EURUSD heads towards new highs: US dollar loses safe-haven appeal

The EURUSD pair continues to climb confidently. The US dollar is losing its appeal as a safe-haven currency. Find more details in our analysis for 24 June 2025.

EURUSD forecast: key trading points

- The EURUSD pair is poised to reach new highs

- Easing tensions in the Middle East reduce the US dollar's attractiveness

- Powell's testimony in Congress is the key event on Tuesday

- EURUSD forecast for 24 June 2025: 1.1632

Fundamental analysis

On Tuesday, the EURUSD rate is rising to 1.1603. The US dollar came under increased pressure following Donald Trump's statement announcing a ceasefire between Iran and Israel.

Although markets witnessed an eventful night, capital markets largely brushed off Iran's retaliatory strike on a US base in Qatar, which resulted in no casualties. Tehran’s decision not to block the Strait of Hormuz further eased concerns about potential disruptions in global oil supply.

Another bearish driver for the USD came from Federal Reserve Governor Michelle Bowman, who suggested that a rate cut in July is possible if inflation remains subdued.

Christopher Waller expressed a similar stance earlier.

As a result, traders are increasing their bets on monetary policy easing. Current pricing implies about 55 basis points of rate cuts by the end of the year. Investors are now focused on Federal Reserve Chairman Jerome Powell’s semi-annual testimony before Congress later today.

The EURUSD forecast is positive.

EURUSD technical analysis

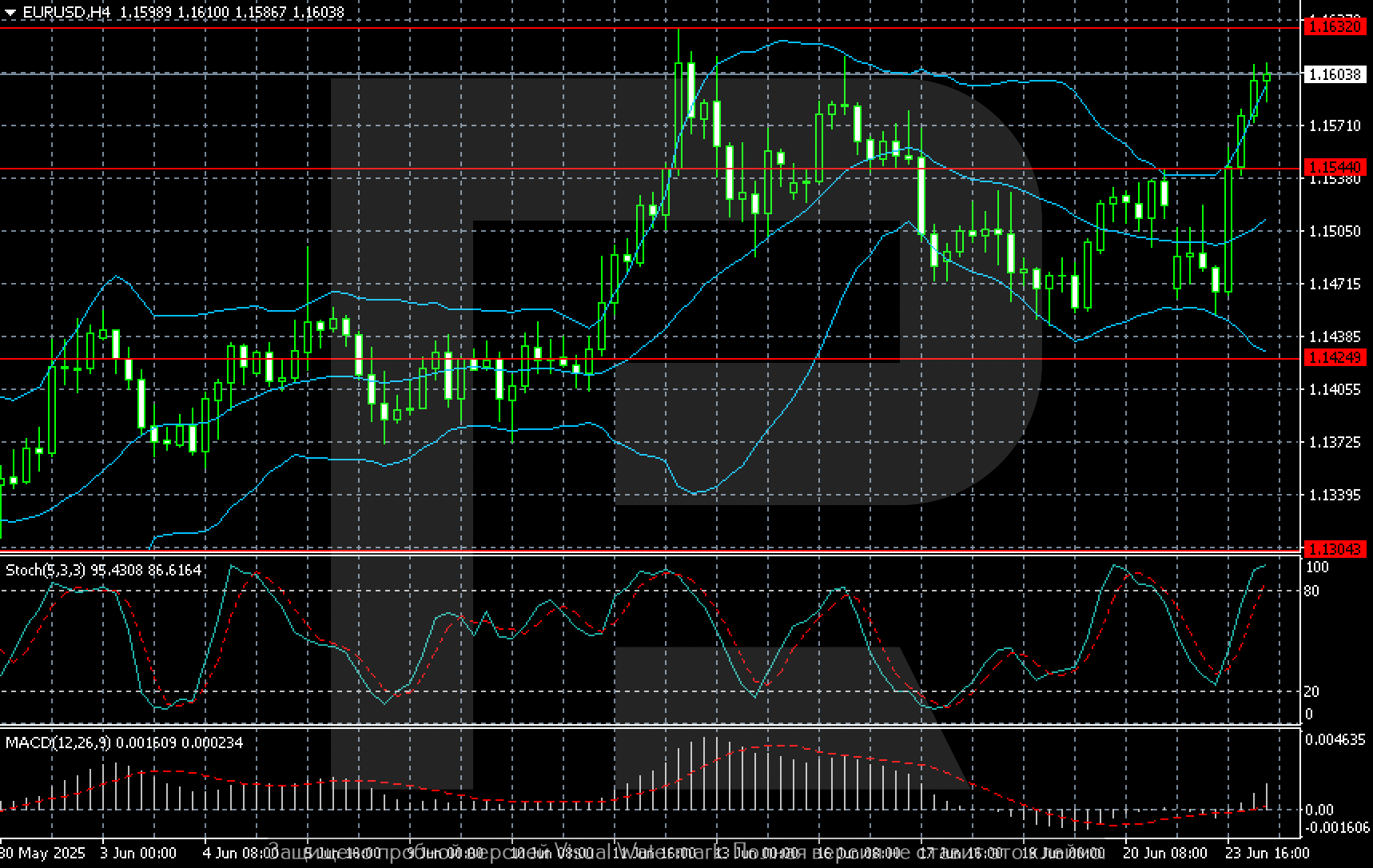

On the H4 chart, the EURUSD pair shows potential to extend its current growth wave towards 1.1632.

The key support level lies at 1.1544, with the next level lower at 1.1424.

Summary

The EURUSD pair continues its rally as appetite for safe-haven assets declines. The EURUSD forecast for today, 24 June 2025, suggests continued upward momentum towards 1.1632.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.