USDCAD prepares for an upward breakout – oil and the Bank of Canada weigh on CAD

Following positive data from Canada, the USDCAD pair has entered a correction phase and are preparing to rise towards 1.4050. Find out more in our analysis for 13 October 2025.

USDCAD forecast: key trading points

- The Canadian dollar is attempting to recover its position

- Employment growth exceeded all forecasts

- USDCAD forecast for 13 October 2025: 1.3995

Fundamental analysis

Today’s USDCAD forecast remains unfavorable for the CAD despite employment growth.

Canada’s labour market surprised with a sharp rise in employment, with the Canadian economy adding 60,400 new jobs in September, far surpassing the forecast of 5 thousand. The strong employment data casts doubt on the likelihood of another Bank of Canada rate cut. As a result, the US dollar slightly weakened against the Canadian dollar, and the USDCAD pair entered a corrective pullback after its recent rise.

The improved employment figures have reduced expectations for a rate cut at the 29 October meeting, offering the CAD short-term support.

However, falling oil prices added to pressure on the Canadian dollar, offsetting the positive labour market effect. This could become a trigger for a new upward movement in the USDCAD rate.

USDCAD technical analysis

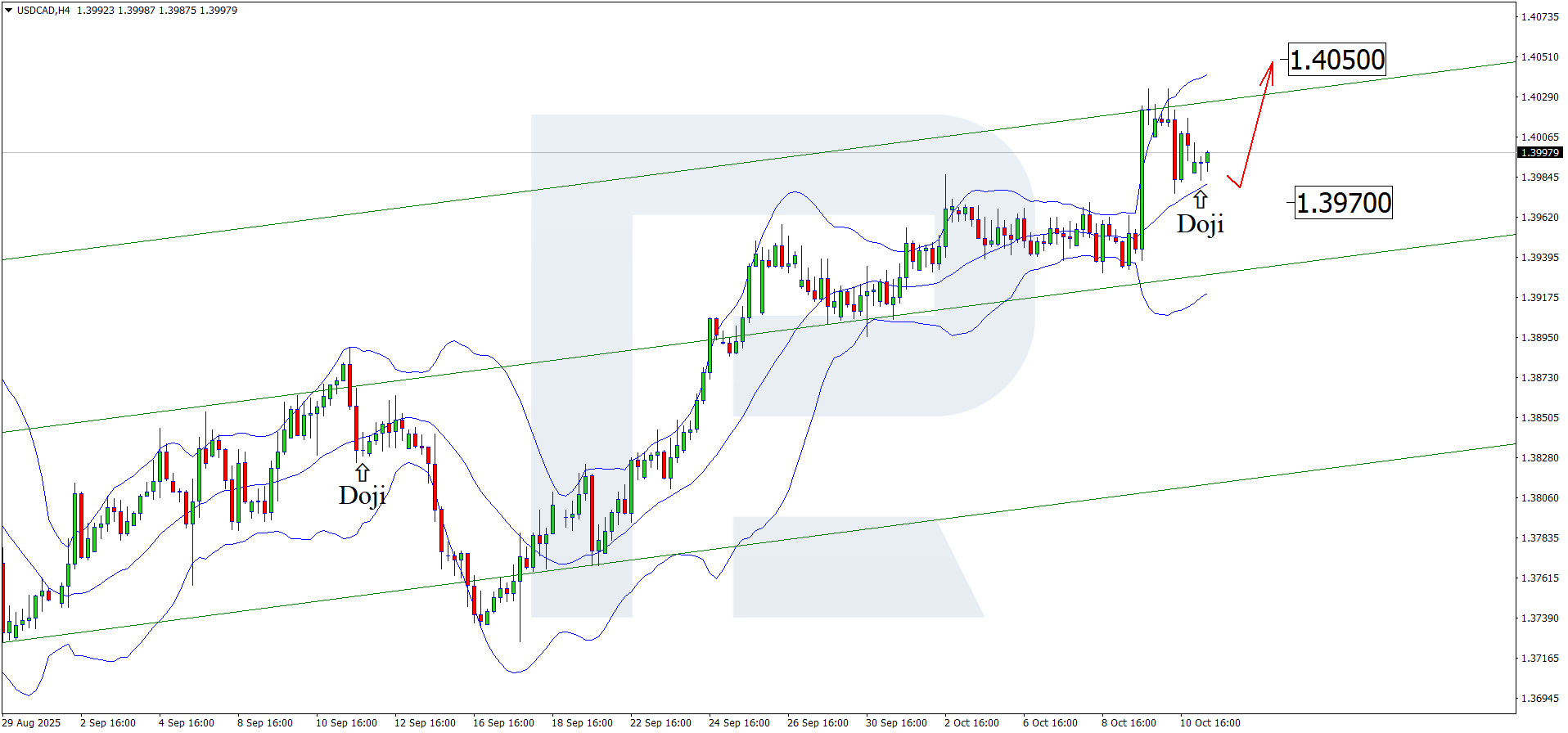

On the H4 chart, USDCAD has formed a Doji reversal pattern near the middle Bollinger Band. The price is now shaping an upward wave following the received signal. Given that quotes remain within the ascending channel, further growth towards the nearest resistance level at 1.4050 is expected. A breakout above this level would open the path for continued bullish momentum.

At the same time, the forecast for 13 October 2025 includes an alternative scenario, where the price extends its correction towards 1.3970 before resuming growth.

Summary

Despite the strong job growth in Canada, pressure from falling oil prices and uncertainty around the Bank of Canada’s future policy continue to pose risks for the CAD. Technical analysis of USDCAD suggests further upside potential, with the target around the 1.4050 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.