EURUSD surges above 1.1600 amid weakening dollar

The EURUSD rate is climbing rapidly, rising above 1.1600 amid a weakening US dollar and upbeat economic data from the eurozone. Find more details in our analysis for 25 June 2025.

EURUSD forecast: key trading points

- Market focus: Germany's ifo Business Climate Index rose to 88.4 in June 2025

- Current trend: upward trend persists

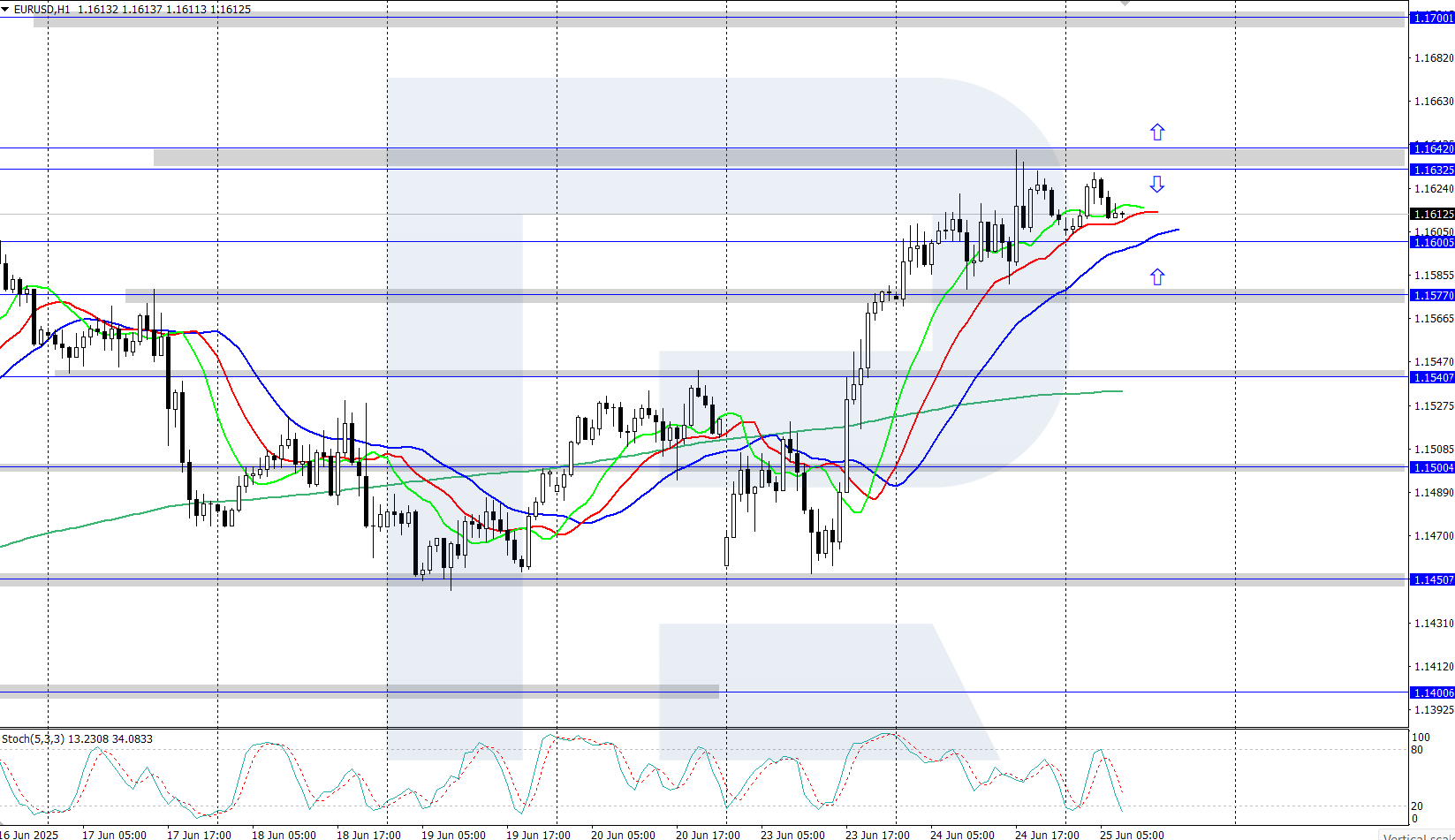

- EURUSD forecast for 25 June 2025: 1.1577 and 1.1642

Fundamental analysis

The US dollar continues to weaken following the announcement of a ceasefire between Iran and Israel. Continued oil supply from the Middle East has eased investor concerns over inflation and supports expectations for further Federal Reserve rate cuts this year.

Germany’s ifo Business Climate Index climbed to 88.4 in June 2025, its highest level in nearly a year, up from 87.5 in May and slightly above forecasts of 88.2. The expectations component jumped to 90.7, the highest since April 2023.

EURUSD technical analysis

On the H4 chart, the EURUSD pair is rising steadily, having reached the yearly high at 1.1632 yesterday. The daily trend remains bullish, supported by an upward-moving Alligator indicator. After a brief correction, the upward movement may resume.

The short-term EURUSD forecast suggests growth towards a new yearly high at 1.1642 if the bulls hold above 1.1577. However, if bears push the price below 1.1577, a downward correction to the 1.1500 support level may follow.

Summary

The EURUSD pair is rallying, benefiting from current US dollar weakness. Strong ifo Business Climate Index data from Germany provided additional support for the euro.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.