Weekly technical analysis and forecast (6-10 October 2025)

This weekly technical analysis highlights the key chart patterns and levels for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, gold (XAUUSD), and Brent crude oil to forecast market moves for the upcoming week (6-10 October 2025)

Major technical levels to watch this week

- EURUSD: Support: 1.1645, 1.1504. Resistance: 1.1820, 1.1900

- USDJPY: Support: 146.50, 145.5Resistance: 148.33, 153.15

- GBPUSD: Support: 1.3390, 1.31Resistance: 1.3550, 1.3720

- AUDUSD: Support: 0.6500, 0.64Resistance: 0.6630, 0.6700

- USDCAD: Support: 1.3930, 1.385Resistance: 1.4040, 1.4125

- Gold: Support: 3,800, 3,66Resistance: 3,915, 4,000

- Brent: Support: 63.00, 62.Resistance: 69.00, 71.50

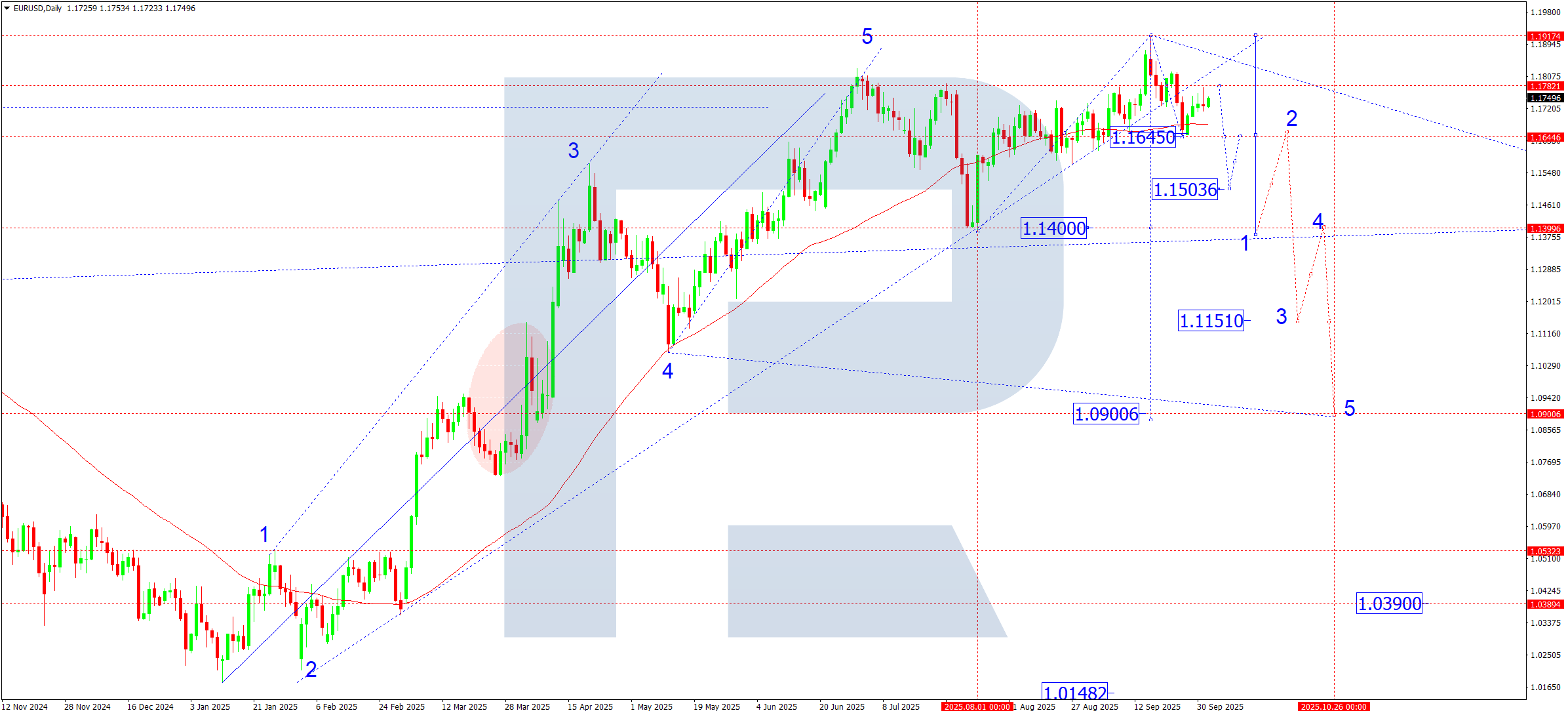

EURUSD forecast

The market continues to assess prospects for Fed and ECB policy. Rising expectations of rate cuts in the eurozone, against Germany’s slowing industrial sector, pressure the euro. Meanwhile, the dollar gains support from strong US labour data and the continued hawkish rhetoric from some Federal Reserve members. Geopolitical uncertainty in Eastern Europe also poses risks for the euro, as investors prefer the dollar as a safe-haven asset.

