USDJPY falls after Powell’s comments on a weak labour market

The USDJPY rate remains under pressure amid US dollar weakness and rising demand for safe-haven assets, currently trading at 151.19. Discover more in our analysis for 15 October 2025.

USDJPY forecast: key trading points

- Political uncertainty persists in Japan following the collapse of the coalition with the Komeito party

- Political events in Japan have increased investor interest in the yen

- China’s refusal to import US soybeans has heightened global trade risks

- USDJPY forecast for 15 October 2025: 151.30 and 153.20

Fundamental analysis

The USDJPY rate is declining for the second consecutive session. Pressure on the US dollar intensified after Federal Reserve Chairman Jerome Powell highlighted signs of labour market weakness in his recent remarks. These comments reinforced expectations of further interest rate cuts, triggering a sell-off in the dollar.

The yen also strengthened amid political developments in Japan. Markets are watching whether Sanae Takaichi, leader of the ruling Liberal Democratic Party, can assume the role of prime minister following the coalition’s split with the Komeito party. Takaichi supports higher government spending and a continuation of loose monetary policy – typically a bearish factor for the yen but supportive for the stock market.

Additional demand for safe-haven assets came from escalating US-China tensions. President Donald Trump threatened to impose an embargo on vegetable oil exports to China after Beijing halted imports of American soybeans, further increasing global trade risks and prompting investors to buy the yen.

USDJPY technical analysis

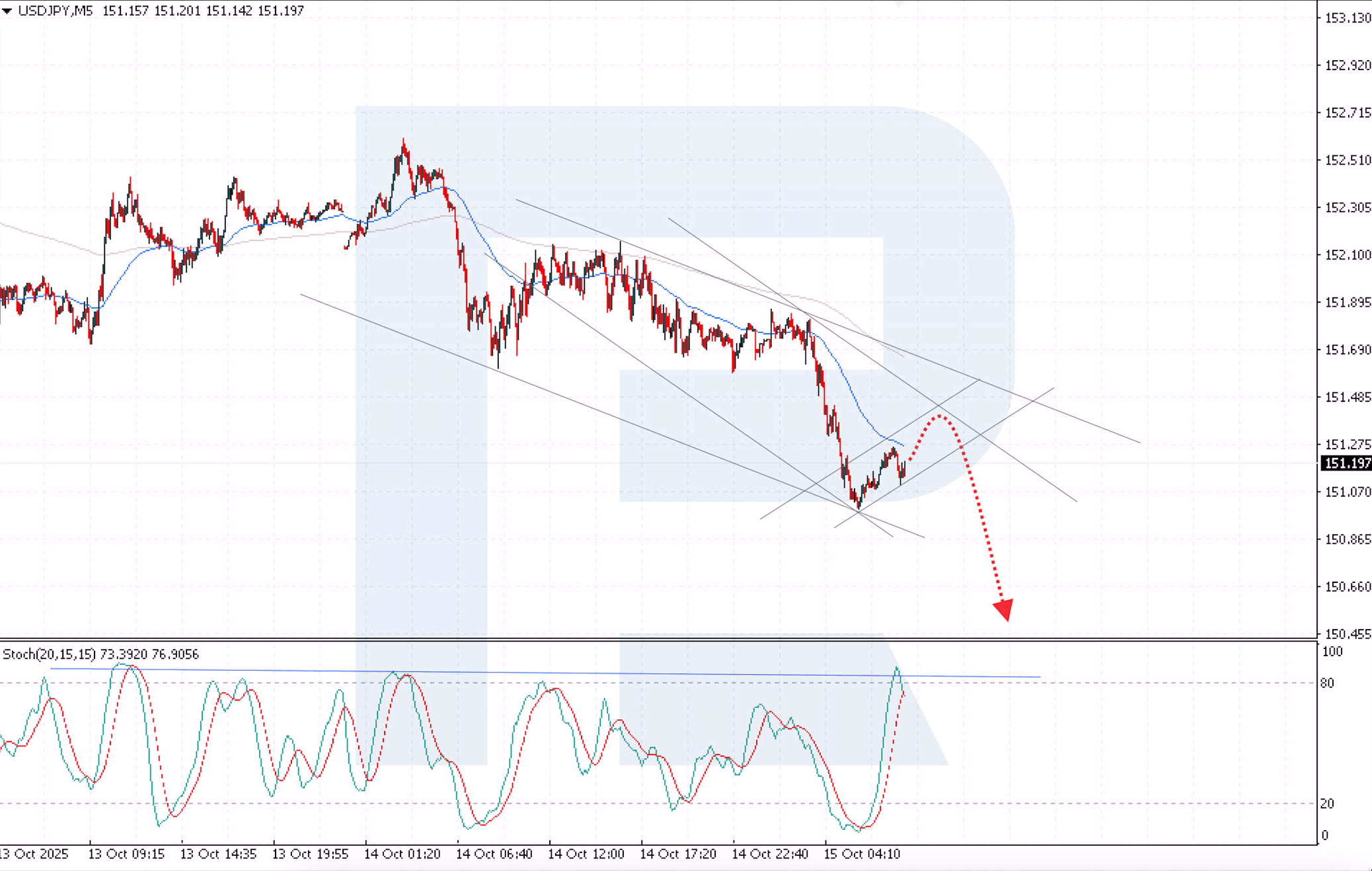

The USDJPY rate continues to move within a descending channel, although signs of a short-term bullish correction are emerging. Prices remain below the Moving Averages, confirming the dominance of bearish sentiment in the market.

The USDJPY outlook expects further downward movement with a near-term target at 150.50. An additional signal supporting the bearish scenario comes from the Stochastic Oscillator, which has exited overbought territory and shows a downward crossover of its signal lines, indicating a likely resumption of selling pressure.

A consolidation below 151.00 would signal a breakdown of the lower boundary of the correction channel and confirm the bearish scenario.

Summary

The USDJPY rate remains under pressure due to the weakening US dollar amid expectations of Federal Reserve rate cuts, political uncertainty in Japan, and increased safe-haven demand driven by escalating US-China tensions. USDJPY technical analysis indicates sustained bearish momentum, with a high likelihood of further decline towards 150.50 once the current correction phase ends.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.