be ruled out. A breakout above the 1.3925 level will confirm bullish momentum, with 1.4000 as the next target. Today’s USDCAD trade idea suggests placing a pending Buy Limit order.

Market sentiment for USDCAD shows a slight bullish advantage – 51% vs 49%. The risk-to-reward ratio exceeds 1:2. The potential profit is 100 pips at the first take-profit level and 110 pips at the second, with possible losses capped at 50 pips.

Trading plan

- Entry point: 1.3890

- Target 1: 1.3990

- Target 2: 1.4000

- Stop-Loss: 1.3840

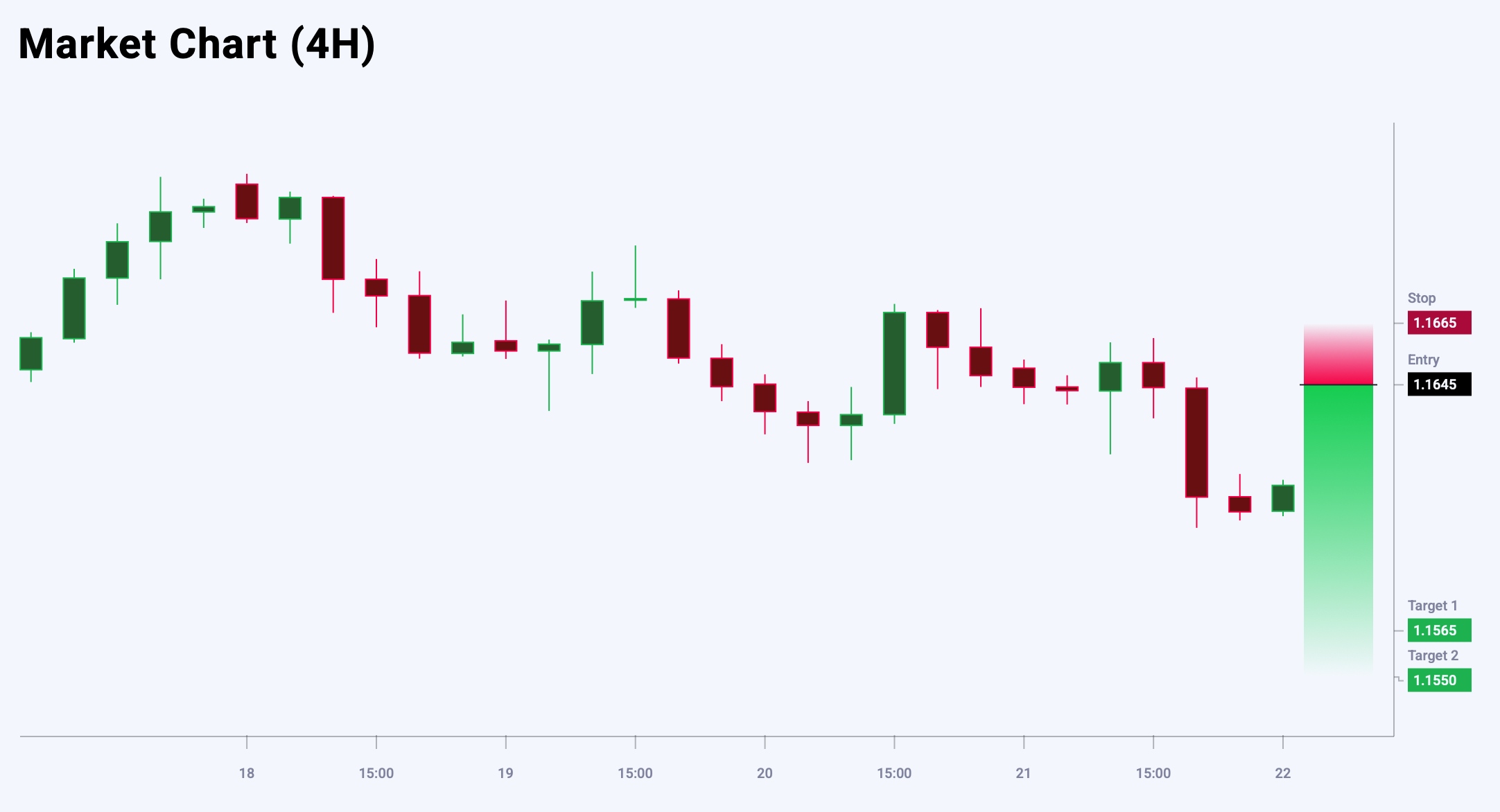

EURUSD trade idea

The medium-term forecast for the EURUSD pair remains bearish. Price action shows signs of forming a top, which may trigger a temporary rebound. The main strategy is to sell on upward corrections, with the key resistance level at 1.1645. Today’s EURUSD trade idea suggests placing a pending Sell Limit order.

News sentiment for EURUSD shows a strong bullish bias – 59% vs 41%. The risk-to-reward ratio is 1:4. The potential profit is 80 pips at the first take-profit target and 95 pips at the second, with possible losses limited to 20 pips.

Trading plan

- Entry point: 1.1645

- Target 1: 1.1565

- Target 2: 1.1550

- Stop-Loss: 1.1665

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.