EURUSD technical analysis

On the daily chart, the EURUSD pair completed a correction towards 1.1778 and started a new downward wave. If the price breaks below 1.1680 with rising volumes, the pair could continue its downward trajectory to 1.1504, with the potential for a further decline to 1.1400. The first target in this phase remains 1.1504.

EURUSD forecast scenarios

Bearish (baseline) scenario:

A downward structure forms, with

- target 1 at 1.1504 (expected this week)

- target 2 at 1.1400 (main support zone – a correction may follow)

Bullish (alternative) scenario:

If the market holds above 1.1820, it can attempt another growth structure towards 1.1900. However, this scenario remains limited without a strong fundamental driver.

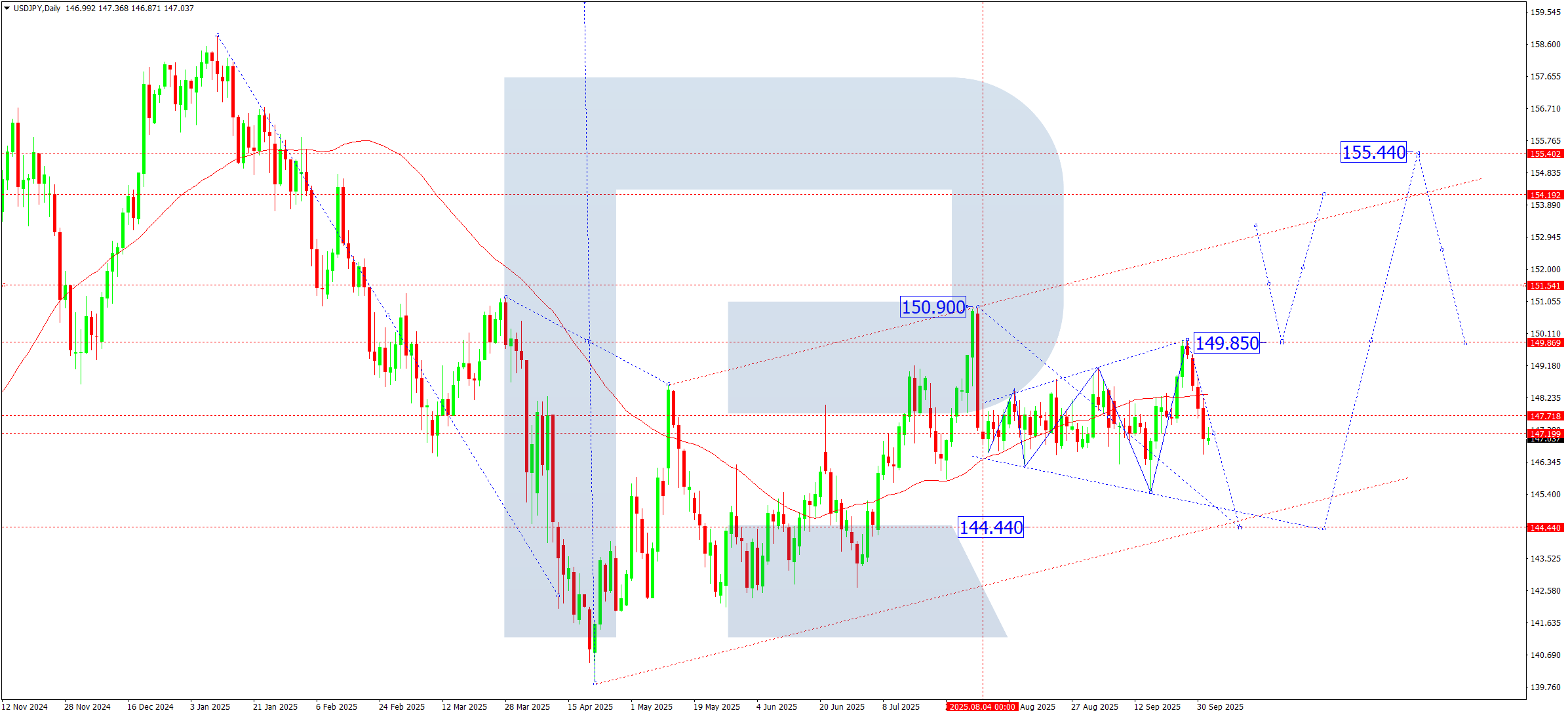

USDJPY forecast

The yen remains under pressure due to monetary policy divergence: the Federal Reserve continues to keep rates high, while the Bank of Japan maintains an ultra-loose stance despite speculation about adjustments. US Treasury yield dynamics add influence, with higher yields supporting the dollar. On the yen’s side, safe-haven demand rises amid Asian geopolitical tensions and equity-market instability. Overall, the balance of factors supports a consolidation range.

USDJPY technical analysis

On the daily chart, the USDJPY pair is holding within a broad consolidation range around 147.72. If the price settles below the SMA50, the decline is expected to continue to 144.44, which would complete the fourth corrective wave. After the correction, a recovery can target 149.85 with scope to extend the trend to 155.44.

USDJPY forecast scenarios

Bearish (baseline) scenario:

A confident breakout below 146.50, confirmed by rising volumes, would open the way to 145.50 with the potential to decline to 144.44.

Bullish (alternative) scenario:

If the market breaks above the 148.33 resistance level, growth could resume.

A local target is 153.15.

The main target is 155.44 (the first large target of the new upward wave).

