EURUSD in suspense, awaiting Fed chair’s remarks

Federal Reserve Chairman Powell’s speech could trigger a pullback in the EURUSD pair towards 1.1770. Discover more in our analysis for 23 September 2025.

EURUSD forecast: key trading points

- US manufacturing PMI: previously at 53.0, projected at 52.2

- Powell’s speech may spark elevated volatility in EURUSD

- EURUSD forecast for 23 September 2025: 1.1770 and 1.1850

Fundamental analysis

The forecast for 23 September 2025 suggests limited upside for the USD ahead of a highly anticipated speech by Fed Chair Jerome Powell.

Key factors to watch:

- Rate outlook: Powell may offer his assessment following the recent rate cut to 4.00%. Markets await hints about potential additional cuts later this year, for example, in October and December

- Policy goals: Powell will likely reiterate the Fed’s dual mandate of price stability and maximum employment. The challenge lies in slowing job growth alongside inflation that remains above target. His balance between these risks will be closely scrutinised

- Tone of guidance: the degree of caution in his remarks could set the market tone. Can he make it clear that the Fed is in no hurry to take drastic steps, or, on the contrary, will he emphasise future easing?

Potential scenarios:

- If Powell hints the Fed could keep rates unchanged longer than markets expect, the USD may strengthen sharply, with risk assets moving lower

- If he highlights persistent domestic risks (inflation, tariffs), expectations for aggressive easing may soften

- If he signals scope for accelerated cuts amid weak data, gold, bonds, and safe-haven assets could rally, weighing on the USD

The forecast for 23 September 2025 shows that the US manufacturing PMI could decline to 52.2, signalling further cooling in the US industrial sector. A stronger-than-expected reading may provide additional support for the USD and pressure the EURUSD rate lower.

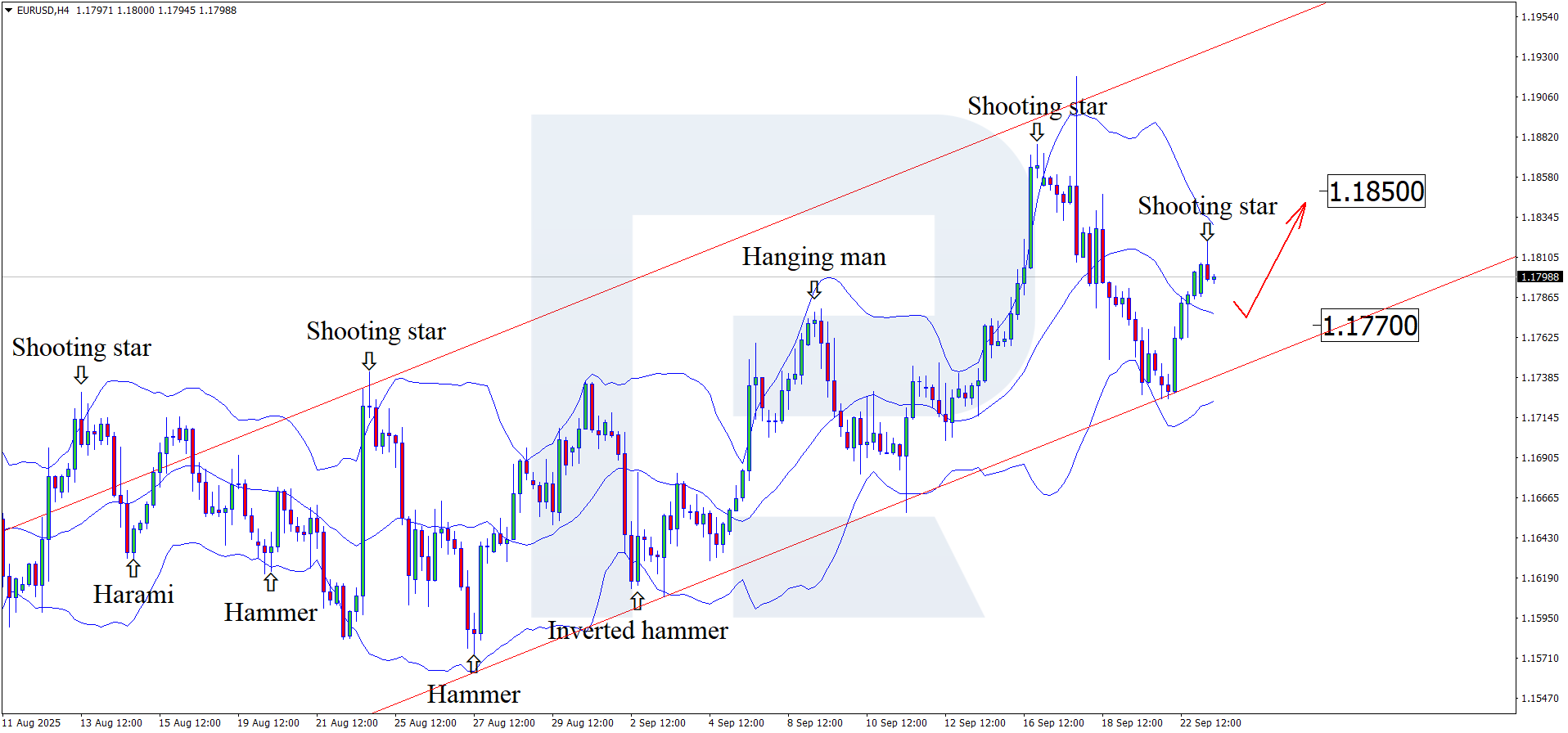

EURUSD technical analysis

On the H4 chart, the EURUSD pair has formed a Shooting Star reversal pattern near the upper Bollinger Band, pointing to a potential corrective wave. Since quotes remain within an ascending channel, the pair could slip to the nearest support level at 1.1770. A rebound from this level would open the door for a continued upward momentum.

However, the EURUSD rate could still climb towards 1.1850 without testing the support level.

Summary

Today’s outlook for EURUSD favours the euro, with Powell’s speech likely to weaken the USD. EURUSD technical analysis suggests a correction towards 1.1770 before buyers attempt another push higher.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.