The dollar falls, the loonie celebrates: what’s next for USDCAD

A stronger Canadian labour market supports the loonie and could push USDCAD down towards the support level at 1.3630. Discover more in our analysis for 9 June 2025.

USDCAD forecast: key trading points

- Canada adds more new jobs

- The Bank of Canada may keep rates unchanged in July

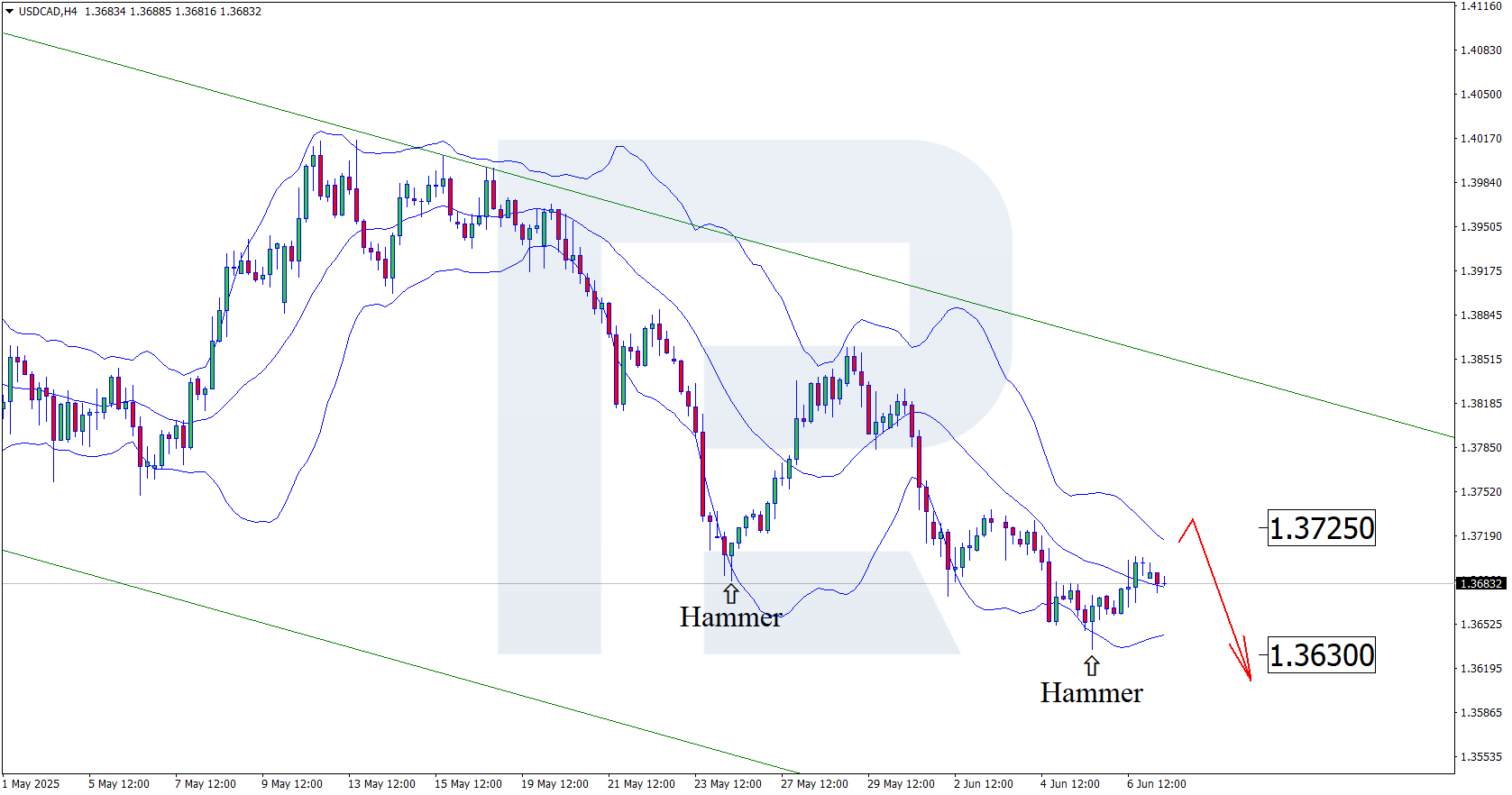

- USDCAD forecast for 9 June 2025: 1.3725 and 1.3630

Fundamental analysis

Today’s forecast for USDCAD is favourable for the Canadian dollar. Canada’s labour market surprised to the upside in May, adding 8,800 new jobs, despite expectations of job losses. Although unemployment rose to 7%, the shift from part-time to full-time roles added optimism. This strengthened the loonie as the US dollar weakened.

The Bank of Canada kept its key interest rate steady at 2.75% and hinted at possible easing if the economy slows. The next rate decision is scheduled for July, but given recent upbeat signals, there's a solid chance the rate will remain unchanged.

Rising oil prices and positive developments in US–Canada trade talks continue to support the loonie, pressuring USDCAD downwards.

USDCAD technical analysis

On the H4 chart, USDCAD formed a reversal pattern – Hammer – near the lower Bollinger Band. The pair is currently developing a correction from this signal. As prices remain within the descending channel, a move towards the nearest resistance at 1.3725 is possible. A rebound from this level may pave the way for a renewed downward move.

Today’s outlook for 9 June 2025 also allows for a bearish scenario with a decline to 1.3630, should support be broken and downward momentum gain strength.

Summary

All macroeconomic factors currently favour the Canadian dollar. Technical analysis of USDCAD supports the view of a continued downtrend once the correction completes.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.