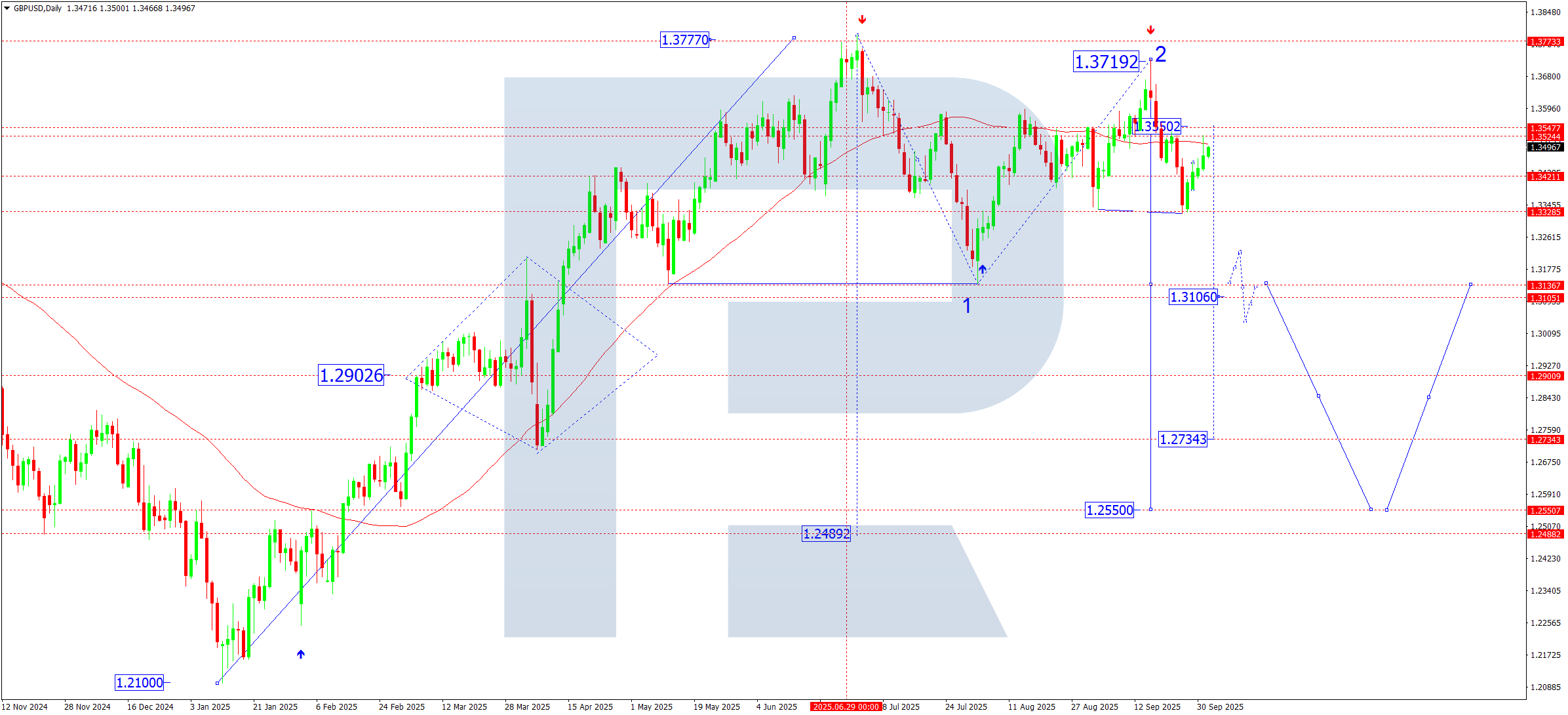

GBPUSD forecast

The pound remains under pressure following weak retail sales and signs of a cooling UK labour market. The Bank of England stays cautious on further tightening, while markets are increasingly pricing in expectations for rate cuts next year. The dollar, in contrast, draws support from robust US data and high Treasury yields, widening the yield differential in favour of the USD and adding to pressure on the GBPUSD pair.

GBPUSD technical analysis

On the daily chart, the GBPUSD pair has bounced off the SMA50 and is developing a downward structure. A breakout below 1.3390 would open the door for a move towards 1.3100, with the potential to drop further to 1.2733. The base case suggests a third downward wave with the main target at 1.2500.

GBPUSD forecast scenarios

Bearish (baseline) scenario:

The five-wave decline remains the priority.

The target of the current (third) wave is 1.3100 as an intermediate step.

The main downside target is 1.2500.

Bullish (alternative) scenario:

Consolidation above 1.3550 would unlock upside potential. Local targets are 1.3720, 1.3800; with strong momentum, 1.4000–1.4160.

