USDJPY rises as markets flee risk

The USDJPY pair climbed to 144.46 on Monday, with the US dollar strengthening amid geopolitical uncertainty. Find more details in our analysis for 16 June 2025.

USDJPY forecast: key trading points

- The USDJPY pair rises amid growing demand for safe-haven assets

- The Bank of Japan may refrain from hiking interest rates this week

- Oil price rally reshapes central bank strategies worldwide

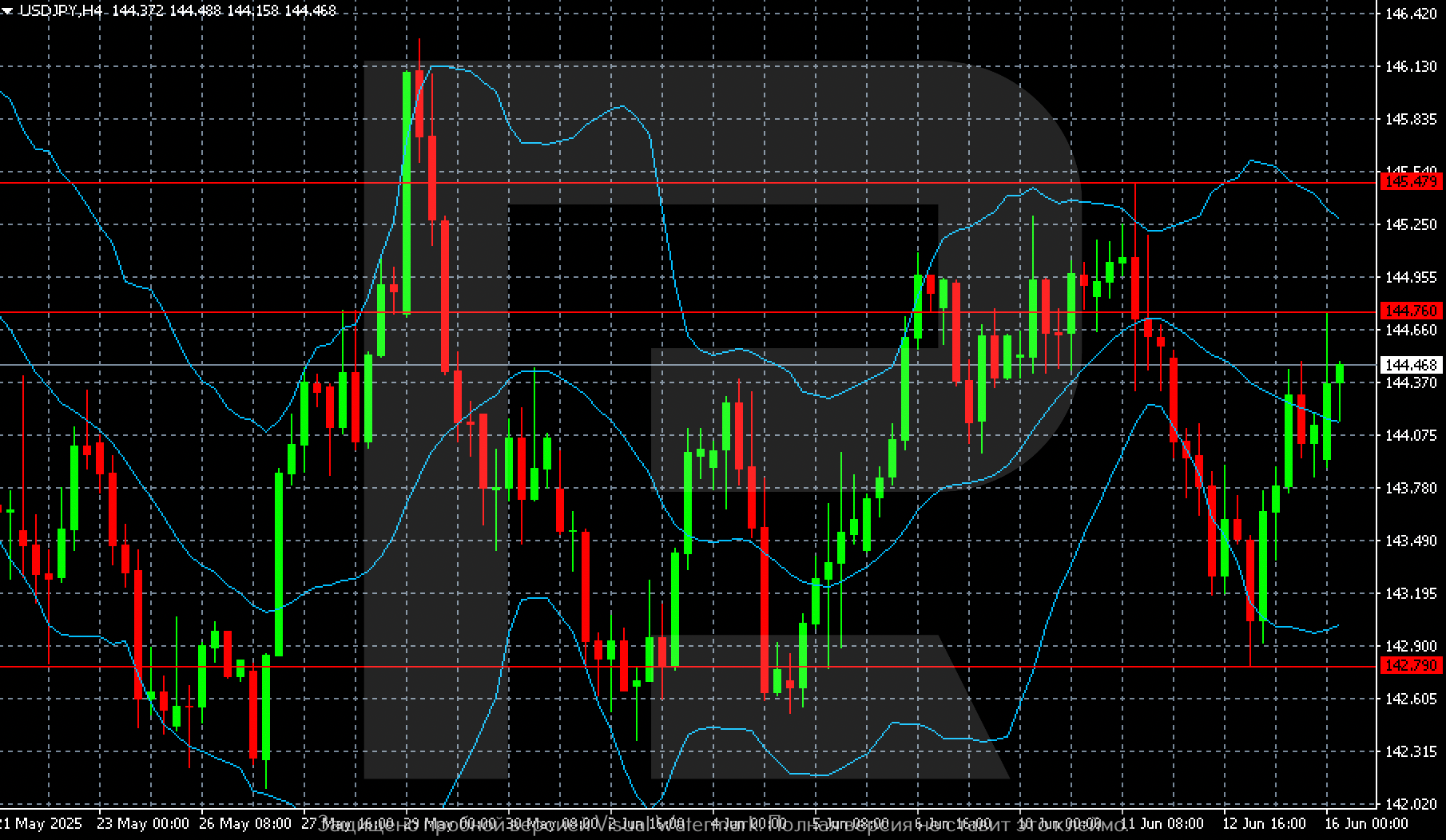

- USDJPY forecast for 16 June 2025: 144.76 and 145.47

Fundamental analysis

The USDJPY rate rose to 144.46 at the start of the new trading week in June, marking its second consecutive day of gains.

The market sees growing demand for the US dollar as a safe-haven asset following renewed attacks between Israel and Iran, targeting key energy infrastructure. This escalation triggered a rally in oil prices.

These developments reduce the likelihood of a near-term policy easing by the Federal Reserve. The central bank now faces additional inflationary and tariff-related risks.

Meanwhile, domestic focus shifts to the upcoming Bank of Japan meeting. Markets expect the BoJ to keep its key rate unchanged while continuing to assess the impact of rising oil prices on Japan’s inflation outlook.

The USDJPY forecast is positive.

USDJPY technical analysis

The USDJPY H4 chart shows conditions for a retest of the daily high at 144.76. A successful breakout above this level could open the path towards 145.47.

Summary

The USDJPY pair maintains its upward momentum as the market risk-off sentiment prevails and the US dollar gains favour. The USDJPY forecast for today, 16 June 2025, anticipates further gains, with the first target at 144.76.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.