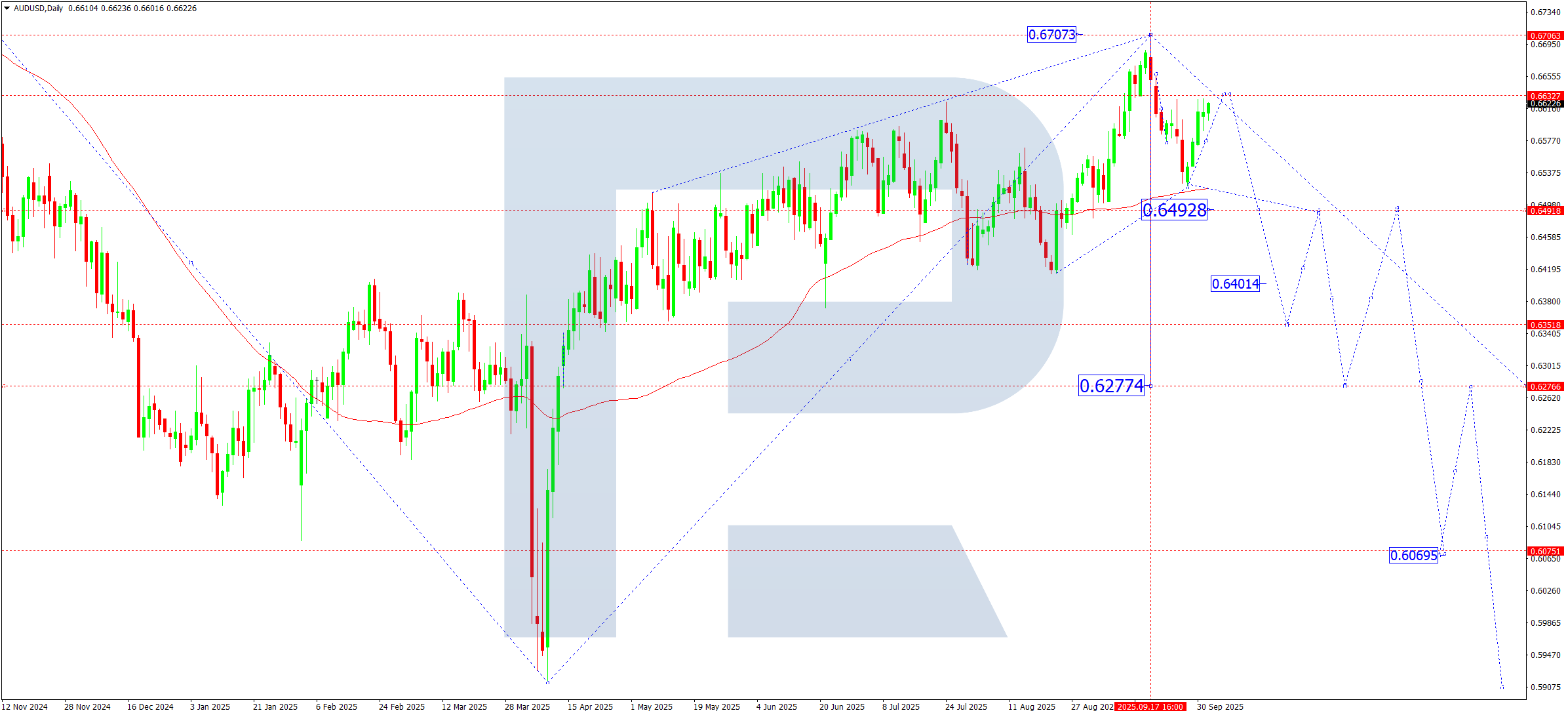

AUDUSD forecast

The Australian dollar remains pressured by expectations of further Fed tightening and soft macroeconomic data from China, Australia’s key trading partner. Commodity price swings, especially in iron ore and coal, and rising Asia-Pacific geopolitical risks add to volatility.

AUDUSD technical analysis

On the daily chart, the AUDUSD pair completed a corrective structure, reaching 0.6622. The next step likely brings another downward wave. The base case suggests a test of the 0.6495 level, with the move continuing to 0.6400 and 0.6350. These levels form sequential targets of the current downtrend. The local downside target remains at 0.6495 (pivot point of the current downward wave). A breakout and consolidation below 0.6495 can accelerate the bearish trend to 0.6350.

AUDUSD forecast scenarios

Bearish (baseline) scenario:

- 0.6495 – intermediate target (calculated pivot point of the current wave)

- 0.6400 – next target in the third downward wave

- 0.6350 – main target of the third downward wave

Bullish (alternative) scenario:

Consolidation above 0.6630 would open upside potential:

- 0.6700 – nearest target

- 0.6750 – local target of the corrective wave

USDCAD forecast

The Canadian dollar stays under pressure as oil prices decline, which traditionally affects the CAD. The US dollar remains strong, supported by hawkish Fed tone and expectations of prolonged high rates. US and Canadian labour reports can add to volatility.

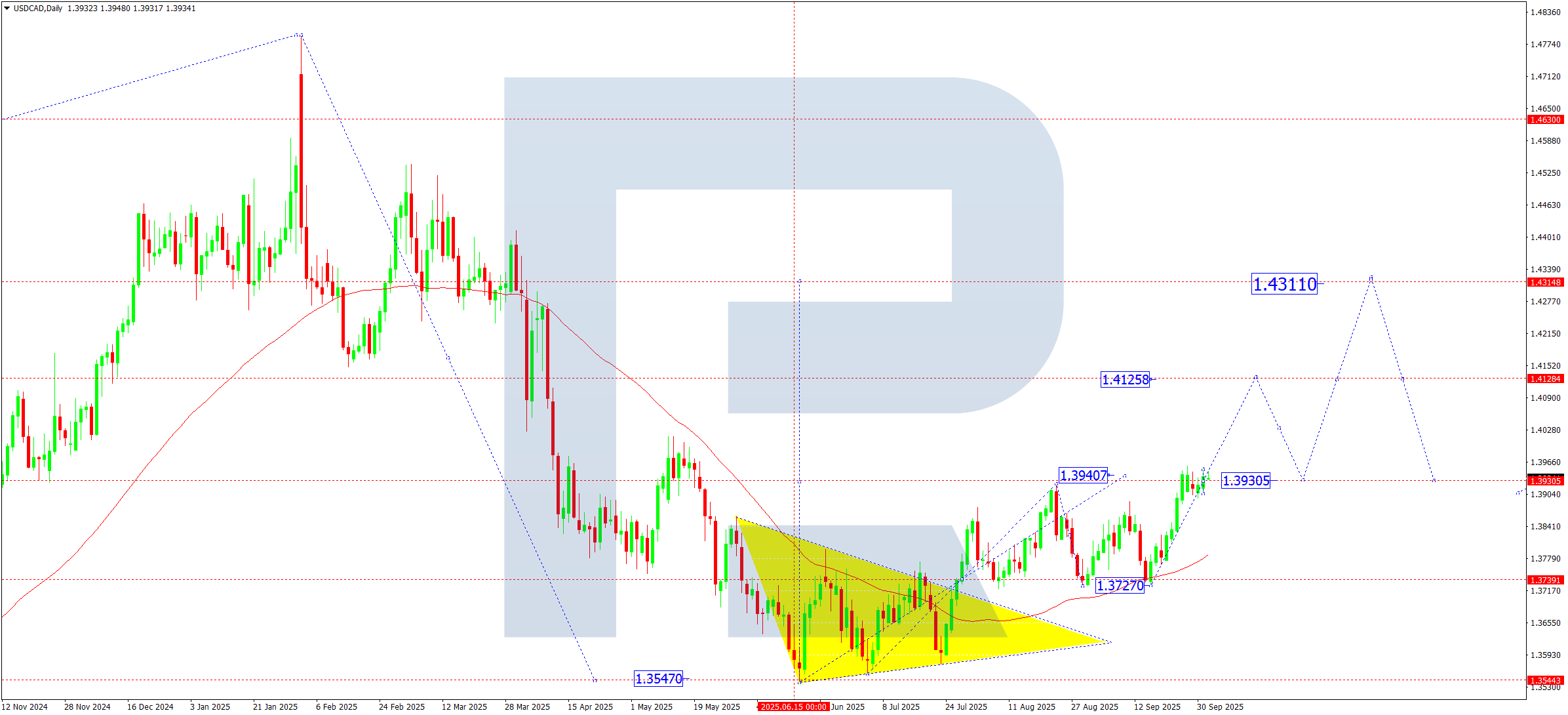

USDCAD technical analysis

On the daily chart, the USDCAD pair rose to 1.3957. In the near term, the market forms a consolidation range around 1.3930. A downside breakout could trigger a correction towards 1.3850 and 1.3730. An upward breakout could see a pivot point forming, with potential for continued growth to at least 1.4125. The week may balance between a local pullback and the likely start of a new growth wave.

USDCAD forecast scenarios

Bullish (baseline) scenario:

Consolidation near 1.3930 followed by an upside breakout on rising volumes would open the path to 1.4125 (local trend target).

Bearish (alternative) scenario:

A corrective decline:

- first target – 1.3850

- second target – 1.3730

XAUUSD forecast

Gold remains near multi-month highs as markets expect a softer Fed tone after slower US inflation prints. Rising geopolitical tensions in the Middle East and Eastern Europe boost safe-haven demand. Weak equity markets and high volatility in commodities also support prices. In these conditions, gold keeps acting as a safe haven for investors, which sustains the uptrend.

XAUUSD technical analysis

On the daily chart, after breaking above 3,815, XAUUSD advanced to 3,898. Prices consolidated firmly above the SMA50, confirming a strong uptrend. In the coming week, gold is expected to maintain its upward momentum towards the key 4,000 level. After reaching 4,000, it could correct towards 3,800. Further recovery can then aim for 4,070 as the main target of the current wave. After reaching 4,070, the odds increase for a larger correction towards 3,660. In the long term, after the correction is complete, the scenario of growth to 4,200 remains in place.

XAUUSD forecast scenarios

Bullish (baseline) scenario:

Consolidation above 3,815 has already opened upside potential.

The nearest targets:

- 4,000 – key resistance level

- 4,070 – the upper boundary of the extended fifth wave

Bearish (alternative) scenario:

A breakout and consolidation below 3,800 can trigger a decline towards:

- 3,660 – intermediate support level

- 3,230 – zone of deep technical and fundamental correction

Brent forecast

Oil remains under pressure. Global demand shows signs of slowing amid weaker growth in China and Europe. Supply stays ample due to rising exports from the US and some OPEC+ countries. Geopolitical risks (the Middle East, Venezuela, conflict zones in Europe) intensify and can cause sharp price swings. Brent, therefore, balances between fundamental softness and a potential geopolitical premium.

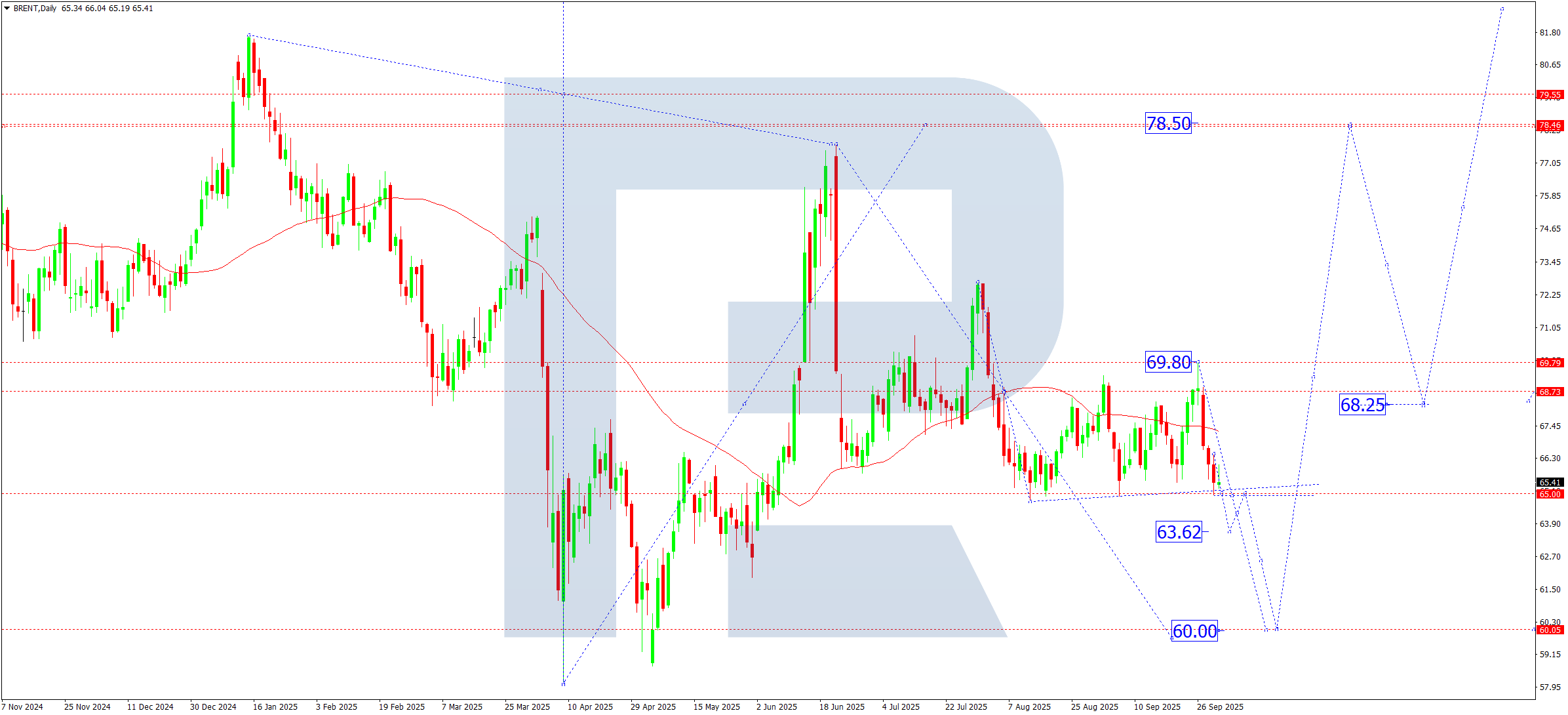

Brent technical analysis

On the daily chart, Brent broke and consolidated below the 65.00 level. The market effectively exited the long-term sideways corridor downwards, confirming the relevance of the fourth downward wave. In the coming weeks, a downward structure is expected to develop, with interim targets at 64.00 and 63.00, and the potential to reach the main 60.00 target. After this corrective wave is complete, the market can reverse into a new upward phase towards 78.50.

Brent forecast scenarios

Bearish (main) scenario:

A breakout below 65.00 confirmed the decline:

- 64.00 – first target

- 63.00 – second target

- 60.00 – main target of the current corrective wave

Bullish scenario (alternative):

Given very high geopolitical risks, a sharp rebound remains possible:

- 69.00 – first recovery target

- 71.50 – second target

- 78.50 – main target of the expected first upward wave

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.